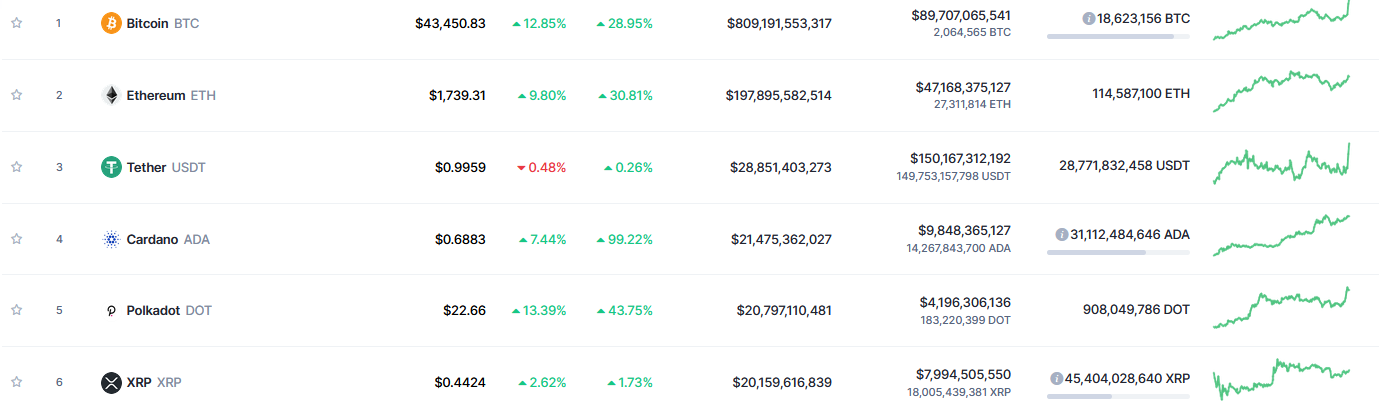

It’s worth noting that Ripple’s digital token XRP has been displaced from the list of five largest cryptocurrencies in the market.

Despite maintaining its stability above $0.42, the digital asset dipped to the sixth position for the first time in seven years. Cardano (ADA) and Polkadot (DOT) now occupy the 4th and 5th positions respectively, behind Bitcoin (BTC), Ethereum (ETH), and Tether USDT.

Read Also: Bitfinex Launches Cardano (ADA) and Stellar Lumens (XLM) Perpetual Contracts

As reported by Herald Sheets, Cardano (ADA) managed to displace XRP for the first time in history a couple of hours ago.

XRP Past and Present Trend On Crypto Charts

XRP’s absence from the top five is truly jarring given that it has long been a fixture on the crypto pedestal. However, the gap is still very small for the cryptocurrency to catch up, and there is still some back and forth between fifth and sixth places due to price fluctuations.

XRP burst into the top five back in August 2013, the same month that the Securities and Exchange Commission (SEC) alleges Ripple started making “unregistered offers and sales” of XRP in its landmark complaint.

The last time XRP dropped out of the top five was back in July 2014, when Peercoin (PPC) and Nxt (NXR), the two coins that only old-timers remember. After trading tackles with Litecoin (LTC), XRP had been the second-largest cryptocurrency for a good portion of 2015 before Ethereum (ETH) surpassed it in February 2016.

Read Also: Crypto Trader Lark Davis Is Bullish on Cardano (ADA) As Goguen Phase Gears to Roll Out

In 2018, XRP managed to “flippen” Ethereum on several occasions. Sept. 22, 2018, was the last day (so far) on which the token was the largest altcoin.

$5-$7 Could Be the Next for Cardano (ADA)

Crypto trader and analyst Michaël van de Poppe, popularly known as Crypto Michael has been closely following Cardano’s performance and aired great optimism in his latest video.

The trader explained that the upside that Cardano experienced in 2017 to $1 will be “small” compared to the rally that will occur in the current bull cycle.

As van de Poppe stated, ADA is currently going through a small correction which could be followed by an acceleration to the 1.61 Fibonacci level on the daily chart. As the image below shows, ADA could be heading for a pullback that will precede a rise well above current levels. When this occurs, Crypto Michael recommends starting to re-accumulate and “buy the dip”.

Read Also: Charles Hoskinson Explains Why Cardano Is Better Designed Than Buterin’s Ethereum 2.0

According to him, the next important resistance for ADA is located at $1.12 and $1.17 (the all-time high of 2018). In the medium term, van de Poppe predicts that ADA could rise to $5 and $7. And in the current bull cycle, Cardano could even rise to $10 to $20, according to the trader, and as high as $170 in the next decade.

$170 per $ADA in 2030.

You heard it here first. pic.twitter.com/GQhUVYU2eM

— Michaël van de Poppe (@CryptoMichNL) February 7, 2021

Follow us on Twitter, Facebook, Telegram, and Download Our Android App.