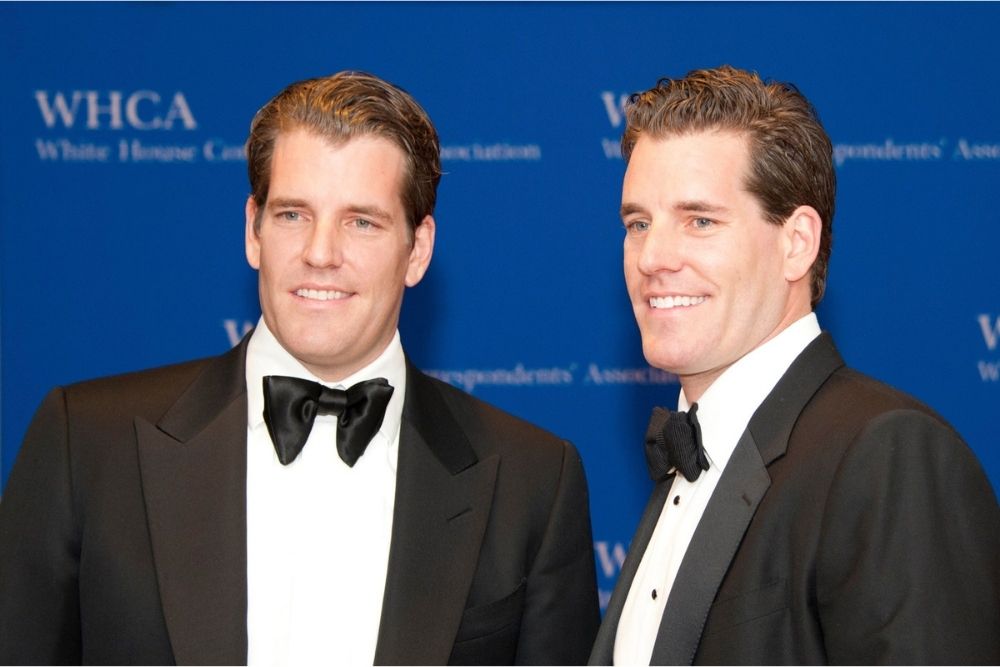

Tyler and Cameron Winklevoss, the co-founders of the Gemini crypto exchange and Winklevoss Capital Management, have jointly predicted that Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has the potential to reach $40,000 in the long run. Their price target for ETH for the end of the year is between $5,000 and $10,000.

In an interview with SumZero reported by Cryptoglobe, Tyler and Cameron stated that they believed Ethereum (ETH) was undervalued at $1,400 when the price bun run commenced in January 2021. Back then, the price of Ethereum was close to the all-time high recorded in 2017.

Read Also: Gemini’s Cameron Winklevoss: Dogecoin (DOGE) Is a Protest

Afterward, Ethereum surged to record a new all-time above $4,300, before the significant downtrend of the past weeks that took its price down to $2,000 price region. At the time of press, ETH is trading at $2,817.92, with a 4.49% price uptrend in the last 24 hours, according to CoinMarketCap.

In the course of the conversation, the Winklevoss twins agreed with the fact that Ethereum (ETH) has the potential to be trading between $5,000 and $10,000 by the end of the year. But they believe that the price of the cryptocurrency could surge 10x in the long run, which could be estimated at around $40,000.

It’s worthy of note that the interview was held in mid-May before Bitcoin (BTC) and Ethereum (ETH) crashed from $50,000 and $4,000 levels respectively. In the interview, they reaffirmed their $500,000 price target for Bitcoin (BTC).

Read Also: BTC, ETH, LTC, BCH Holders Will Soon Be Able To Transfer Coins from and To PayPal Addresses

However, the Winklevoss twins believe that Ethereum needs to overcome certain psychological barriers before their prediction can come to pass.

Ethereum (ETH) Has Huge First Mover Advantage Over Competitors

Tyler and Cameron also discussed the competitions around Ethereum. They pointed out that only projects that are 10 times better than Ethereum can threaten its supremacy, claiming that the largest smart contract platform has a huge first-mover advantage over competitors:

“There’s so much building happening there that there’s where you want to go, that’s where the eyeballs are. The thing that has to happen is scalability and throughput: its ability to process many transactions cheaply.”

Read Also: Bitcoin (BTC), Ethereum (ETH), Others Plunge as China Calls for Crackdown on Crypto Mining

Regarding Ethereum 2.0, the twins said scalability problems with ETH will soon vanish once the upgrade is complete. However, they stated that Ethereum can fall victim to the weight of its own success if transaction fees become too high.

Follow us on Twitter, Facebook, Telegram, and Download Our Android App