The leading cryptocurrency asset fund manager, Grayscale investments, has reportedly filed form 10 with the United States Securities and Exchange Commission for its Ethereum Trust. Its total investment in ETH now worth $763.8 million.

Grayscale Ethereum Trust Eyeing Next Level

The recent filing initiated by the Grayscale investments with the US Securities and Exchange Commission looks forward to making its Ethereum Trust an SEC reporting firm.

The approval of the filing by SEC will subject Ethereum Trust to the requirements of Regulation 13 A under the Exchange Act. According to the crypto asset fund manager, SEC is already reviewing its application.

“The filing is subject to SEC review; if the Registration Statement becomes effective, it would designate Grayscale Ethereum Trust as the second digital currency investment vehicle to attain the status of a reporting company by the SEC, following Grayscale® Bitcoin Trust as the first.”

Making Grayscale Ethereum Trust an SEC reporting company would boost Grayscale’s reputation in the eyes of institutional investors that are still not fully convinced with investing in digital assets.

Grayscale Keeps Increasing Its Investment in Crypto Assets

In the past weeks, Grayscale has been reporting its increased investment in crypto assets, which progressively started in January 2020.

Obviously, the outbreak of coronavirus contributed to the infamous price crash that hit the crypto market sometimes in March. However, the market has been in steady recovery after the prices of digital assets such as Bitcoin (BTC), Ethereum (ETH) and others bottomed a few days after the crash.

Many crypto analysts have opined that the long-anticipated bull season is already here, considering the upside price trend recorded across the board lately.

Grayscale investments has continued to increase its investment in Ethereum and other cryptocurrencies. A few days ago, Herald Sheets reported that the firm doubled its investment in the Ripple’s digital token XRP within 24 hours.

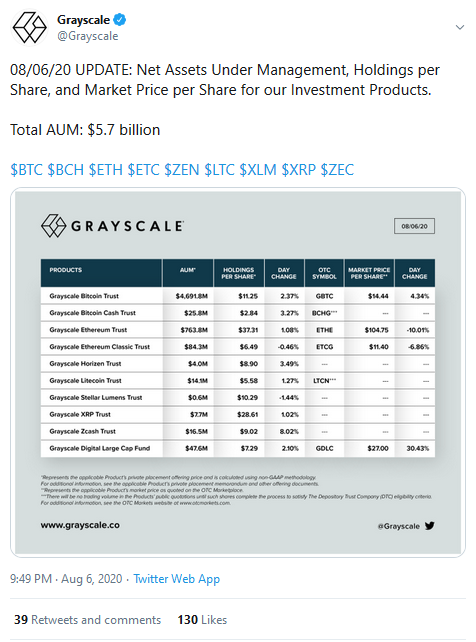

The recent report shared by Grayscale via its official Twitter handle indicates that the firm now has $5.7 billion worth of various crypto assets under its management. Bitcoin (BTC) takes the highest part of the investment, followed by Ethereum (ETH) with a total of $763.8 million.

Grayscale’s investments since the start of the year showcase the promising future of cryptocurrencies as a whole.