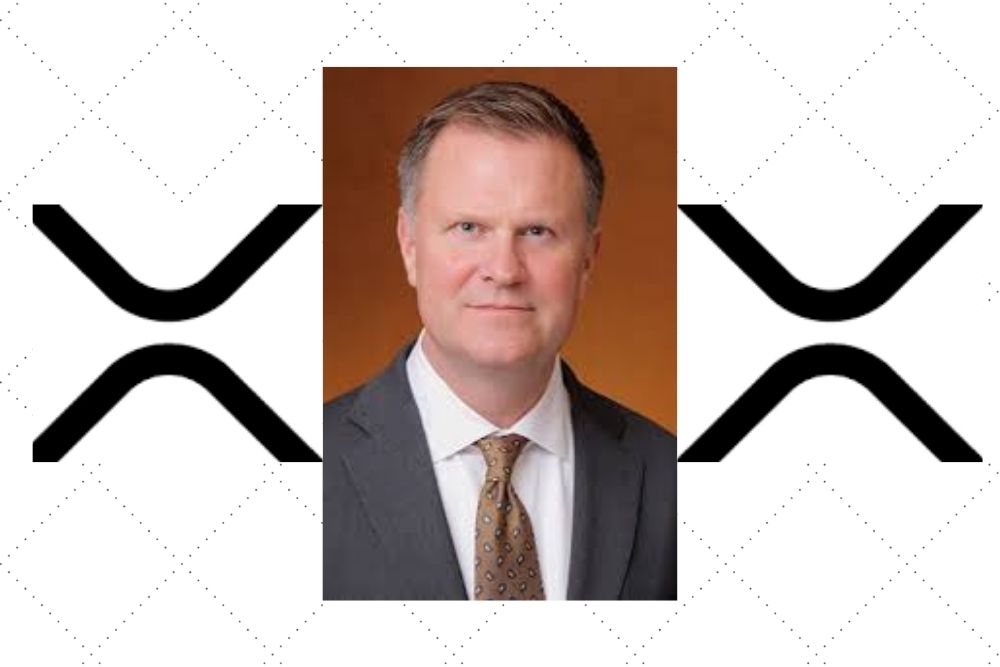

Joseph Hall, a partner at the law firm Davis Polk and former executive of the United States Securities and Exchange Commission (SEC), has recently stated that there is a strong chance for the regulatory agency to lose the securities case against Ripple, the San-Francisco based cross-border payment firm that oversees the distribution of the digital token XRP.

In a new interview on Thinking Crypto, Joseph Hall found the SEC case “pretty astonishing”. He argues that a judge reviewing the lawsuit will possibly be influenced by the fact that the case doesn’t “seem to have been involving any imminent investor harm.”

Read Also: Prominent Crypto Lawyer States What Ripple Must Do Now For XRP to Survive

Joseph Hall noted:

“The judge just might say, ‘If XRP was a problem, you’ve known about XRP since 2012. Why now? What is going on here?’ So I think we start out with the XRP case with a factual posture that may not be the best for the SEC. So I think that there’s a good chance – I can’t give you a percentage on that – I think there’s a good chance that the SEC loses this one.”

The lawyer made headlines after publishing an opinion piece a couple of days ago. The piece was centered on the SEC’s lawsuit against Ripple. There, he highlights the need for regulatory clarity in the crypto industry.

Hall worked for the SEC during President George W. Bush’s administration. He concluded his time at the commission as managing executive for policy.

In the course of the conversation on Thinking Crypto, Hall noted that Ripple’s case could threaten the SEC’s ability to regulate other forms of cryptocurrencies in the future:

“Frankly, if they lose it at the district court and they don’t settle it, they’ll surely appeal it to the Second Circuit. They could end up with a ruling that makes it very difficult for them to exercise any authority at all over the entire crypto space. And I don’t think that would be a great thing

Read Also: A Need for XRP? Bank of England’s Governor Says Cost of Cross-Border Payments Is Too High

As I said earlier, I think there are some interests that the US federal securities laws are designed to protect that would make sense here. You just have to be very thoughtful about what kinds of requirements you put on this industry.”

Follow us on Twitter, Facebook, Telegram, and Download Our Android App.