Despite the entire crypto market (including large-cap crypto-assets such as bitcoin) experiencing a market correction, Synthetix’s native token (SNX) was rising. SNX rose for four consecutive days by over 50% to now trade at about $9.61.

It even rose sharply by 18.30% in a prior daily session, but that sharp rise was the consequence of bitcoin’s surge past the crucial $35.5K resistance level. As is the custom, altcoins toed the path of the leading cryptocurrency.

SNX and BTC Price Chart Comparison. Source: TradingView

However, there are several reasons for SNX’s bullish run. One reason is the massive investment into the decentralized finance (DeFi) space. The 7-day timeframe showed that almost all the leading DeFi assets gained double figures. For example, Uniswap, Aave, and Compound gained about 17%, 25%, and 39.50%, respectively.

Also, the SNX/USD pair rose by almost 32% within the same timeframe. It was only SNX that posted profits among all the DeFi tokens on the 24-hour timeframe.

SNX 24-hour Profits. Source: Messari

Ether also rose by over 9% in the last seven days, and it does so because almost all DeFi projects are hosted on it.

VORTECs Metrics Is Bullish

Cointelegraph reports that its market analytics app (VORTECs) has started showing signs of a possible bullish trend for SNX before its recent bullish run. The VORTEC’s score is determined by combining various data points from historical and current market situations. Such data points include twitter actions, recent price movements, trading volume, and market sentiment.

VORTECs score and SNX price comparison. Source: Cointelegraph markets pro

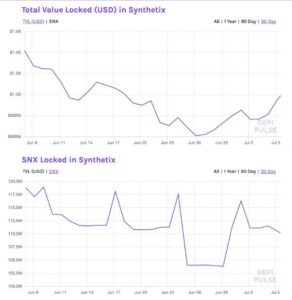

Synthetix’s Total Value Locked Is Now Almost One Billion Dollars

The 50% rise in SNX resulted in an increase of Synthetix pools’ total value locked to almost one billion dollars. Unfortunately, the SNX token declined despite an increase in its TVL reserves when considered in USD. It had peaked at almost 115.30 million units last Thursday but declined by about 5 million units.

Decline in SNX locked in Synthetix pools. Source: DeFi Pulse

Synthetix offers blockchain exposure to standard assets like indexes, stocks, commodities, and currencies as a decentralized asset platform. Users can lock their native token (SNX) into their smart contracts as collateral to support the synthetic assets (called synths). The synths monitor the prices of several assets. Thus, enabling traders and investors to perform a peer-to-contract trade on its exchange.

Also, users can unlock their SNX by burning some of their synths as debt. The SNX tokens reached their peak last year December when it was at about 168.38 units. However, it declined to less than 100 million units early this year and has been rising gradually since that time, but the rise hasn’t been straightforward.

One other possible reason for the rise in Synthetix TVL is the increase in the annualized percentage yields (APY). SNX’s APY is far greater than standard, yielding assets such as the U.S. Decade treasury note.

SNX APY. Source: Synthetics Website

The new SNX surge has caused its price to shatter its normal technical support and resistance levels of $7 and $8.50.