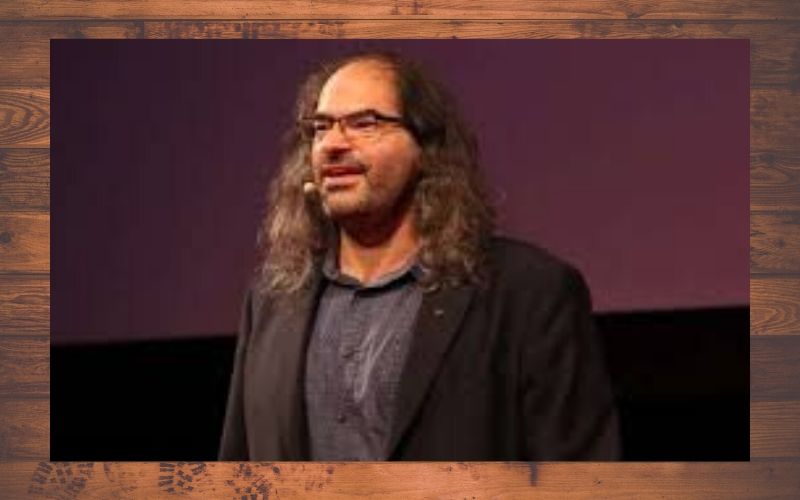

Ripple CTO, David Schwartz has given the reason why some Ripple’s partners are not willing to allow the blockchain tech to handle their retail payments directly.

David Schwartz has been usual with answering community questions lately. And due to his modality of attending to their concerns, the majority of XRP community members are willing to take their issues to him and others are also ready to listen to his opinion regarding any matter arising.

Why Some Partners Are Unwilling to Allow Ripple Handle Their Retail Payments

The question was raised by a supposed XRP community member on Twitter. This concern was about the recent article published by Ripple on its official website, credited to SVP of Product, Asheesh Birla, and titled “Staying the Course in Remittances and Payments”.

This article has since raised anxiety amidst XRP community members. Some even cast doubt on whether the strategic partner, MoneyGram, believed to mostly adopt the use of XRP for its transactions, is still using the digital token as generally believed.

For clarity, the XRP community member, who tagged the Ripple CTO, David Schwartz in his question, wrote, “Seems this has caused a bit of anxiety. Are you able to offer any further clarity – THX.”

https://twitter.com/FfattMedia/status/1270125936189505538

In response to the question, Schwartz wrote:

It was always our preference to handle smaller payments directly, rather than handling larger payments that are later divided into smaller ones.

Some partners weren’t willing to let us handle their retail payments directly until we could prove that the technology worked reliably. Treasury operations were safer because customers weren’t waiting for them to complete.

There’s an obvious advantage to handling larger payments. If you think the size of the payment measures its economic importance or relevance, then big payments mean big $ numbers.

But handling lots of smaller payments has advantages too, they’re just subtler. A big one is that it’s “stickier”. The benefits are pushed all the way down to the customer and then it becomes more than just a replaceable tiny cog in a big machine.

You also need to prove lower fixed costs to handle smaller payments. And the benefits flow more directly to those who most need them.

I’d encourage people to give some thought to the relative advantages and disadvantages of more dollar value versus more individual payments, particularly in the remittance context. It’s not clear cut.