New blockchain analysis revealed that trading activities are now more concentrated in North America and Europe and no longer in Asia. On-chain blockchain analytics platform, Kaiko, recently surveyed trading activities across Coinbase, Gemini, and Kraken exchanges on random days and varying time zones.

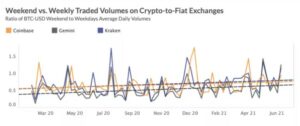

The survey showed that the weekend and weekday trading volume on the BTC/USD pair has increased by 100% between March last year and this year. It also discovered that the ratio of weekend and weekday Bitcoin trading volume is increasing, especially among non-Asian traders on the three exchanges.

Weekend Vs. Weekly Traded Volume Crypto To Fiat. Source: Kaiko

Kaiko also discovered that in the last year, the BTC/USDT ratio for weekdays and weekends has remained at one on three crypto-crypto exchanges – Binance, Huobi, and Okex. Activities on these three exchanges represent the market sentiment among retail investors in China and other parts of Asia.

Weekend Vs. Weekly Traded Volume Crypto To Crypto Exchanges. Source: Kaiko

Results From Studying The Derivatives Market

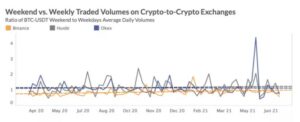

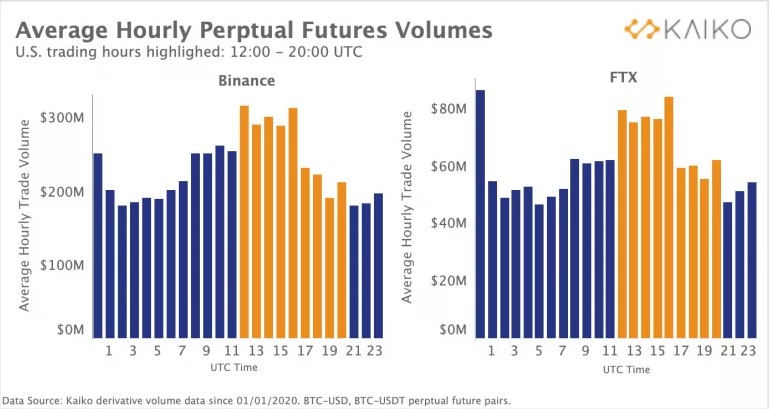

Kaiko also discovered some subtle differences in the derivatives market. It discovered that every day at 16:00 UTC, the 1-hour chart indicates a sharp rise in trading volume for Bitcoin‘s perpetual futures contracts on the two leading derivatives exchanges (Binance and FTX).

There is often an overlap between the US and Europe trading sessions during the peak trading time on the two exchanges. This indicates that Europe and America have become essential regions for crypto exchanges.

Average Hourly Perpetual Futures Volumes. Source: Kaiko

Co-founder of BKCoin capital, a quant hedge fund, Kevin Kang, agreed with the survey stating that “there has been a massive shift to North America in the past year and has even been helped by china’s clampdown on crypto activities, especially Bitcoin mining.”

Kaiko’s survey also revealed that retail participation is increasing faster than institutional investors, even though most of the focus has been on increasing the participation of institutional investors.

The Role Of Traditional Finance

The Kaiko research further revealed that more automated trading tools suited for weekend trading activities are partly responsible for increasing weekend trading volume. Kaiko revealed that some traders have discovered that they can reduce execution costs and price impact by splitting their large volume transactions into smaller ones over a long period.

Kang further said that there is now higher liquidity on weekends than in the past as more traditional financial institutions move into the crypto world. The BKCoin co-founder also said, “more traditional investors are making the most of the unlimited access to the crypto market. They can make market moves based on live events whether it’s weekend or weekday compared to being unable to do anything till the market opens on Monday.” A top crypto analyst with LMAX Digital, Joel Kruger, revealed that during the proceedings regarding the $1 trillion crypto infrastructure bill this past weekend, institutional investors’ activities in the cryptocurrency market surged by almost 90% compared to the previous weekend. It remains to be seen the effect of this change on the Asian market.