CoinMetrics, a crypto analytics and research firm, has shared what the net daily issuance of Ethereum (ETH), the second-largest cryptocurrency by market cap, would look like if the upcoming Ethereum Improvement Proposal (EIP) 1559 results in 75% of fees burned.

Some institutional investors have had concerns in relation to Ethereum’s economic policies, especially the rate of the increase in transaction fees compared to Bitcoin (BTC).

Read Also: Vitalik Buterin: Ethereum 2.0 Benefits Such As 100k TPS Will Come Faster Than People Expect

However, some of those issues will soon be addressed once Ethereum Improvement Proposal (EIP) 1559 is implemented in July as slated.

CoinMetrics on Net Issuance of Ethereum (ETH) In Relation To EIP-1559

As aforementioned, the implementation of EIP-1559 is set to play out along with Ethereum’s London hard fork in July 2021. Aside from improving ETH gas UX, EIP-1559 will burn a portion of the digital token transaction fees, which will permanently remove a portion of supply from circulation and reduce the daily net issuance of Ethereum (ETH).

Read Also: Vitalik Buterin Compares Ethereum Miners’ Daily Rewards to Ethereum Foundation’s Annual Budget

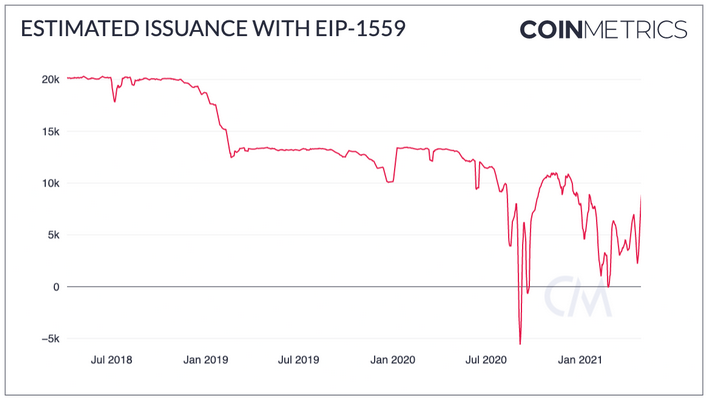

In order to make it more explanatory, CoinMetrics shared a chart that shows what the net daily issuance of Ethereum (ETH) would look like if EIP-1559 results in 75% of fees being burned.

According to the analytical firm, this is just a historical estimate calculated by subtracting 75% of daily fees from the amount of ETH issued on a daily basis.

The firm pointed out that there is currently no way to know the exact percentage of fees that will be burned compared to the percentage of tips once EIP-1559 is released. However, the chart shows that issuance will possibly be reduced significantly and likely turn negative when fees are extremely high.

Read Also: Berckmans to CZ Binance: Competitors Can Only Attack Ethereum Now, Table Will Turn Next Year

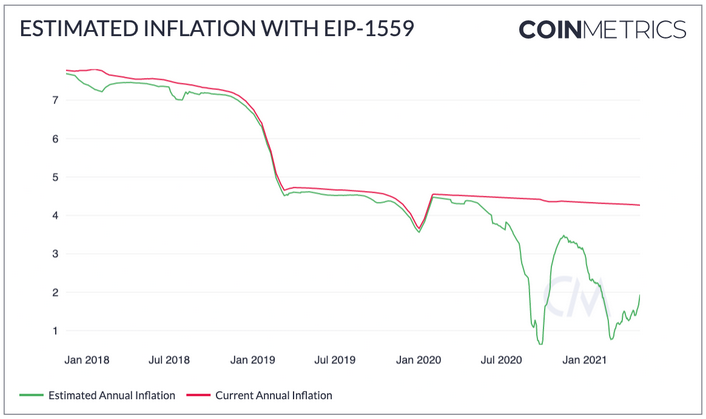

The firm further illustrated that this would lead to an estimated annual inflation rate (30-day average) of between 1 to 2%, which is a notable drop.

According to CoinMetrics, this is just an estimation, stating that it will fluctuate depending on the amount of daily transaction fees and the percentage that is burned. But the firm is optimistic that Ethereum’s inflation rate will drop significantly.

What ETH 2.0 Would Bring to the Ethereum Network?

According to Vitalik Buterin, the co-founder of Ethereum in the recent Ethereal Summit, the optimistic estimate of the ETH 2.0 launch is the end of this year.

Read Also: Credible Crypto Says $3,000 Is Just the Start for Ethereum, Sets $10,000 Price Target for ETH

The much-anticipated launch of Ethereum 2.0 will introduce staking, which will effectively turn the digital token ETH into a yield-bearing asset.

At the time of writing, 4,419,778 ETH worth $17.2 billion has been locked in the Ethereum 2.0 deposit contract. This number is expected to increase considering the introduction of Ethereum staking products by Coinbase and a number of other exchanges.

Follow us on Twitter, Facebook, Telegram, and Download Our Android App