Londongroup Investments Review

Today, we are going to review an online trading platform called Londongroup Investments. We decided to study this online broker in depth because of its attractive trading conditions. In this article, we will go over every aspect of its offerings for readers to assist them in determining if it’s worth registering with them or not. Is it a trading firm you have been looking for? Find the answer in the full broker review below.

Trading Products

When getting to know about the trading instruments available through Londongroup Investments, users are given a variety of trading products to discover. As the growth of cryptocurrencies continues fast, the brand offers digital assets like Bitcoin, Ethereum, and Ripple for those interested in venturing into this field.

The availability of major, minor, and exotic currency pairs allows users to diversify their portfolios and take advantage of economic trends. Traders can also gain exposure to international stock markets via their indices trading. If you want to invest in global companies, this solution could be a good option with the opportunity to trade shares of popular stocks.

Trading Tools

The Londongroup Investments trading platform integrates various trading tools to help customers make sound decisions on their trades. Traders get access to real-time streaming prices on all the assets listed on the terminal. Order placement is designed intuitively, and risk management tools are made available to help limit the risk of investments. There are also technical analysis tools that assist in understanding market trends and evaluating potential opportunities.

Additionally, customers have the flexibility to access the platform from any device, including PCs, laptops, tablets, and mobile phones. We usually use the trading software at night, and it operates consistently and smoothly.

Trading Accounts Offered

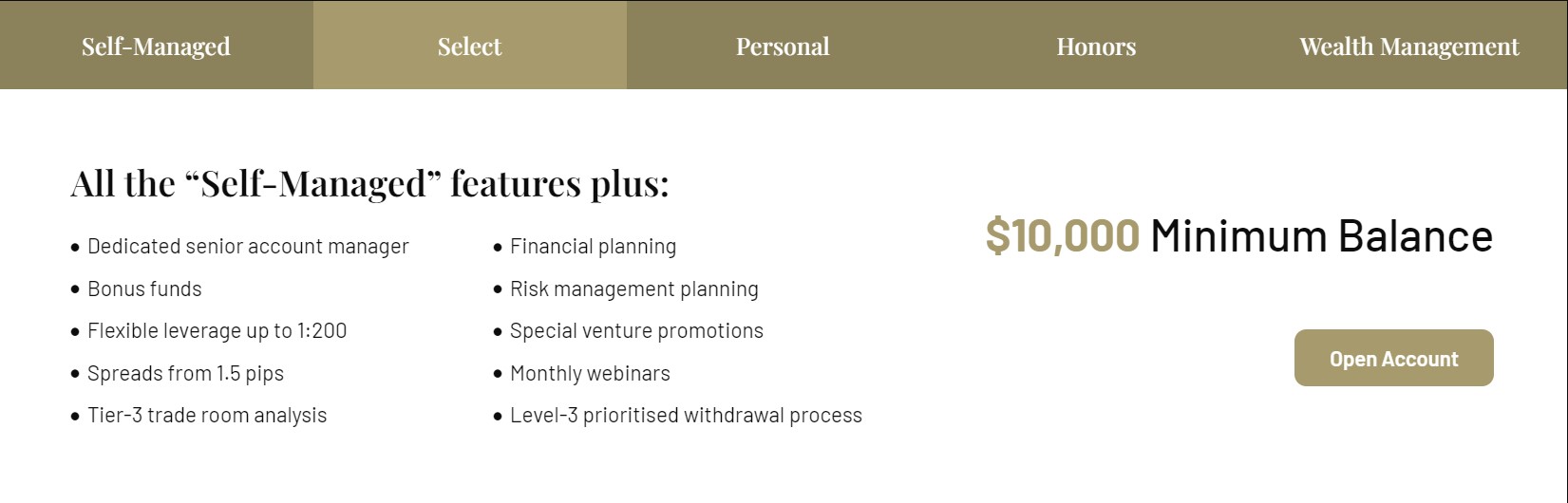

There are various kinds of trading accounts available to traders, making sure that everyone coming here finds what suits them. Self-Managed is the starter account with Londongroup Investments, designed for those who have just joined the financial markets. Realizing they have no ideas about the markets and want to learn more about them, the firm gives them access to market reviews and more than 200 tradable assets.

Select is the second account offering many more trading features to support clients with basic knowledge and seeking to advance their trading career. They receive support from a senior account manager, a financial risk management plan, and invitations to monthly webinars. For experienced traders wanting to create complex trading strategies, Personal and Honors opens an array of features and resources needed. The minimum deposit of these accounts is accordingly much higher than the previous ones, ranging from $50,000 to $250,000.

Wealth Management is the last trading account created for VIP traders. The benefits of this solution are tailor-made based on user experience, trading style, and demand.

Following our Londongroup Investments review, there are many reasons why you should consider registering with the company. They have diverse asset coverage and five account types to serve most customers out there. Their solid offers make it an appealing option for 2024.