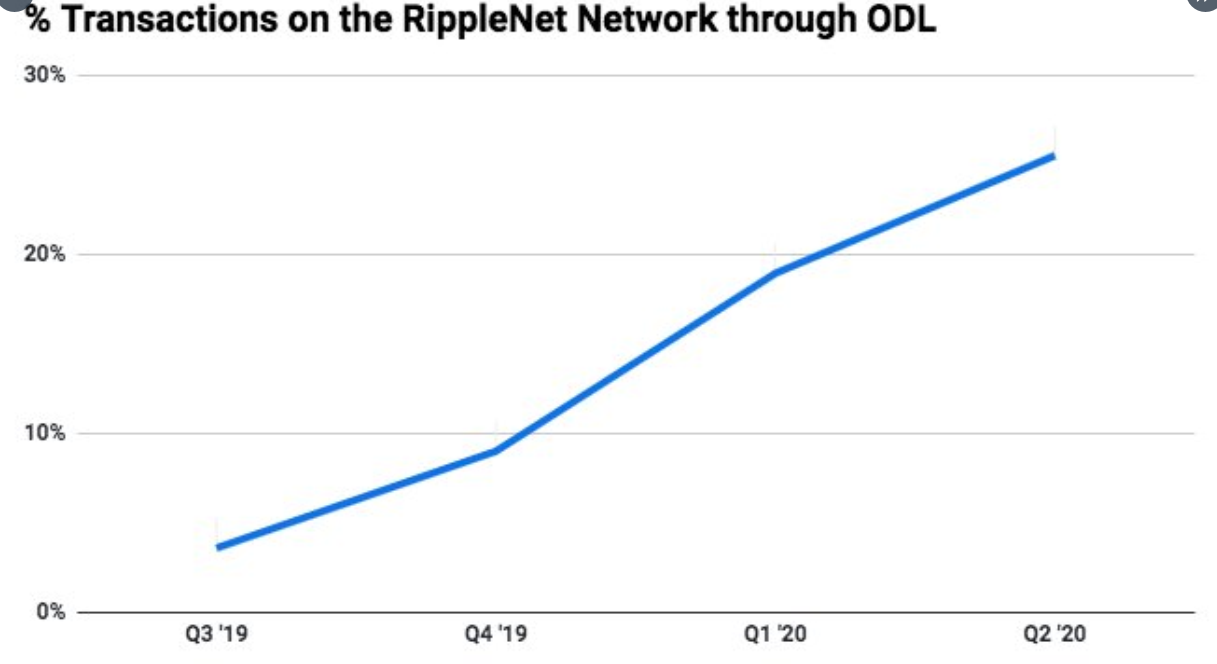

A recent report has it that over 20% of all transactions on RippleNet, the Ripple’s global network of financial institutions, now involves the digital token XRP.

There have been speculations over the number of Ripple’s network of banks and financial institutions that accept to use its native digital currency XRP.

Ripple CEO, Brad Garlinghouse, had once assured the XRP community members that banks and financial institutions will adopt XRP due to its use cases. In this regard, the latest report makes it look like the dream is gradually playing out.

XRP Continues To Gain Ground in RippleNet Transactions

Virtually all the XRP enthusiasts know the impact of the increase in the daily use of XRP. According to Ripple’s senior vice president of product and corporate development, Asheesh Birla in a series of tweets, the payment company’s On-Demand Liquidity (ODL) that facilitates cross-border payments using XRP as the bridge currency, is now increasingly involved in RippleNet transactions.

Asheesh Birla noted:

“Blockchain isn’t just a technology with potential, it’s actually being used. For Ripple, our On-Demand Liquidity (ODL) product using XRP as a bridge currency accounts for nearly a fifth of all transactions on RippleNet.

“All in all, an interesting time to be in crypto (when is it not though?). It feels like the potential we saw early on to leverage blockchain and rethink how to move value without a central counterparty is on the precipice of something extraordinary.”

Birla added that the use of XRP in remittances keeps growing with the increasing institutional adoption of cryptocurrencies as a whole:

“What’s one common denominator here? Likely global uncertainty with fiat currencies, and many in the crypto industry focusing on utility, beyond just speculation. Examples like Dogecoin aside, there’s a new, growing focus on an asset’s use case, its tangibility.

We’re seeing a melding of the old world and new. It’s only a matter of time before banks offer custody services, acquire companies with those capabilities, and potentially even offer crypto lending as they see consumer interest in DeFi.”

Stablecoins Are Showcasing Strong Use Cases

Asheesh Birla also stressed the growth of the dollar-backed stablecoins such as Tether (USDT) and USD Coin (USDC). He stated that they are starting to showcase strong use cases, as they give the unbanked consumers and nonresidents of the United States a means to access the world’s reserve currency, US dollar.

“Stablecoins, esp. dollar-backed, are another fascinating use case. Their success to date is largely due to a unique go-to-market strategy enabling global consumers to access the USD without a bank account via Tether,” Asheesh Birla noted.

Join us on Twitter

Join us on Telegram

Join us on Facebook