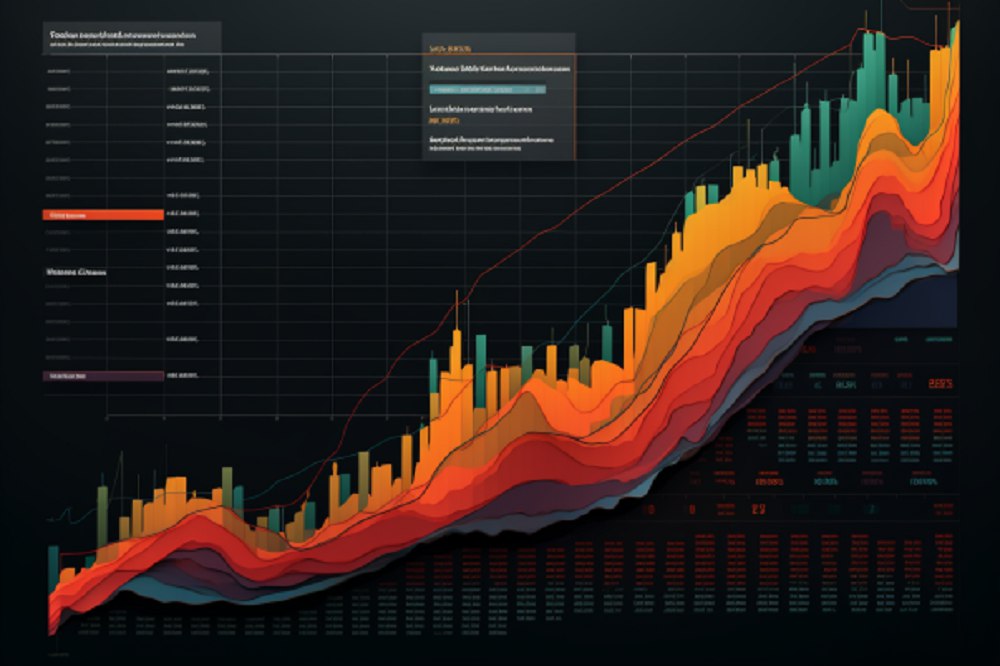

The cryptocurrency market has witnessed remarkable uptrends in recent trading sessions. However, the performances of SOL, ETH, and BTC have been notable.

Solana’s Breakthrough Ignites Bullish Sentiment

Solana, the blockchain platform known for its high-performance decentralized applications, has captured the spotlight with its monumental breakthrough. Solana’s price has surged past the $130 mark, breaking through a critical resistance level and signaling a trend shift for the cryptocurrency.

Analysts attribute this breakthrough to strong technical indicators and growing investor interest in Solana’s ecosystem. The chart analysis confirms the bullish sentiment among traders.

Supported by robust trading volume, the cryptocurrency eyes the $140 zone as the next potential resistance level. While the $107 mark stands as immediate support, analysts remain optimistic about Solana’s potential for sustained growth in the coming days.

ETH’s Rally Continues

Meanwhile, Ethereum, the second-largest cryptocurrency by market capitalization, continues its meteoric rise, surpassing one milestone after another. Currently trading above $3,400, the rally showcases Ethereum’s ecosystem strength and investor confidence.

However, analysts warn that a bearish reversal could happen soon. The $2,695 mark emerges as a critical support level; a break below this level of support could present a significant challenge for the digital asset.

Despite Ethereum’s bullish sentiment, traders should keep monitoring key support levels and exercise proper risk management strategies to navigate market downturns.

BTC Displays Formidable Strength

After surging past the $60,000 resistance level, on-chain data shows that BTC’s latest ascent is fueled by significant buyer confidence and increasing trading volume. Analysts point to the bullish technical indicators as signs of Bitcoin’s continued uptrend.

With BTC’s Relative Strength Index (RSI) trending towards overbought territory, analysts remain cautiously optimistic about the cryptocurrency’s potential for further gains. Despite the possibility of short-term corrections, Bitcoin’s solid fundamentals and growing institutional adoption continue to fuel investor optimism.

With Solana’s breakthrough, Ethereum’s meteoric rise, and Bitcoin’s strength, investors are witnessing historic milestones unfold before their eyes.

Whale Banks $3.49M From PEPE, Diversifies Profits

Meanwhile, a crypto whale recently sold off their entire 1.97 trillion PEPE tokens, earning $6.07 million. The move resulted in a net profit of $3.49 million for the investor, who promptly reinvested the funds into diverse digital assets, according to data from blockchain analytics firm Lookonchain.

Notably, the investor acquired significant stakes in Shiba Inu (SHIB), The Sandbox (SAND), Decentraland (MANA), and Gala (GALA). This diversification strategy mirrors a common practice among large-scale investors within the crypto space, aiming to capitalize on the unique opportunities presented by each digital asset.

Despite mixed performance across the selected assets, the investor’s diversified approach reflects confidence in sectors with high growth potential.