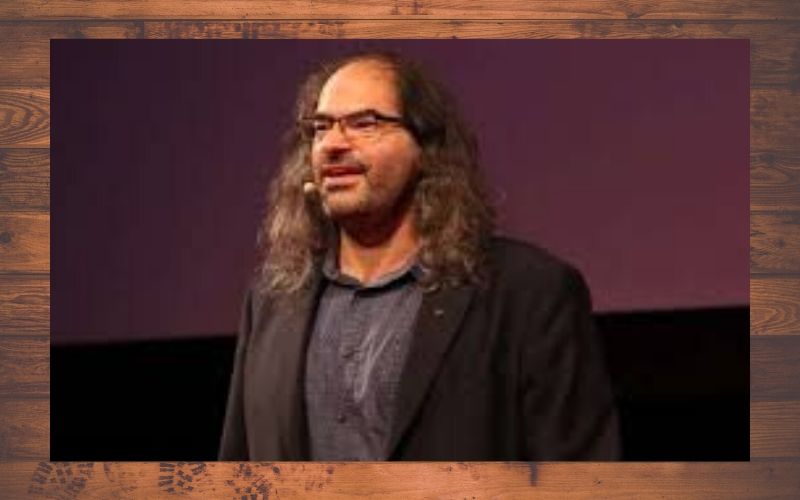

David Schwartz, Ripple CTO has also joined a number of crypto big guns that recently charged Peter Schiff, for his continuous criticism of the first and largest cryptocurrency, Bitcoin (BTC).

Peter Schiff is a gold investor, who founded an asset management company, Euro Pacific. He became very popular in the cryptocurrency space, due to his constant criticism of Bitcoin (BTC) use cases.

He recently made a comment regarding the upcoming Bitcoin halving. There, he criticized the investors in anticipation of the upcoming event that is generally believed to be a catalyst for the significant increase in BTC price in the past.

In the tweet, Peter Schiff said Bitcoin halving is usually regarded as being bullish and many unknowingly fall for it. He then added that it’s too risky for the incoming investors, as those who take advantage of the halving to campaign for Bitcoin are doing it for personal interest.

He said, “The Bitcoin halving, the most highly anticipated milestone in Bitcoin’s development, is now less than a month away. As it’s universally regarded as being bullish, lots of speculators have already bought. This risks a huge “sell the fact,” as those hoping to cash in, cash out.”

Reacting to Peter Schiff’s Opinion, David Schwartz said:

“You’re saying the halving’s bullish effect on supply is priced in but the bearish sell pressure after it isn’t? The reverse seems much more plausible to me, and yet still pretty implausible.”

You're saying the halving's bullish affect on supply is priced in but the bearish sell pressure after it isn't? The reverse seems much more plausible to me, and yet still pretty implausible.

— David "JoelKatz" Schwartz (@JoelKatz) April 14, 2020

The Benefit of Bitcoin Halving to other Cryptocurrencies

Obviously, Bitcoin halving is the most anticipating event in the cryptocurrency space, owing to its past impact on the price of virtually all cryptocurrencies in the market, including XRP.

The next Bitcoin halving will take place in early May 2020. Like in the past, Bitcoin enthusiasts believe it’s about time to smile to the bank, as the price of the digital currency is expected to spike exponentially in the coming months.

Since inception, Bitcoin having has twice been conducted. First in 2012 and second in 2016. And the two scenarios were succeeded by an unimaginable price bull run.

Due to the sovereignty of BTC in the market, other digital currencies also replicated the bullish trend of Bitcoin, as many of them recorded their price all-time highs. So, that’s why the event is expected at all quarters in the cryptocurrency ecosystem.

In conclusion, the nature of events that play out in months after Bitcoin halving will either prove Peter Schiff right or wrong.