Grayscale’s Attorney, Joseph Hall, has released an objective analysis on the securities case filed by the United States Securities and Exchange Commission (SEC) against Ripple, the cross-border payment firm that oversees the distribution of XRP.

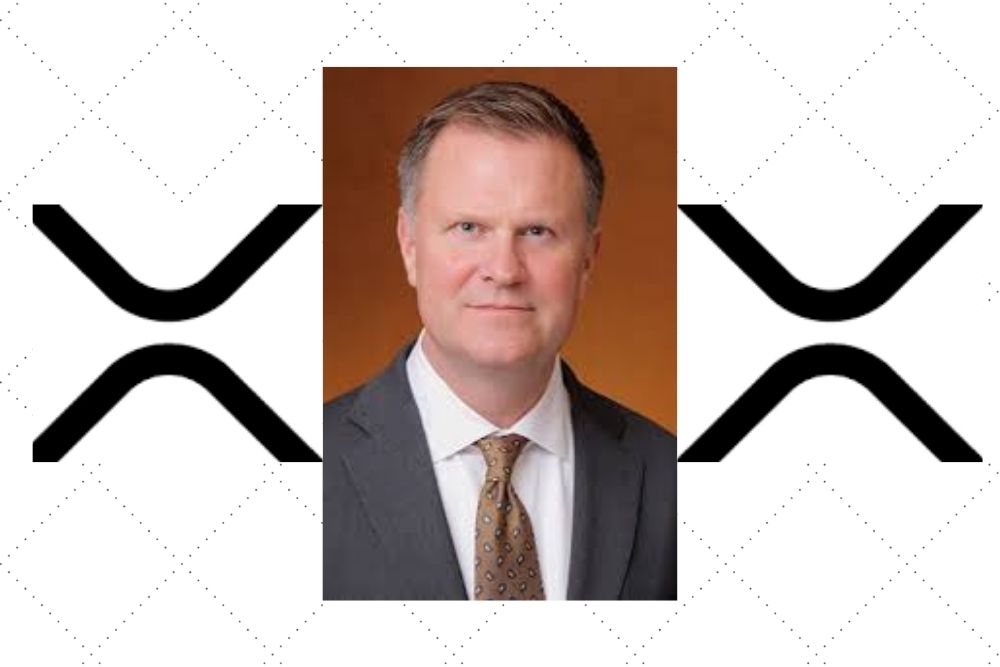

Joseph Hall, a partner at Davis Polk, who was previously at the SEC in Senior Policy roles during the era of the former President George W. Bush, shared his thought in an exclusive article titled “Ripple Token Case Highlights Need for SEC Clarity on Crypto”.

Read Also: American Rapper Soulja Boy Who Currently Holds Bitcoin Showcases Stern Interest in Buying XRP

This article was shared with the crypto community a couple of hours ago by Stuart Alderoty, Ripple’s General Counsel.

Some objective analysis on the SEC’s complaint from Joe Hall, partner at Davis Polk, who was previously at the SEC in Senior Policy roles. https://t.co/fiLT9D2TiU

— Stuart Alderoty (@s_alderoty) January 26, 2021

Read Also: Galaxy Digital’s Mike Novogratz Targets $2,600 As Ethereum (ETH) Hits New Price ATH

XRP Should Have Been Classified as a Non-Security Along With Ethereum (ETH)

According to the former high-ranking SEC official, there are lots of problems with the lawsuit against Ripple. For instance, Hall believes that XRP should have been classified as a non-security alongside Ethereum (ETH).

He said when Bill Hinman, the former director of the SEC’s Division of Corporation Finance said in a speech in 2018 that Ethereum is not a security, it would have been a fair bet if XRP received the same treatment:

“…Ethereum might have been born a security but later morphed into a nonsecurity, it was a fair bet that XRP would get the same treatment. In other words, maybe there were some issues with early sales of XRP, but at this point surely XRP itself was in the clear. Right?”

Read Also: XRP and Spark (FLR) Holders Are Primed To Receive Second Airdrop in DAOFlare (DFLR)

Gensler Should Use the Case against Ripple to Chart New Regulatory Course

According to Joe Hall, applying the Howey test to XRP is not timely:

“Imagine trying to explain what an iPhone is in language your great-grandfather would have understood just after World War II. That’s how easy it is to predict which digital assets are securities under the postwar Howey test.”

Hall calls the lawsuit against Ripple an indication of what went wrong with the SEC’s treatment of cryptocurrencies under the former Chairman Jay Clayton. He calls on Gary Gensler, who was recently appointed by Joe Biden as the SEC’s new chairman, to use the lawsuit to “chart a different course” in the treatment of digital currencies.

“It’s difficult to overstate the impact this uncertainty has on the development of blockchain technology in the U.S. Outside the venture capital community, corporations, major investors and banks are understandably skittish about risking serious sums of money on technologies their lawyers can’t assure them comply with law…”

Read Also: Brad Garlinghouse Explains Why PayPal Did Not Include XRP in Its New Crypto Business

The Timing of the Lawsuit Suggests Possibility of a Rift among SEC Commissioners

Hall also criticized the timing of the lawsuit. He thinks the timing suggests the possibility of a rift among the SEC commissioners:

“The SEC’s decision to bring charges against Ripple Labs for ongoing sales of XRP is thus remarkable on several levels. First, the timing —the day before Clayton stepped down —suggests the possibility of a rift among the commissioners as opposed to a case everyone agreed had to be brought immediately in order to avert looming investor harm.”

He also referenced the fact that SEC’s decision to file suit caused massive harm among investors, whom it supposed to protect:

“Whatever one’s views on the merits, before news of the SEC’s intentions broke, XRP traded with a market cap in the $25 billion to $30 billion range, meaning that any precipitous action by the SEC would surely result in heavy investor losses — ending recently around $13 billion.”

Read Also: A Need for XRP? Bank of England’s Governor Says Cost of Cross-Border Payments Is Too High

Another cogent point made by Hall is related to the reason why Ripple was chosen by SEC as a precedent:

“Why on earth did the agency bring a case that was considerably less a slam dunk than its previous crypto enforcement actions? Barring a settlement, the Article III courts and not the SEC will ultimately say whether XRP is a security. There are plenty of digital assets with more tenuous use cases than XRP, any one of which might have better helped the SEC etch its views into federal caselaw before taking on a leviathan like Ripple Labs.”

Follow us on Twitter, Facebook, Telegram, and Download Our Android App.