A pseudonymous DeFi investor, identified on Twitter as Arthur, has called the attention of the Ethereum community to three important data that showcase the significance of the digital token ETH in the Ethereum ecosystem.

According to Arthur in a thread of tweets, the role of ETH is becoming more significant in the ecosystem, averring that it’s now being used more than ever as a non-speculative asset. He backed his claim with three different data that uniquely describe the outstanding performance of ETH.

Read Also: Ethereum (ETH) Ecosystem about to Welcome Over 400 Million People

ETH Continues To Move Out Of Centralized Exchanges

According to Arthur, the first data about the significance of ETH’s role in the Ethereum ecosystem was shared by Bloqport.

Going by the data, there has been a decrease in the amount of ETH on centralized exchanges. This implies that many ETH holders want to hold the assets for quite a long time.

Bloqport tweeted, “The amount of ETH held on centralized exchanges has reached a 19-month low.”

The amount of $ETH held on centralized exchanges has reached a 19-month low pic.twitter.com/A6daguJmGK

— Bloqport (@Bloqport) March 22, 2021

Read Also: Ethereum Light Wallet MetaMask Launches In-Wallet Transaction

ETH Held in Smart Contracts Has the Flipped Balance on Centralized Exchanges

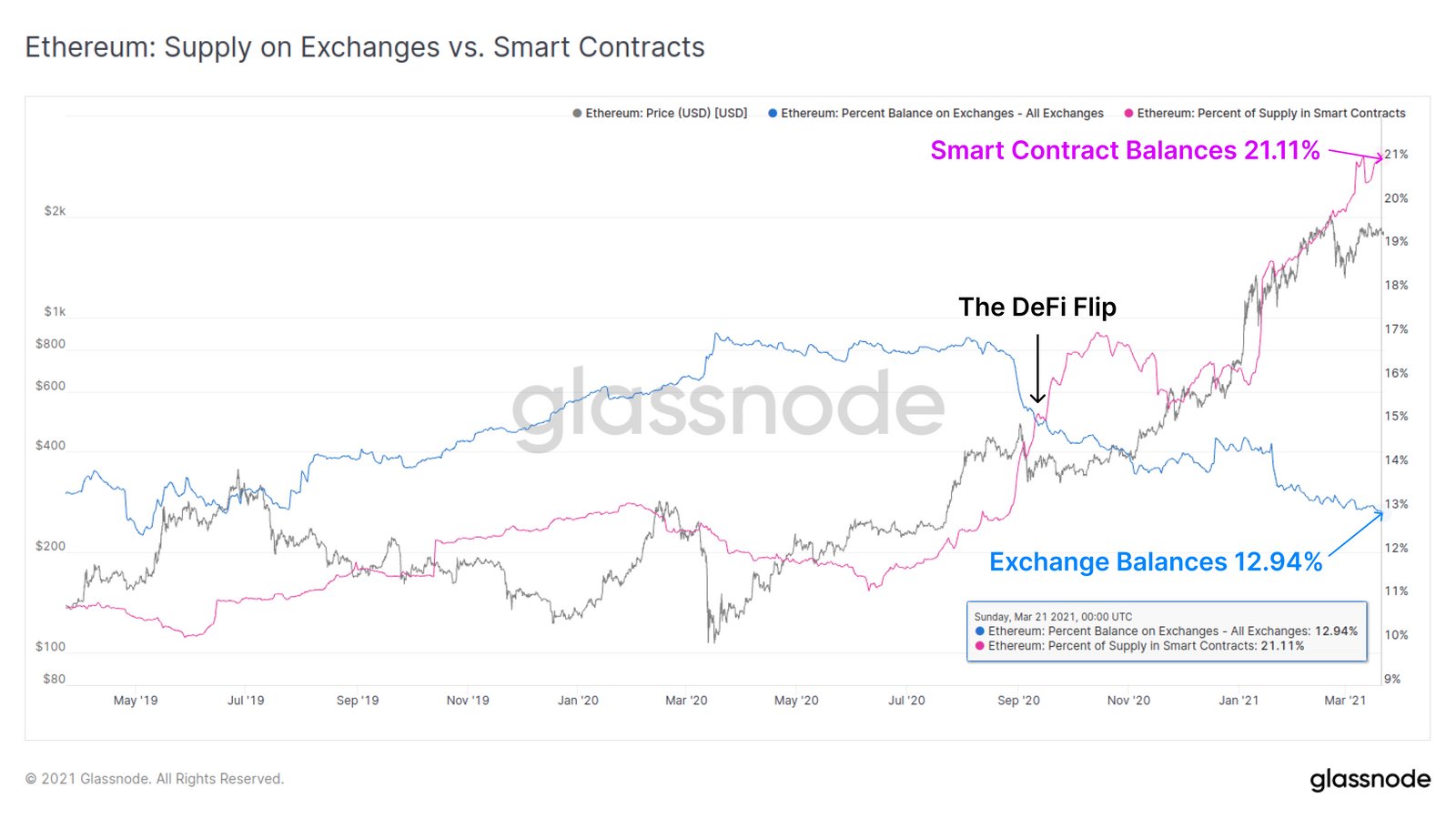

Arthur also called the attention of the Ethereum community to the fact that the amount of ETH held in smart contracts has surpassed the balance on centralized exchanges (CEXs) since the 2020 summer.

Captioning an illustrative data provided by Glassnode, Arthur tweeted, “The ETH balance held in smart contracts has also flipped the balance on CEXs since DeFi summer last year. As of today, exchange balances hold 12.94% of ETH whilst smart contracts now hold over one-fifth of the supply at 21.11%.”

Increase in Amount of ETH Locked in Ethereum 2.0 Deposit Contracts Address

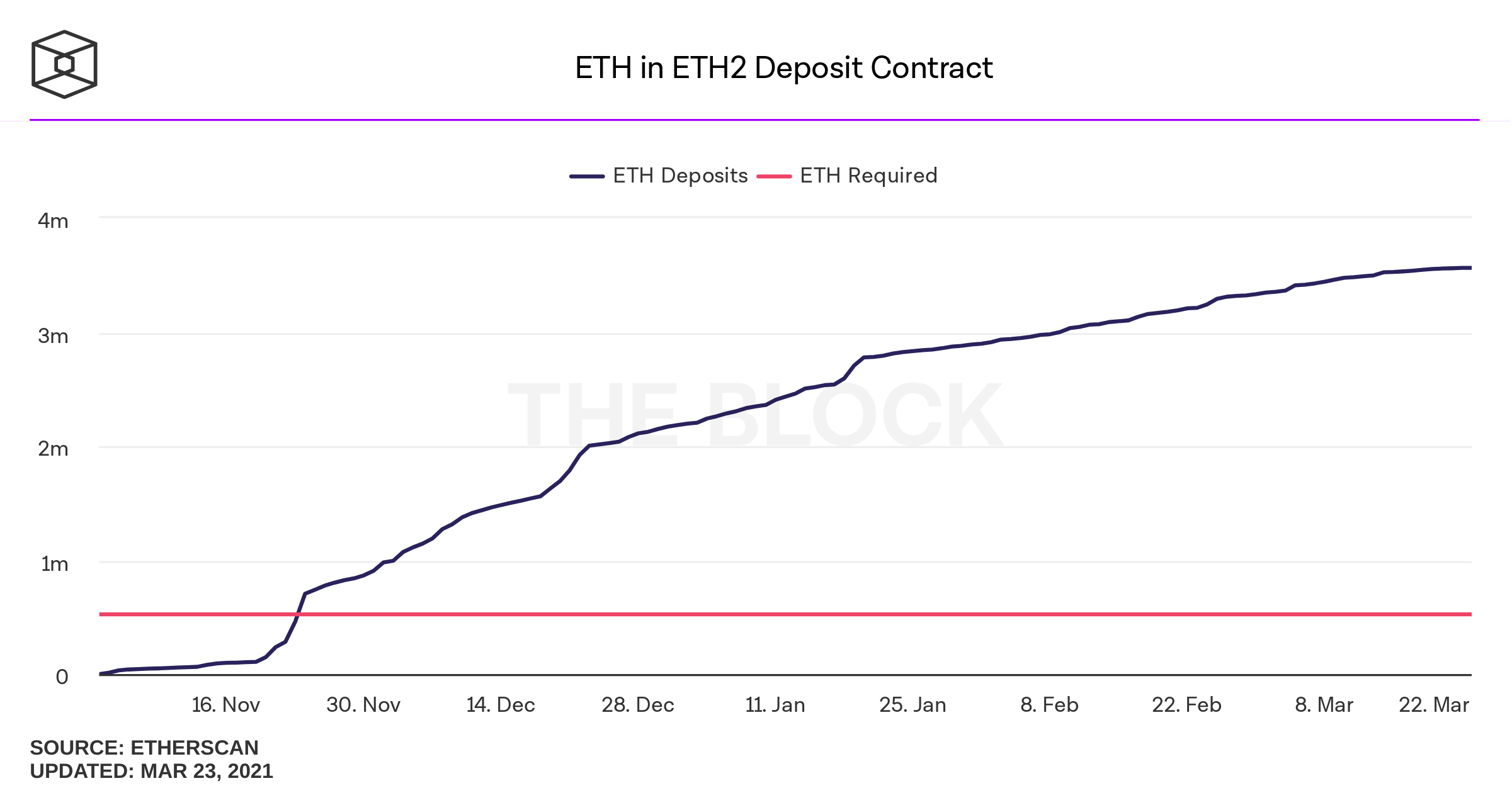

The last fact that shows the significant role of ETH in the Ethereum ecosystem according to Arthur is the increase in the number of ETH locked in the Ethereum 2.0 deposit contract address.

Arthur wrote, “The amount of ETH locked in ETH 2.0 deposit contracts continue to increase steadily, standing at 3.56m of ETH now, representing ~3% of ETH’s supply.”

In conclusion, the DeFi investor stated that the implementation of EIP-1559 and the accelerated timeline of Proof of Stake merging should further enhance the value of ETH in the market, which implies that the future of Ethereum is bright.

Follow us on Twitter, Facebook, Telegram, and Download Our Android App