For some time, decision-makers have criticized Bitcoin mining, calling it an expensive and ineffective industry that wastes energy that could be used more effectively by homes or other, more productive sectors.

The sheer scale of Bitcoin mining operations globally has been astounding. According to on-chain data, current Bitcoin miners consume about 13.5GW of electricity, roughly 15% of the Texas grid’s maximum output.

Adapting To Changes

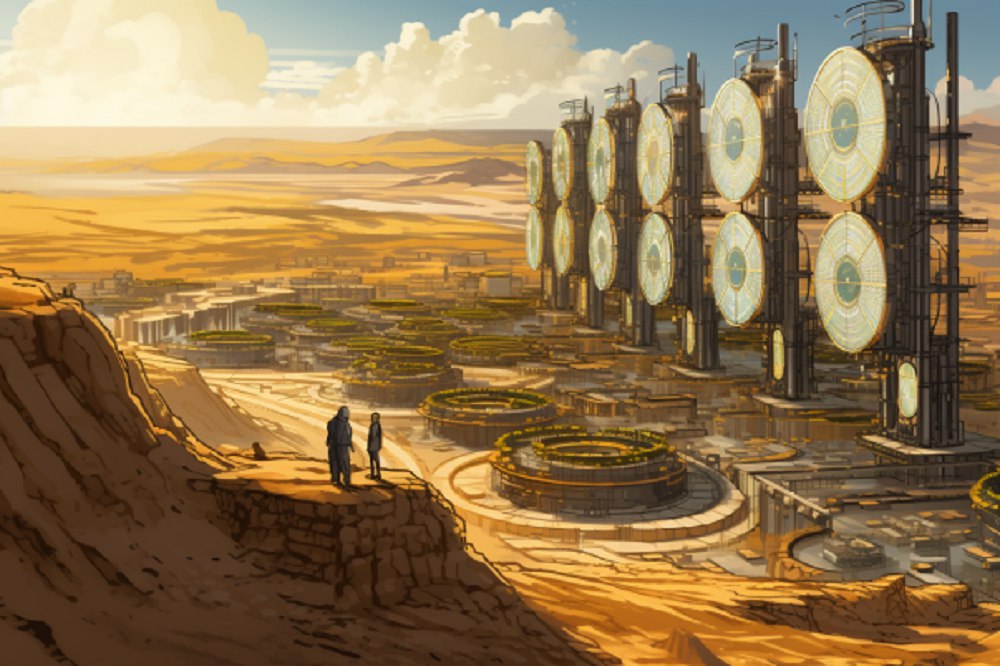

However, in the past few years, crypto miners have developed strategies to significantly lessen the impact of their activities after adapting to changing grid conditions. This entails leveraging energy resources that were previously underutilized, such as flared gas, collaborating with untapped renewable energy projects, and actively participating in other power initiatives that increase the flexibility of the electric grid.

Bitcoin miners are pioneers in this regard, and other energy-intensive industries will likely follow their lead. Experts predict that environmentalists and decision-makers will eventually stop criticizing Bitcoin miners and start respecting them.

The innovative industrial “smart load” that can successfully integrate renewable energy sources, link power consumption to generation, and adjust as necessary was shaped in large part by miners and will be widely acknowledged by policymakers in no time. Furthermore, the dynamics of electrical grids are changing due to the shift toward sustainability.

The crypto mining industry is moving away from an energy-focused system based on fossil fuels that modulates power production to match variations in demand and toward a system where variable renewable sources become the main focus.

However, this shift has several implications. One such implication is the need for grid operators to find ways to adapt electricity demand flexibly to accommodate the unpredictable nature of solar and wind energy rather than concentrating only on supply changes.

The above concept is known as “demand response,” environmentalists see it as a critical mechanism in the energy transition phase. With this strategy, energy users can quickly adjust to changing grid dynamics in the future.

To reach Net Zero goals, the International Energy Agency (IEA) has argued for significant increases in demand response. As a result, miners have begun incorporating demand response into their operational strategies.

Surprisingly, miners can increase their profitability in some markets by strategically turning off operations during energy scarcity (when costs are high) and aiming for online presence levels of 95% or 90%.

Leveraging Location

Due to their independence from operating at a specific location, miners can take advantage of underutilized energy sources, particularly renewable ones. Traditional fossil fuel-powered power plants are frequently built close to populated areas.

This makes it necessary to build expensive transmission infrastructure to move the energy from wind and solar resources to urban areas or industrial areas. However, miners can have direct access to these energy sources regardless of location due to their geographic adaptability.

Additionally, this approach provides a valuable model that newer industrial loads could benefit from, especially given the increasing integration of remote wind and solar resources in modern grids and in certain situations where transmission capacity is limited.

Other energy-intensive industries, such as green hydrogen production, desalination, and fertilizer manufacturing, already employ strategies similar to those in the Bitcoin mining sector. Players in the cloud computing industry aim to adopt this trend, owing to the rapid expansion of artificial intelligence (AI).

Standard data centers currently lack the means to pause operations as effectively as Bitcoin data centers do, owing to the significant financial outcomes they would face if suddenly required to reduce output. On the other hand, cloud computing service providers guarantee continuous availability and dependability to clients, making data center-level disruptions unacceptable.

However, the inference process involves querying an existing model, which makes it prone to intermittent interruption. Hence, experts suggest that AI data centers adopt the Bitcoin miners’ strategy by exploring co-location with renewable energy sources to evade policymakers’ scrutiny.