Despite the slight price appreciation experienced by ETH lately, Grayscale Ethereum Trust still recorded over 50% loss this week alone.

The update about the crash came after the Grayscale announced a successful quarter. The investment company recently reported that assets under management (AUM) attained all-time-highs.

Also, reports about the accumulation of Ethereum (ETH) and Bitcoin (BTC) by Grayscale indicate that institutional investors now have a growing interest in cryptocurrency.

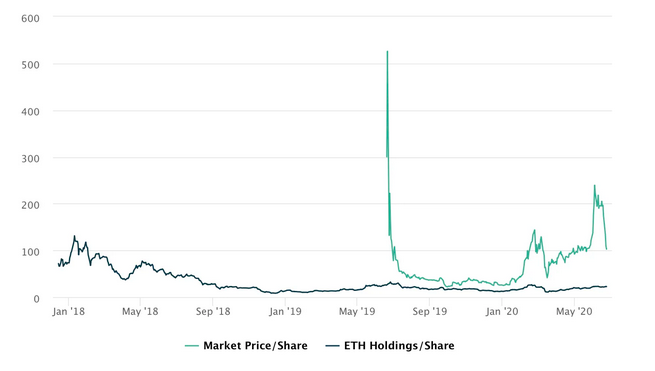

Over the past month, the Grayscale Ethereum Trust recorded a notable gain. At the end of May, the price per share was a bit above $110. In relatively a week later, it rose by over 100%, having the price per share at over $220.

Back then, the price of the Ethereum Trust share grew up to 700 percent. As of now, its value is now back to the point it was before the June uprising, due to the significant plummet it recently experienced.

As the sudden crash brings new investors to take advantage of the new price, some in-house investors will be left stumbled due to the huge decline.

Going by the account of Nic Carter, the founder of Coin Metrics, Grayscale Ethereum Trust lost value because institutional investors such as Hedge Funds are liquidating positions.

He added that the liquidation can only play out after a 1-year delay, which also stops sellers from offloading their holdings as fast as they wish.

Grayscale’s Investment in Ethereum (ETH)

Grayscale’s interest in Ethereum (ETH) has grown since the beginning of 2020, resulting in an increased purchase of the digital asset by the investment firm.

In early June, the director of investor relations at Grayscale, Ray Sharif-Askary reported that the crypto fund manager has substantially increased its investment in Ethereum (ETH), stating that its investment in the digital asset has grown up to $110 million, which represents 22 percent of Grayscale Investments’ purchases year-to-date.