A new study by the Federal Reserve Bank of Dallas has shown that the third-largest cryptocurrency by market capitalization, XRP, is distinct from other cryptocurrencies in terms of price reaction to regulatory news.

The study conducted was published in April 2020, and titled, “Cryptocurrency Market Reactions to Regulatory News”.

Part of the abstract of the study says “cryptocurrencies are often thought to operate out of the reach of national regulation, but in fact, their valuations, transaction volumes, and user bases react substantially to news about regulatory actions.”

The study started with Bitcoin (BTC), the largest cryptocurrency by market cap, followed by other six digital currencies, which include Ethereum (ETH), Ripple’s XRP, Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), and Zcach.

The report reads:

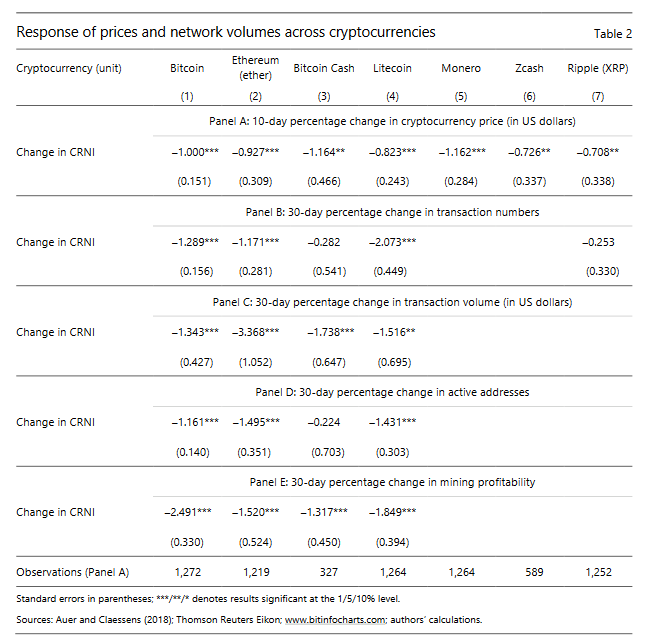

“This index captures how, on a given day, regulatory events would have moved the price of bitcoin. We then gauge the price responses of other cryptocurrencies to changes in this index, i.e. we essentially see whether the prices of these other cryptocurrencies reacted more or less strongly to regulatory news than bitcoin did, on average.”

The study shows that the price of Bitcoin (BTC) notably responds to regulatory news. This reaction could be positive or negative, depending on the nature of any regulatory news at a given time.

Columns 2-7 show the change in prices of the other 6 cryptocurrencies, which include Ripple’s digital token XRP. So, in terms of responsiveness of digital currencies compared to Bitcoin, the study reveals that the two coins forked from Bitcoin – Bitcoin Cash (BCH) and Litecoin (LTC), including the second-largest cryptocurrency by market cap, Ethereum (ETH), react notably to Regulatory News, as much as Bitcoin (BTC).

The two Privacy Coins (Monero and Zcash) included in the study were also examined. Monero reacts significantly and more strongly than Bitcoin, while Zcash reacts less to Regulatory News.

Federal Reserve Bank of Dallas cited a shorter life span in the case of Zcash, since it came to existence just 2 years ago, which probably impacts the outcome.

Federal Reserve Bank of Dallas Reveals Distinct Nature of XRP

The last on the list is Ripple’s XRP. Federal Reserve Bank of Dallas reveals the distinct nature of XRP, thanks to Ripple’s consistent regulatory compliance.

The study reveals that XRP is distinct from other cryptocurrencies sampled, in terms of price reaction to regulatory news.

The report reads:

“The XRP token also react less, which may reflect that its network of trusted nodes is centrally controlled by its issuer Ripple, making the XRP token distinct from other, permissionless, cryptocurrencies.”