Within the past 24 hours, nearly 190K ETH have moved out of crypto exchanges, the largest outflow from exchanges since the beginning of this year.

$470m Worth Of ETH Moved Out Of Crypto Exchanges Within 24 Hours

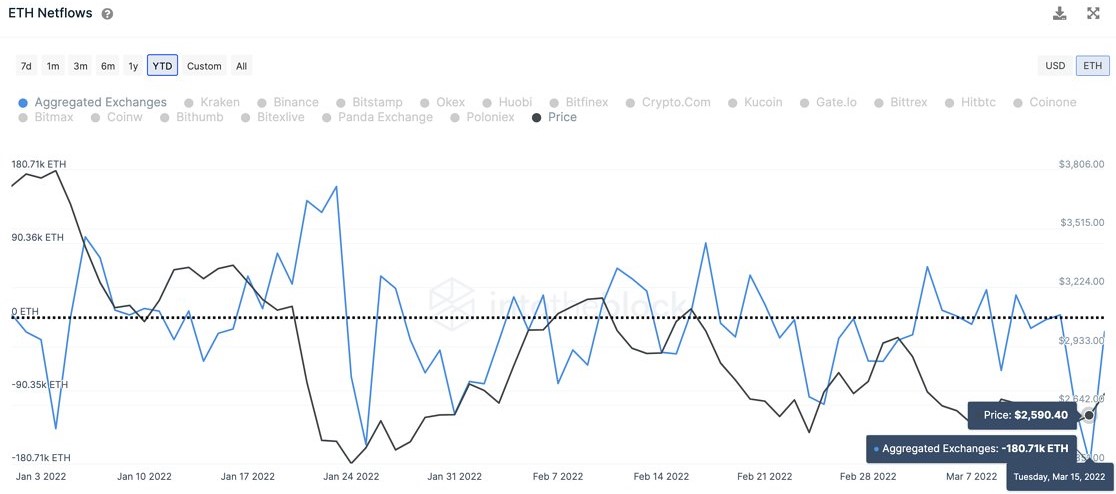

The latest data from IntoTheBlock (a popular on-chain crypto analytics platform) revealed that the combined amount of ETH that moved out of exchanges (like crypto.com, Binance, and Coinbase) in the past 24 hours is 180,711 ETH. Using the price of ETH at that time means that nearly $470m worth of ETH tokens moved out of exchanges and represents the largest outflow since the beginning of this year.

Net ETH outflows. Source: IntoTheBlock

The data added that the last time this amount of outflow occurred was last October. That outflow culminated in a 16% rise in ETH price in less than 12 days. Hence, the report predicts that the massive outflow at this time may also have the same effect since history tends to repeat itself with the price of digital assets.

Ether’s Market Cap And Transaction Fees

Unsurprisingly, the largest Ethereum outflow for this year coincided with the rise in the crypto’s market cap. The market cap of the second-largest crypto surged by nearly $25B over the past seven days.

The latest Coinmarketcap data states that Ethereum’s market cap is $348B. There has also been a significant drop in transaction charges on the ETH and BTC network. Thus, making them less expensive for the general populace. As of this writing, the total transaction fee on the Ethereum network is slightly over $8.

Hence, this is one of the factors that Coinmarketcap analysts considered when they predicted that ETH would trade at $3,622 before the end of this month. But, based on ETH’s current price and the huge outflows from CEXs, many crypto investors would closely monitor this digital asset’s price throughout this month.

Over 10% Of ETH Is Staked In ETH2 Contract

Analysts believe that ETH price will surge by 25% after the ETH to ETH2.0 switch hits the testnet. Many investors view this move to have a positive effect on ETH price. As of this writing, over 10% of ETH’s supply has been staked in the ETH2.0 contract.

Ethereum enthusiasts opined that the switch to ETH2.0 should be completed before Q3 2022, which would cause significant growth in the network’s staking yield. These Ethereum enthusiasts also argued that completing this switch would turn Ethereum into a deflationary asset.

Thus, resulting in increased bullish action and a rise in ETH price. Many experts expect the network’s daily emissions to reduce by 85% within a few months of the merge completion. Also, validators’ rewards could rise by 250%. Many Ethereum investors are bullish about this digital asset based on the factors above. Many crypto analysts are still optimistic that ETH will flip BTC to become the leading digital asset and the switch to ETH2.0 is one of the ways that’s going to happen.