Over the last 24 hours, there were instances when the Ethereum network crashed due to the significant increase in trading volume. On two occasions within the same time frame, the leading crypto exchange, Binance, suspended ETH withdrawals.

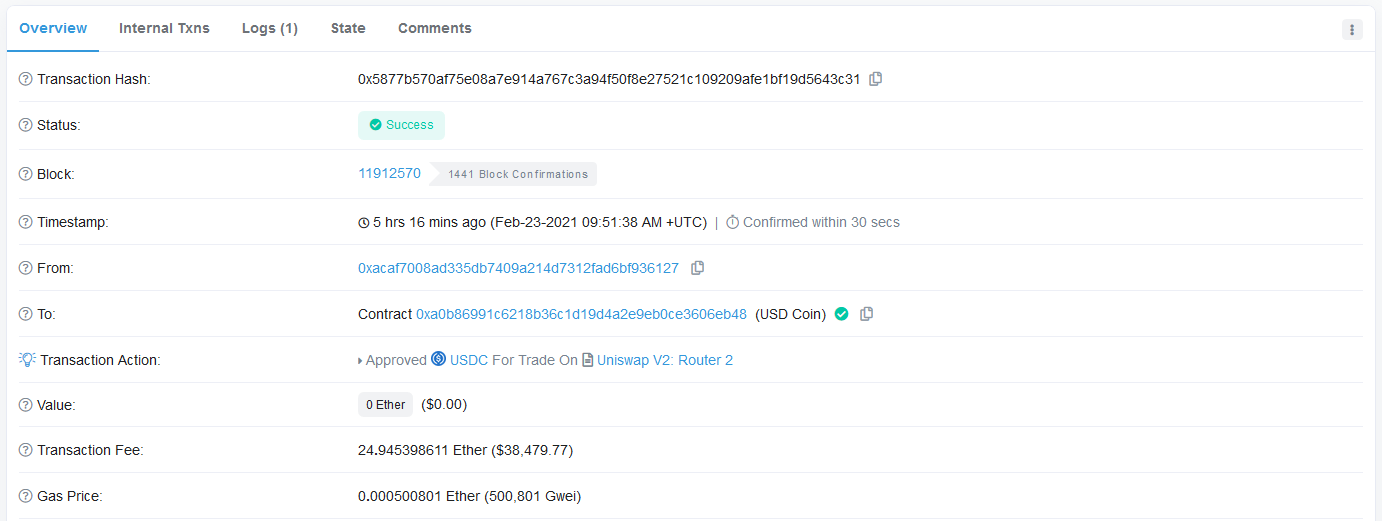

Owing to the current issues with the Ethereum network, a user had to part with 24.9 ETH worth $38,500 at current prices in a single transaction.

Read Also: Vitalik Buterin Reveals Underrated Bull Case for Bitcoin and Crypto amid Massive Uptrend

The whopping transaction fee was reported a while ago on Twitter by Andrew Redden, the CTO and co-founder of GroundHog Network, a blockchain development studio.

The whopping gas fee came about in the course of transferring Uniswap on the Ethereum network. ethereum eth

Andrew Redden tweeted, “Presenting: The most expensive approve.”

Presenting: The most expensive approve https://t.co/WQvgjZWFug

— androolloyd.eth🦇🔊🐬 $ETH 🚀4.4M (@androolloyd) February 23, 2021

Read Also: Cardano (ADA) Will Outperform Ethereum 2.0 in DeFi Space –Charles Hoskinson

Source: Etherscan

Many crypto enthusiasts have been wondering why the sender sternly desires Uniswap’s approval, a decision that forced him/her to pay such a huge amount in a single transaction.

Lark Davis Anticipates Ethereum 2.0 Roll Out To Solve Issues with Transaction Fees

A popular crypto influencer, Lark Davis, has also joined those who are clamoring for the final launch of Ethereum 2.0 amidst the daily increase in gas fees and exits of users to alternative decentralized platforms such as Binance Smart Chain (BSC).

Lark Davis said this in a video shared with his teeming subscribers on the popular video-sharing platform, YouTube. According to the trader, he’s bullish on Ethereum (ETH) but the transaction fees have become insane and dissuading.

He thereby called on the Ethereum co-founder, Vitalik Buterin, to make Ethereum 2.0 a reality as soon as possible.

Lack Davis noted:

“You do have to keep it real right now. The fees for Ethereum are crazy, crazy high which obviously doesn’t matter for the big money guys who are gobbling up Ethereum and waiting for it to go up to five digits. They’re looking at the investment thesis here.

But we’re now at the point where ETH 1.0 – oh we need ETH 2.0 so soon, come on Vitalik Buterin, get it going, man – ETH 1.0, most regular users are priced out of using the majority of applications on Ethereum.

Read Also: Vitalik Buterin Shares Roadmap of What Comes Next After Beacon Chain Rollout

And let’s keep it real, a transaction on Uniswap costs $50 on average these days. That’s crazy man, come on, come on that’s not cool at all. And if you want to get into a DeFi farm, you’re probably going to be paying a few hundred dollars to do that, which is loco, man. Totally loco.

Follow us on Twitter, Facebook, Telegram, and Download Our Android App