Key Insights:

- Changpeng Zhao sentenced to four months, significantly less than the prosecutors’ recommendation of 36 months for compliance failures.

- Zhao’s case highlights the urgent need for stricter regulatory compliance in the rapidly evolving cryptocurrency industry.

- Despite serious allegations, the judge found insufficient evidence that Zhao had direct knowledge of illicit activities on Binance.

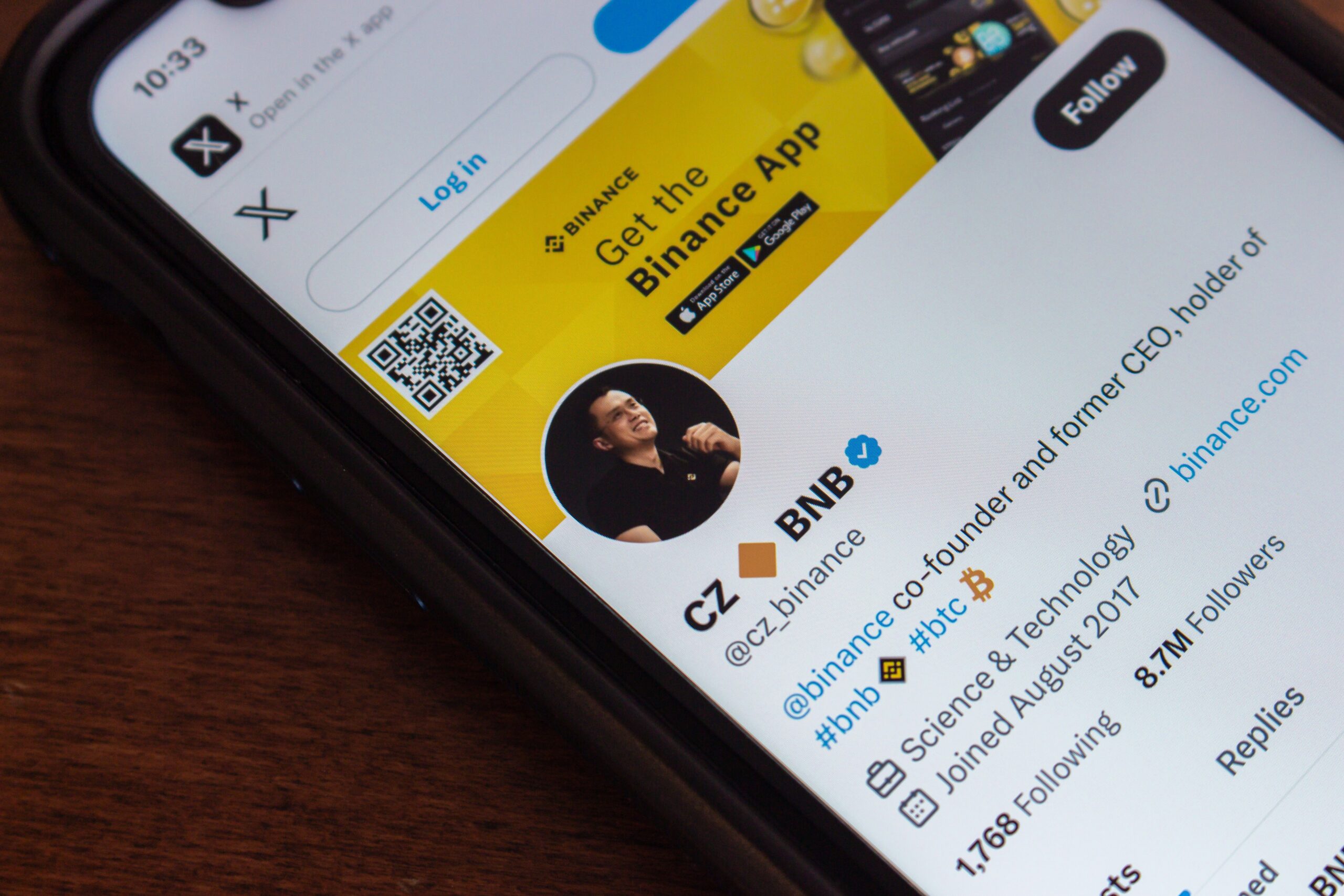

Changpeng Zhao, the former CEO of the cryptocurrency exchange Binance, has been sentenced to four months in prison. This decision is a reduction from the 36 months sought by U.S. prosecutors, who charged him with failing to implement an adequate anti-money laundering (AML) program in compliance with the Bank Secrecy Act. The sentencing occurred on April 30, concluding a high-profile case that has captured the attention of the global crypto community.

Judicial Proceedings and Plea for Leniency

In the lead-up to his sentencing, Zhao submitted a heartfelt letter to the court, expressing deep regret for his past decisions and promising that his actions would not be repeated. His plea highlighted his voluntary surrender and cooperation with law enforcement as an effort to amend his mistakes. Furthermore, Zhao detailed his previous efforts to return investments after business failures and his commitment to philanthropic and educational projects across various continents.

During the trial, over 160 letters from Zhao’s relatives, friends, and colleagues were presented to the judge, advocating for leniency and testifying to his character and contributions to the technology sector. These letters described him as a family man and a professional who shunned the extravagant lifestyle typically associated with high financial success.

Prosecutorial Arguments and Sentencing Outcome

Prosecutors presented a starkly different picture of Zhao, accusing him of knowingly allowing Binance to engage in transactions linked to a range of illicit activities, including narcotics trafficking and terrorism financing. According to their claims, Zhao’s lack of action in implementing necessary AML controls facilitated financial crimes on a scale described as unprecedented. They highlighted the failure to report over 100,000 suspicious transactions as evidence of his disregard for legal obligations.

Despite these serious allegations, the judge concluded that there was insufficient evidence to prove Zhao had direct knowledge of the illicit activities facilitated by Binance’s platform. This factor played a crucial role in the decision to impose a sentence much lighter than what was initially proposed by the prosecutors.

Implications for the Crypto Industry

The sentencing of Changpeng Zhao marks a pivotal moment for the cryptocurrency industry, which has been under increasing scrutiny by regulators worldwide. The case sheds light on the challenges of enforcing regulatory compliance within rapidly evolving digital finance platforms. While the lighter sentence might suggest potential leniency in similar future cases, it also underscores the need for crypto exchanges and other entities to strengthen their compliance frameworks to avoid legal repercussions.

This case arrives amidst broader regulatory actions against other cryptocurrency figures and platforms, notably the severe sentence recently handed to Sam Bankman-Fried of FTX. Together, these cases contribute to a critical reevaluation of operational and ethical standards within the cryptocurrency industry.

The outcome of Zhao’s case is likely to influence the global regulatory landscape for cryptocurrencies. As authorities enhance their focus on compliance and oversight, crypto businesses may need to invest significantly in robust compliance measures. The industry’s response to this and similar legal developments will likely shape its ability to achieve sustainable growth and mainstream acceptance.

As the cryptocurrency market continues to mature, the lessons learned from high-profile legal cases like that of Changpeng Zhao will play a fundamental role in defining the path forward for regulatory engagement and technological innovation within this dynamic sector.

Editorial credit: Koshiro K / Shutterstock.com