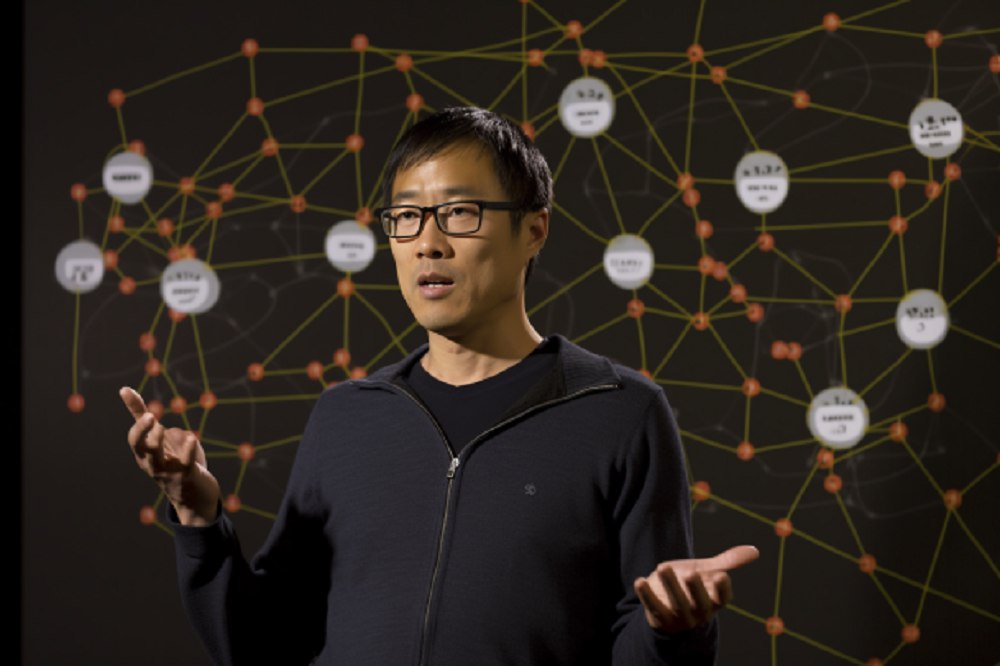

Professor David Tse of Stanford University believes that Bitcoin’s proof-of-work (PoW) consensus mechanism can secure most proof-of-stake (PoS) smart contract blockchains. He made this revelation after a group of researchers led by David Tse discovered the applicability of Bitcoin’s PoW in solving PoS vulnerabilities.

Using PoW To Tackle PoS Vulnerabilities

Professor David Tse and his dedicated research team are pioneering groundbreaking initiatives to enhance the security of PoS networks, utilizing the unparalleled potential of the leading crypto network. Tse, who played a pivotal role in co-founding Babylon blockchain, envisions a novel paradigm where Bitcoin (BTC) can help provide network security and create incentives for BTC holders to actively engage in a transformative approach—staking Bitcoin on PoS chains.

This ambitious move can help revolutionize the crypto landscape by harnessing the power of Bitcoin to unlock new levels of network security and user participation. The professor also provided details about Babylon’s innovative methodology.

He revealed how the project skillfully leverages the Bitcoin scripting language to establish a robust connection between a PoS-based slashing mechanism and the expansive Bitcoin network. Moreover, this integration facilitates the creation of ingenious smart contracts capable of defining precise spending conditions.

Thus, it opens up possibilities for enhanced transactional control and flexibility within the Babylon ecosystem. By capitalizing on the capabilities of Bitcoin’s scripting language, Babylon drives the boundaries of what is possible regarding advanced spending conditions and smart contract functionalities.

According to Tse, Babylon’s BTC staking enables the asset to secure PoS chains without the need to fork the Bitcoin protocol. Thus, this concept allows Bitcoin token holders to earn passive rewards for securing the PoS protocol through staking their assets.

A Simplified Approach To Preventing Vulnerabilities

According to the professor, this approach’s seamless use has helped maximize blockchain security and prevents vulnerabilities hindering numerous cross-chain bridges.

Per on-chain data, cross-chain attacks and exploits have increased in the last 12 months, with over $2 billion stolen from different platforms in 2022. So far, Bitcoin has the edge over the others.

It has the largest market capitalization and follows a consistent operational approach set out by its creator Satoshi Nakamoto. Nevertheless, the Bitcoin ecosystem has seen a fresh wave of enthusiasm and expansion thanks to the advent of Bitcoin Ordinals.

This innovative concept allows users to imprint their non-fungible tokens (NFT) onto their Satoshis (the minutest denomination of a Bitcoin unit). This new development has breathed new life into the Bitcoin landscape, opening up unprecedented possibilities for tokenization and creative expression within cryptocurrency.

With Bitcoin Ordinals, the potential for capturing unique value and associating it with specific Satoshis is unleashed, ushering in a new era of user innovation and exploration. Meanwhile, the Stanford professor believes that platforms like Babylon hold the key to dispelling the notion of Bitcoin being a mere store of value.