IC Markets Review

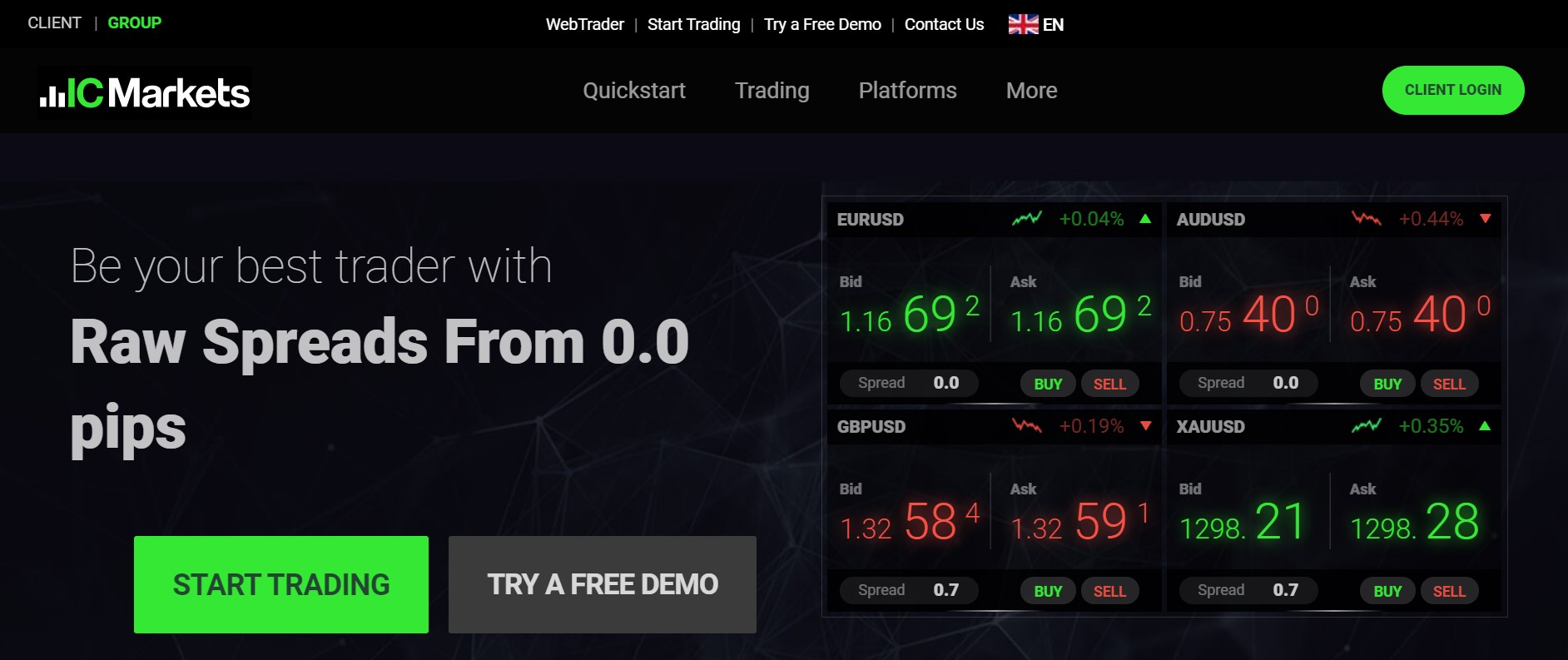

IC Markets is a broker based in Australia that welcomes customers from all around the world. The business, which was founded in 2007, has a solid track record to date. The broker’s secret is that it offers genuine market access and has meager trading costs for the finest trading technology. The business was founded by a group of financial experts in Sydney, Australia, to bridge the gap between retail and institutional customers by providing trading solutions. Recently, the broker has grown to become one of Australia’s top trading providers and expand its services to include foreign and European entities, establish a Chinese support center, and offer genuinely competitive trading conditions.

IC Markets is a broker based in Australia that welcomes customers from all around the world. The business, which was founded in 2007, has a solid track record to date. The broker’s secret is that it offers genuine market access and has meager trading costs for the finest trading technology. The business was founded by a group of financial experts in Sydney, Australia, to bridge the gap between retail and institutional customers by providing trading solutions. Recently, the broker has grown to become one of Australia’s top trading providers and expand its services to include foreign and European entities, establish a Chinese support center, and offer genuinely competitive trading conditions.

At IC Markets, security is a crucial concern. At the Australian National Bank, customer accounts are handled independently from corporate money. Furthermore, the broker has the biggest liquidity providers engaged, demonstrating a high level of commitment. As a result, orders are processed quickly. IC Markets provides traders with a lot of liquidity. Currently, the business is growing in other nations and gaining a lot of popularity. The company’s headquarters are located in Australia, the Seychelles, and Cyprus, respectively. Many traders operate under the Seychelles company since each client trades with a high leverage.

the broker is a good option for large-volume traders, EA traders, and scalpers that want to avoid dealing desks and price manipulation. Trader orders are connected to the market through fiber-optic connections via servers in Data Centers in London and New York. the broker is a respectable and well-established online trading brokerage headquartered in Sydney, Australia, regulated by the Australian Securities and Investments Commission.

The online broker is well-known in Australia. It is often regarded as the most acceptable online brokerage accessible since it provides the most considerable possible leverage, costs, minimal spreads, and much more. By providing investment options that were previously exclusively available to investment banks and high net worth individuals, the trading firm aims to bridge the gap between regular customers and large institutional investors. IC Markets specializes in forex trading and provides futures, indices, and commodities to its clients.

Regulation

Regulation by a government agency is critical for internet trade. A license establishes a reliable connection between the broker and the client. IC Markets must adhere to a set of rules and regulations to acquire such a license. Violations of these criteria will result in the permit being revoked immediately. As a result, consumer fraud may be ruled out in this case. The Australian Securities and Investments Commission, Cyprus Securities and Exchange Commission, the Seychelles Financial Services Authority, regulate IC Markets. It is a state government agency’s autonomous entity. Two of the world’s most well-known multinational banks, both of which have a lot of cash on hand, handle customer transactions. IC Markets also employs external and independent auditors to oversee the broker.

Because registered and regulated trading businesses are continuously monitored and inspected by an external recognized body, the broker is regarded as a safe broker. The broker is based in Australia, and it operates under the Australian Securities and Investments Commission. Furthermore, IC Markets operates a licensed company in Cyprus, allowing it to provide legitimate and legal trading services to European customers.

IC Market traders may feel secure since they are licensed and regulated by ASIC, one of the most rigorous financial authorities globally. Money protection is offered in a number of regulated methods, including client money segregation in accounts that are only accessible by the customer and used to facilitate their trading. the broker is also a member of an authorized Australian external dispute resolution system that handles complaints between customers and member financial services companies fairly and impartially.

Try Crypto Engine With IC Markets Now – FREE Sign Up

Leverage

Leverage is a term used to describe a loan provided by a broker to a trader to allow the trader to trade with larger capital and enhance possible profits. However, we would advise any trader to utilize the tool wisely and carefully study how to build up proper leverage for a particular product or trading strategy and leverage specified by the IC Markets organization and specific jurisdiction laws. IC Markets offers leverage of up to 1:500, making the forex market accessible to retail traders with a modest or no initial deposit to cover margins. Leverage may increase profits, but it’s essential to realize that losses can easily surpass your original investment.

Instruments for Trading

The markets provide a wide variety of products to meet the needs of every trader, including all of the leading trading instruments and newer ones such as Cryptocurrencies. FX, Equities, Commodities, Futures CFDs, Stocks, and Bonds are the asset classes. The Crypto trade provides trading pairs for Ethereum, Dash, Bitcoin, Litecoin, Cash, and the ability to go long with a leverage of 1:5 and a minimum lot size of 0.01.

Withdrawals and Deposits

IC Markets provides ten different financing alternatives in ten foreign currencies: AUD, JPY, GBP, HKD, NZD, SGD, CHF, EUR, CAD, and USD. That’s fantastic since you can choose the one that’s right for you and avoid paying additional conversion costs. Clients may deposit and withdraw money using various methods, including credit cards, bank transfers (including local ones), PayPal, Neteller, WebMoney, Skrill, Qiwi, UnionPay China, and more. First, The Basic (standard) Account, which is enabled via MetaTrader4, and the other two account types offered at IC Markets, need a minimum deposit of $200. The majority of these deposit options are instantaneous and accept various currencies.

IC Markets does not impose any extra fees on deposits or withdrawals. However, for International Bank Wire withdrawals, IC Markets passes on the business banking institution’s transfer costs, which amount to around AUD20 and are taken from the amount of your departure. Check with your payment provider about any transaction fees applicable to payments to and from certain foreign financial institutions. Various payment methods will execute withdrawals in the timeframe specified, while the accounting staff at IC Markets verifies transactions within 1-2 business days. Many of the same techniques as deposits may be used to make withdrawals. Domestic bank transfers and e-wallet withdrawals are free and may be completed on the same business day. Withdrawals from outside the United States may take up to 3-5 business days.

Platforms for Trading

IC Markets provides its traders with a choice of three high-quality trading platforms. Traders are given various tools and analytical techniques to execute their trades viq three distinct trading platforms. IC Markets also provides innovative software proposals and the comprehensive technical optimization of execution offered by leading technologies. MetaTrader 4 and cTrader are two of the most popular trading platforms on the market today. Therefore IC Markets offers both their direct access to the ECN trading environment. If you want, you may still trade using MetaTrader5, which is an upgraded and better version with a slew of additional features.

Desktop Platform

There is no need to go into great detail regarding the platform’s capabilities since they are all-powerful trading tools. Each platform is offered in various variants that may be used via the Web Platform or straight from your browser, or you can install the Desktop version and take advantage of the complete customization that MetaTrader or cTrader provides. Overall, IC Markets’ extensive features, enhancements, and additions to their platform elevate trading. These innovations facilitate the trading process for traders while giving them a top-notch user interface.

Try Crypto Engine With IC Markets Now – FREE Sign Up

The Platform for Mobile Devices

Mobile Apps are also available, which are extremely helpful for contemporary traders who want to keep up to date on market conditions while on the go. MT4, MT5, and cTrader are also accessible on Android and iOS smartphones, allowing account management and position administration.

Customer Service

IC Markets aims to provide the most cutting-edge technology solutions and recognizes the need for excellent customer service and support. The broker assistance is accessible 24 hours a day, seven days a week. The company has client offices in different locations, ensuring that the broker is ready to answer questions and help teams worldwide.

Education

Finally, the IC Markets staff has a great deal of expertise in the forex business to know what traders want and need. Frequent technical analysis reports, video lessons, informative tools, webinars, and other educational resources are given for free and allow for a clear view of the subject via regular technical analysis reports, video tutorials, informational tools, and more.

There are also research resources available, such as inbuilt various analytical tools inside platforms and an IC Markets-designed Market Analysis Blog, Economic Calendar, and trade ideas accessible through platforms. Numerous video lessons are available on the brokerage’s website, with the goal of teaching traders on different elements of day trading. They also provide a variety of articles and tips to assist their traders. Advanced charting and analysis tools, as well as calculators, are available from the broker. In addition, many technical indicators are utilized in technical analysis. There is a large selection of assets to pick from, making this brokerage ideal for new and experienced day traders.

Products

As previously said, the broker is one of the biggest forex brokers, offering more than 50 currency pairs for trading. The spreads are very minimal, particularly when utilizing the raw spread account. On more than ten currency pairings, there is a genuine 0.0 pip spread. Furthermore, the order book shows that there is plenty of liquidity and competitive pricing for retail traders. It is one of the most reputable FX companies. CFDs may be used to trade more than ten different commodities. You may make them long or short. Here, too, the circumstances are excellent. Brent, Coffee, Cocoa, Corn, Sugar, Soybean, WTI, Wheat, and various other commodities may be traded. The spreads are very minimal, and there are no trading commissions.

Among traders, indices are extremely popular. More than 20 indexes from across the globe are accessible. You will not be charged any commissions and will benefit from a reduced spread. The NASDAQ indexes, for example, have a minimum spread of 2.0 points. Metals are exchanged for EUR, USD, or AUD. There are over five different metals to choose from. The spreads are minimal, but if you select the raw spread account, you will have to pay a fee, just as in forex. The costs are low when compared to other brokers.

Cryptocurrencies are hot right now, and you can trade them through CFD on IC Markets 24 hours a day, seven days a week. You will not be charged any commissions and will have a minimal spread. The irony is that trading CFDs on the broker is less expensive than buying actual currency on an exchange. You may also buy stocks at IC Markets. Stocks from the United States and Australia are available. There are approximately 100 company securities accessible in total. The leverage varies depending on the security. CFDs are used for trading equities, but dividend payouts are also offered. The ASX, NYSE, and NASDAQ are the stock exchanges.

Pros

- A fully regulated broker

- Platforms provide a wide variety of trading items, as well as raw spreads and basic accounts.

- Education is provided for free.

- Support is available 24 hours a day, seven days

- International broker licensed by ASIC and CySEC

- Years of operation and global coverage

- Opening an account is quick and easy, and everything is done digitally.

- Excellent choice for a variety of trading styles

- No Withdrawal charge

- Trading in micro-lots is possible.

Cons

- Regulation affects the trading proposition

- An offshore corporation is used to process international proposals.

- There is a fee for inactivity

Promotions

Unfortunately, IC Markets does not provide any incentives to its traders. This, however, should not be seen negatively. The firm has a solid reputation and is justifiably proud of its services. They don’t want to promote excessive trading or misrepresent their goods via incentives.

Assets

The IC Markets trading brokerage does not disappoint when providing various trading instruments and assets to its customers. Currency pairings, CFDs on indices, equities, commodities and futures, precious metals, and even the most prominent cryptocurrencies, such as Bitcoin and Ethereum, are all available via the brokerage.

Customer Service

Customer service is an area where IC Markets shines. They provide multilingual assistance to their customers through live chat, email, or worldwide telephone support hotline 24 hours a day, five days a week. In addition, there is a helpful support center where users may get solutions to the majority of their concerns.

Day Trading

Due to some reasons, the broker is an excellent day trading brokerage. The significance of lowering trading costs is well understood by active, regular traders. Day traders’ earnings are not reduced by excessive commission or trading expenses, with typical spreads of only 0.1 on EUR/USD, for example. As a result, the broker is a suitable option for high-frequency trading.

Accounts

There are three major account kinds, all of which provide the same compatibility and capability as the others but are tailored to various trading styles’ expectations and requirements. Two of the first accounts provide raw spread conditions and commission charges for each transaction, as well as the option of using either the MT4 or cTrader platform.

The accounts may be opened in up to ten different currencies, are entirely separated from the company’s money, and are backed up by a multilingual customer service staff. Traders that follow Sharia laws may also sign up for a Swap-free or Islamic account at IC Markets, as well as a risk-free trial account on both MT4 and cTrader to practice their trading approach. Costs Now, let’s look at the differences in trading fees on different accounts since the prices vary significantly depending on the account type and platform you select. Also, keep in mind that distinct IC Markets companies in other countries may have their trading conditions, so double-check.

The Basic (standard) Account is a MetaTrader4-based account with Cross-Connect starting at 1.0 pips. While the raw account offers micro lot trading, spreads starting at 0 pips, and commissions on MT4, the other version does not. EUR-USD spreads are, according to IC Markets expert advisers, the narrowest average EUR-USD spread in the world. cTrader ECN account offers almost the same features as MT4, except the platform, which larger professional traders mainly utilize. The relevant spread begins at 0.0 pips, with a fee of $3.00 per $100,000 transacted, and Equinix LD5 provides execution.

Try Crypto Engine With IC Markets Now – FREE Sign Up

Conclusion

As a general impression, IC Markets has a sophisticated trading offering, with the ability to customize virtually every trading parameter, including which instrument to trade, which platform to use, which account to create, whether to use auto trading or social trading and even whether to become a partner. IC Markets’ technical optimization is among the best in the industry regarding execution, platform optimization, toolset, and customer service. The broker offers a wide variety of markets to pick from and a strong Cryptocurrency offering, in addition to genuine ECN and highly competitive pricing strategies based on spread alone or with the lowest spreads but a fee per transaction. With the IC Markets broker, you may get all of this and more.