Stanford-Financial.com Introduction

Driven by growing demand for retail trading services, StanfordFinancial launched operations with the end-user in mind, or at least that seems to be the case at first glance. This CFD brokerage promises diverse market access and the ability to choose from multiple accounts.

Its offer built around the benefits of crypto makes sense this year, which is why we are moving forward with a stanford-financial.com review. In case any of you want to know the broker better, this article should be a good starting point. Here we go!

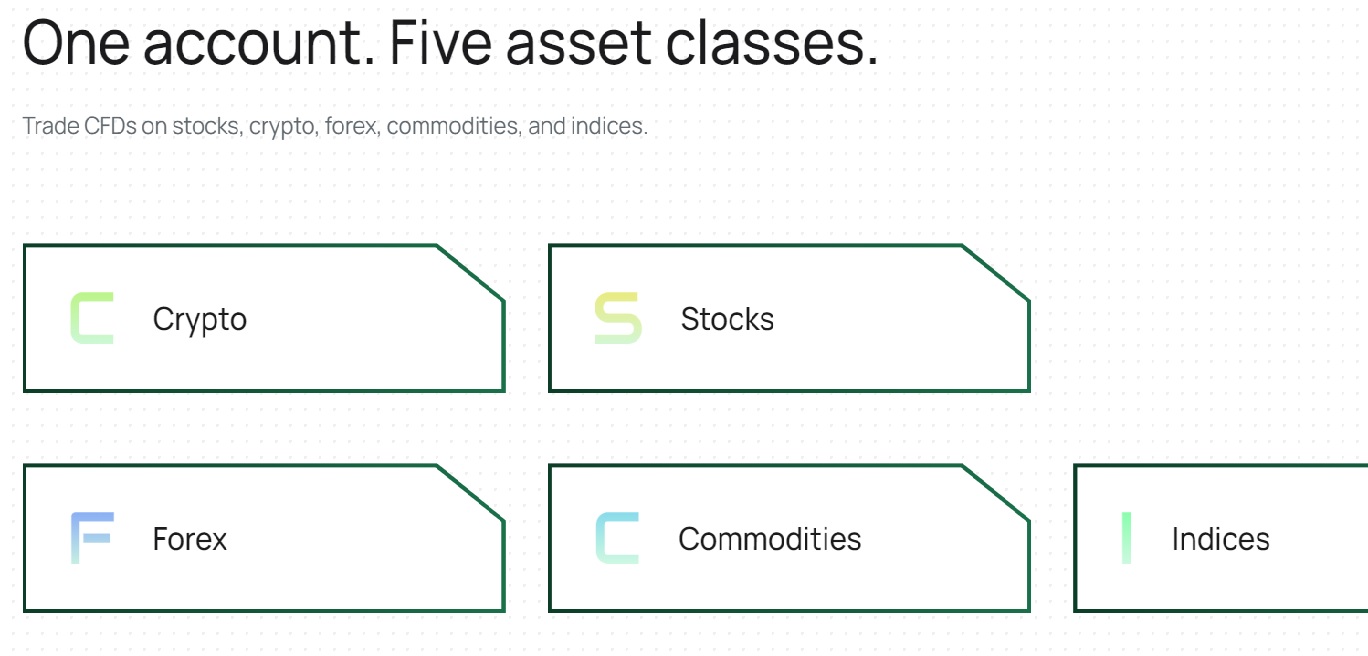

Investment Portfolio

First and foremost, there are tens of cryptocurrencies available inside the platform. That offers great diversification capabilities. Additionally, StanfordFinancial seems to encourage crypto usage because customers are able to deposit in several popular coins. Another interesting feature, dependent on your account type, is the option to order a crypto debit card, which some people might like.

On top of the crypto offering comes the traditional market coverage. Basically, if you want to diversify with popular CFDs, you can buy/sell currency pairs, equities, commodities and indices. This asset index resembles what most brokers in the market currently provide.

Trading Features

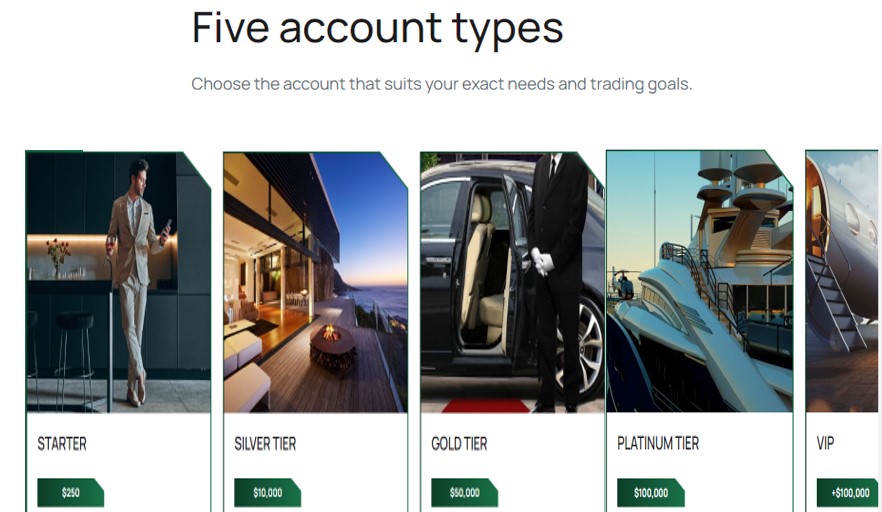

When it comes to the bundle of features associated with the six accounts available at stanfordfinancia.com, diversification is the main keyword again. Those who want affordability should choose the lowest account tier, requiring only $250.

Conversely, demand for more trading features will require more capital. In exchange, the broker grants access to tighter spreads, up to 1:300 leverage, Tier 3 room analysis, on-demand educational content, tens of eBooks, and access to trading platform analytics.

There’s also the VIP program, designed for traders able to deposit a lot of capital in exchange for top trading terms. Here as well we’ve found three different tiers: The Exclusive Club, Wealthy Lifestyle and The Ultimate VIP.

As things stand right now, there is an account for any type of trader out there. Platform accessibility is not an issue either, because StanfordFinancial offers a proprietary web-based solution. Integrating analysis tools, risk management and detailed charts, it can be useful when searching for new trade setups.

Support

The regular support service is available via email and phone. This only applies if you don’t already hold an account with StanfordFinancial. Once you sign up, support can get better, based on your account.

For the lowest account tier, there are no special support features, but once moving to the 2nd ranking account, the broker grants access to 1-on-1 sessions with analysts. Another interesting benefit is the support from a dedicated account manager. Basically, each time you have an issue, you will address the same person, without having to wait a lot of time.

Final Thoughts

Our stanford-financial.com review ends on a positive note because there are plenty of features to explore with this broker. After analyzing the offer in greater detail, some traders might conclude the company is what they’ve been looking for. All in all, the bundle of benefits is modern and useful, at the same time.