Bitcoin has reached its greatest level since 23 of August since Ether’s climb to a three-and-a-half-month high has given Bitcoin a boost. Since Aug. 23, the leading digital currency’s selling price has exceeded $50,000 for the first time.

BTC/USD CHART. Source: Tradingview.com

ETH, the native currency of Ethereum’s blockchain surged beyond $3,800 on Tuesday; it has now hit a record high since mid-May, according to CoinMarket. This is the greatest single-day increase since July 21 for the digital asset, which closed the day up 11 percent. Experts expect that ether will continue to rise.

Bitcoin is now also trending upwards, with statistics indicating that major traders are positive. Financial institutions had a record long exposure of $165 million according to the Commitment of Traders (COT) report released by the U.S. Commodity Futures Trading Commission (CFTC). For perhaps the first time since April, Arcane Research’s weekly analysis shows that establishments are now optimistic about Bitcoin, according to the research firm’s findings released on Tuesday.

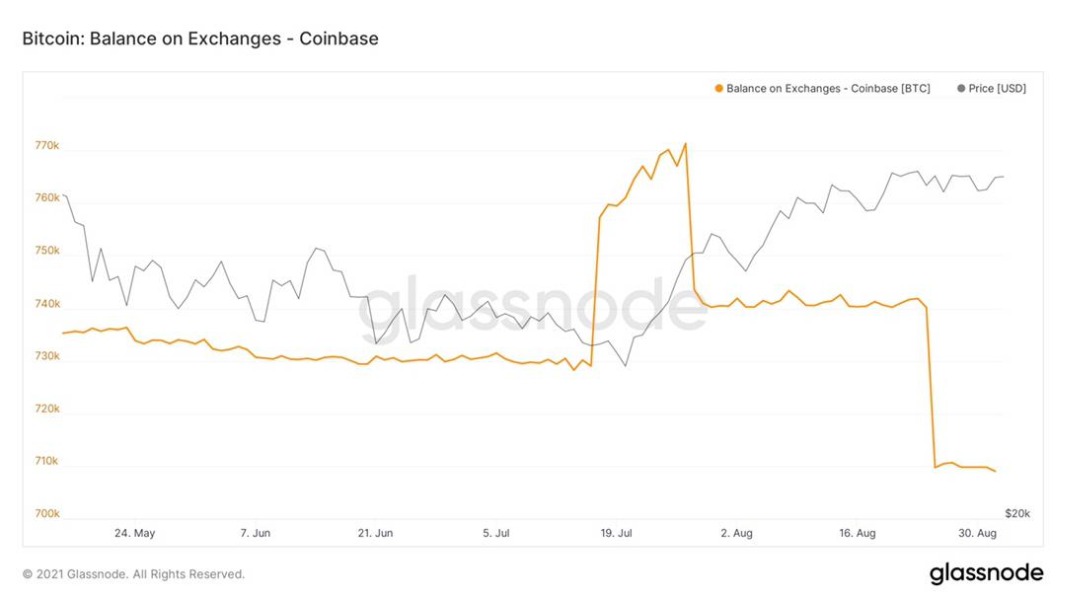

Others point to Coinbase, a U.S.-based platform registered on the Nasdaq stock market, as an indication of renewed interest from institutional traders. In an early-morning tweet, Blockware Solutions’ principal intelligence expert William Clemente said, “Coinbase purchasers are back.” He also included a graphic from Glassnode that showed the amount of Bitcoin holdings dropping by 32,000 BTC since. Coinbase owned 709,695 BTC as of Wednesday, the lowest level since 2017.

GLASSNODE CHART. Source: Glassnode.com

Coinbase Influx

A lot of people believe that Coinbase’s fluxes are a reflection of commercial demand because of the exchange’s safety options, which are directly connected with its over-the-counter desk. To avoid affecting the current market rate, corporations choose to deal over-the-counter, as mentioned in December.

The bullish Coinbase idea is, nonetheless, contested by several analysts. It was reported in April that stablecoin had overtaken Bitcoin as the leading currency in exchange and that this trend is reflected in outflows.

Despite this, other blockchain data indicate that traders are reinvesting. It was reported on Tuesday that the number of BTC held by wallets with 100k to 10k BTC has flipped 180 degrees in the previous week, suggesting increased confidence among certain Bitcoin giants. These investors have raised their joint account by about 30,000 BTC ($1.5 billion) in the previous seven days, Santiment reported, and their combined total now equals 48.95 percent of Bitcoin’s entire tokens. A single investor might have numerous addresses, thus address stats aren’t ideal.

It’s worth $58,000, according to Clemente, because of the supply chain factors. Using a trading strategy, bulls need to gain ground above $50,000 before they can go on to the next breakpoint, which is $58,000.