Ethereum is showing immense signs of strength today, with the cryptocurrency finally ending its bout of underperformance and rallying higher as traders aim at it seeing further upside.

Where the altcoin market trends next will likely depend on whether or not ETH will be able to surmount $450, as a close above this level would be technically significant.

One trader is noting that he is expecting Ethereum to see similar price action to that seen by Bitcoin throughout the past few weeks.

This means that it could be gearing up for a parabolic move that allows it to climb to $500 and beyond.

Read Also: This Popular Analyst Chooses XRP as His Choice Altcoin; Says the Coin Needs Time

Ethereum Rallies Towards $450 as Bulls Roar

Before the deployment of the Ethereum 2.0 staking contract address, the cryptocurrency was stuck in a tight trading bout around $380.

This was quickly ended after news broke regarding the imminent rollout of ETH 2.0, but even this incredibly bullish news only sent the crypto towards $410.

Yesterday, however, this tempered strength transformed into a full-fledged bull trend, with ETH exploding towards $450 and taking the rest of the altcoin market with it.

It is now in the process of attempting to break above $450.

Read Also: Vitalik Buterin Adds 3,200 ETH worth $1.3 Million to the Ethereum 2.0 Deposit Contract Address

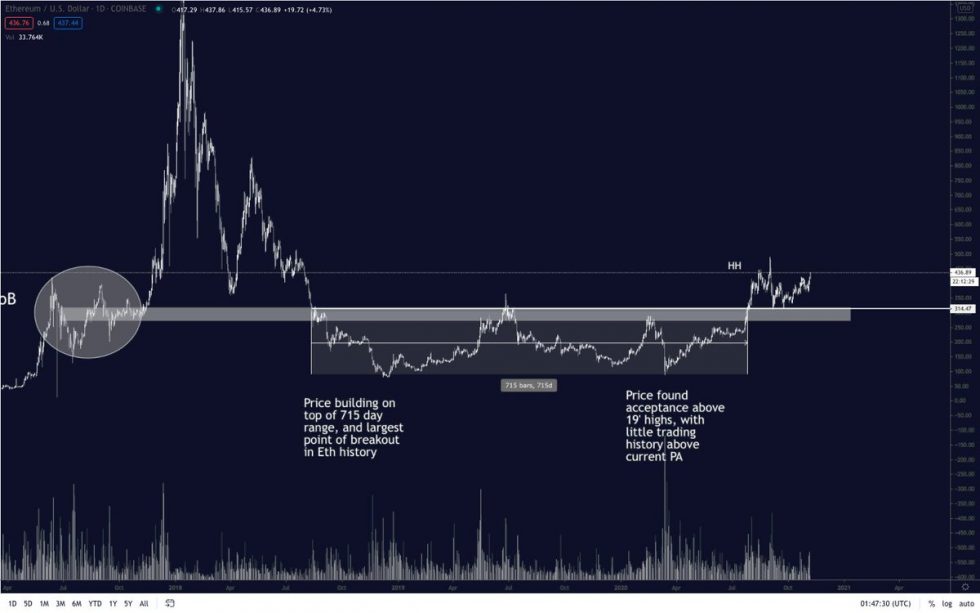

Analyst Claims ETH is About to Mirror BTC’s Recent Gains

While sharing his thoughts on Ethereum, one analyst explained that it is about to see price action similar to that seen by Bitcoin over the past couple of weeks.

He points to a few key developments that are significantly bolstering the bull case for the cryptocurrency.

“What you’re seeing in Bitcoin is going to happen in ETH. The upside on Ethereum can’t be overstated. If you don’t understand. I’m sorry. ETH will be needed for staking, for gas for uniswap, for EIP-1559, for DeFi, for DAO’s. It will and always has been the driver of alts,” he said.

Image Courtesy of Pentoshi. Source: BTCUSD on TradingView.

Unless Ethereum faces a rejection at $450 that slows its ascent and causes it to see some serious near-term downside, there’s a strong possibility that it will see significant further gains.

Source