Grayscale Investments, the world’s largest crypto assets manager, has added $93 million worth of ETH to its Ethereum Trust in the last 24 hours.

According to the report, the recent Grayscale’s buy is the highest daily inflow of Ethereum (ETH) since subscriptions were open in early January 2021.

This new attainment was tracked and reported a few hours ago by the team at Unfolded via a tweet that includes a chart that illustrates the magnitude of the recent Ethereum (ETH) purchase by Grayscale.

Read Also: Grayscale Investments Dumps Massive Portion of its XRP and XLM Holdings

Unfolded tweeted, “Grayscale adds $93m worth of Ether in the last 24h, the largest inflow since Grayscale reopened the trust.”

Grayscale adds $93m worth of Ether in the last 24h, the largest inflow since Grayscale reopened the trust. pic.twitter.com/hoONnmGNCq

— unfolded. (@cryptounfolded) February 12, 2021

Grayscale Ethereum Trust Received the Highest Daily Inflow 52,730 ETH Purchase

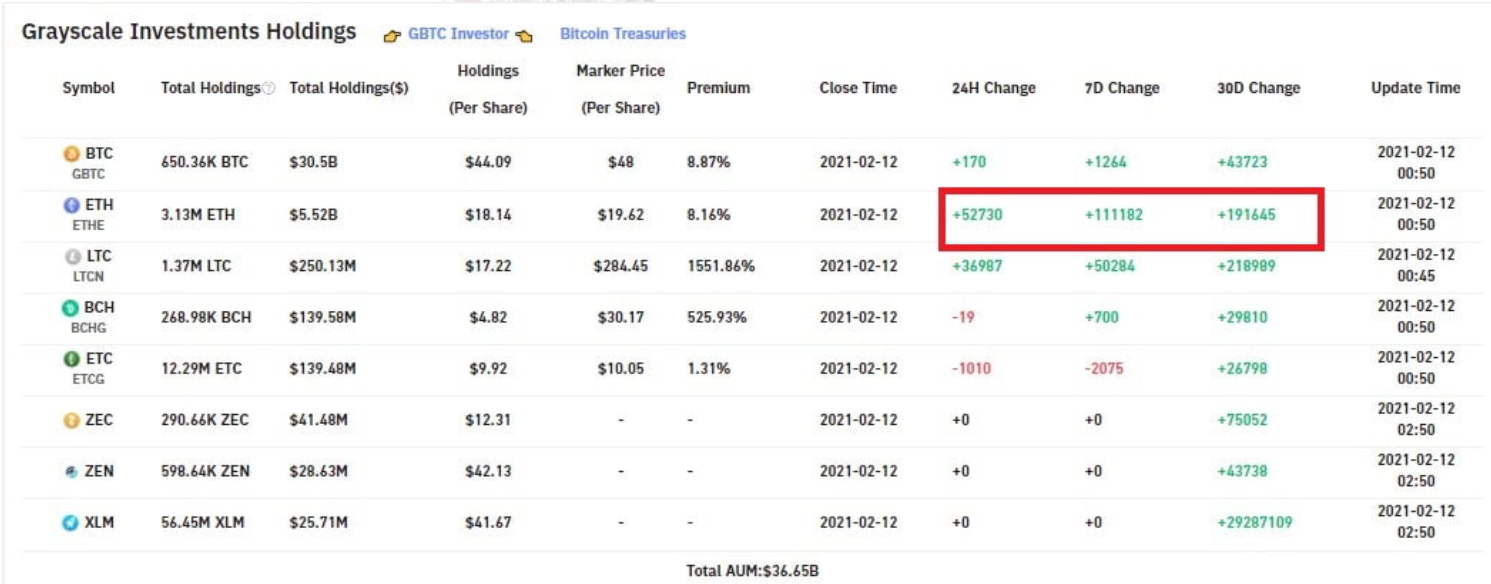

A closer look at Bybt.com reveals that the $93 million purchase of Ethereum (ETH) by the leading crypto assets manager Grayscale was a total of 52,730 ETH.

Moreover, according to the data, Grayscale Investments has accrued a total of 191,645 ETH worth relatively $339 million in the last 30 days, which implies the time subscription reopened to its Ethereum Trust.

Ethereum (ETH) Finally Retests $1,800 Resistance

Many traders and investors have been looking forward to Ethereum (ETH) breaking above the $2,000 price mark after proving resilience at the launch of CME ETH Futures earlier this week.

Many traders were using the price action printed by Bitcoin between December 17th and 18th in 2017, as a blueprint as to how Ethereum might lose value after its CME futures contracts went live.

Read Also: Grayscale Now Has $110 Million Worth of Ethereum (ETH) So Far In 2020

However, Ethereum only dipped from $1,700 levels to as low as $1,486 before bouncing back to post a new all-time high of $1,837.

At the time of publishing, ETH is priced at $1,820.53, with about a 1% price uptrend in the last 24 hours, according to CoinMarketCap.