There have been concerns regarding the increase in the gas fees on the Ethereum network. And there are claims that Ethereum users have been leaving for other chains in numbers. But the latest data shared by Ryan Watkins of Messari is saying otherwise.

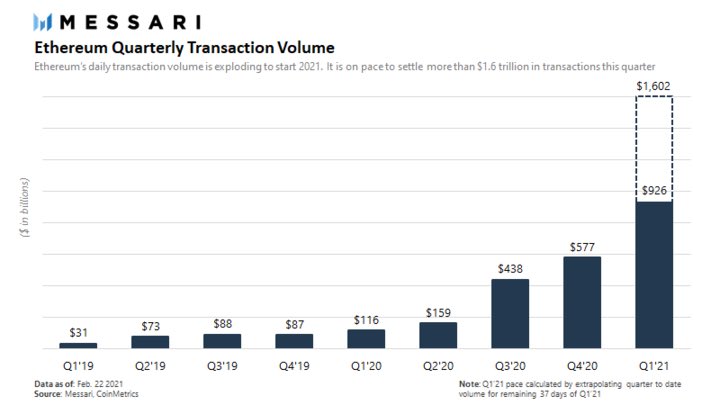

According to the data, $926 billion has already been settled on the Ethereum network in the Q1 of 2021 and it’s on track to settle a record $1.6 trillion before the end of the first quarter.

The data is also saying that a whopping $2.1 trillion in transactions has been settled on the network in the last 12 months.

Read Also: American Singer Gene Simmons’ $300,000 Investment in ETH Becomes $1.376 Million in 4 Months

Ryan Watkins, a researcher at Messari shared this timely information on 24th February via his official Twitter handle. He added that the data only includes stablecoins and Ethereum (ETH).

According to Watkins, this is an incredible scale for a network that has been widely criticized for not scaling as expected.

Captioning an illustrative chart, Ryan Watkins tweeted, “Ethereum is on pace to settle $1.6 trillion in transactions for Q1 2021. In the last 12 months it has settled $2.1 trillion in transactions. Incredible scale for a technology that critics claimed couldn’t scale.”

In the same thread, Watkins questioned the claims that users and developers alike are exiting the Ethereum network in numbers, stating the data is saying otherwise:

“But please tell me how Ethereum is unusable and people are fleeing to other chains. The data points to the exact opposite.”

Read Also: IntoTheBlock Data: Three Reasons Why Ethereum (ETH) Will Likely To Keep Growing

Massive Demand on the Ethereum Network

The increase in the transaction fees on the Ethereum network has been attributed to the magnificent growth in the decentralized finance (DeFi) and non-fungible token (NFT) sectors.

The enormous demand on the network has initiated an increase in gas prices to all-time highs, which is massively phasing out retails traders from initiating smaller transactions.

According to data from Cryptofees.info, an average daily fee generation for the last seven days on the Ethereum network sits around $32 million.

As shared by a supposed Ethereum community member, “Revenues to miners on the ethereum ecosystems are going crazy. Everybody wants to use it.”

Revenues to miners on the ethereum ecosystems are going crazy.

Everybody wants to use it.#ETHEREUM pic.twitter.com/iapXN312Xx

— odin free (@odin_free) February 24, 2021

Read Also: CME Saw about 400 Ethereum Futures Contracts Traded On First Full Market Day

Meanwhile, Ethereum (ETH) has entered into a state of recovery after a notable crash from the $1,950 price region. At the time of publishing, ETH is trading at $1,637.12, with a 0.4% price increase in the last 24 hours.

Follow us on Twitter, Facebook, Telegram, and Download Our Android App