Decentralized finance (DeFi) aims to give global access to financial products via decentralized blockchain networks. That is achieved by eliminating intermediaries, reducing transaction fees, and often offering yield-generating opportunities for increased returns.

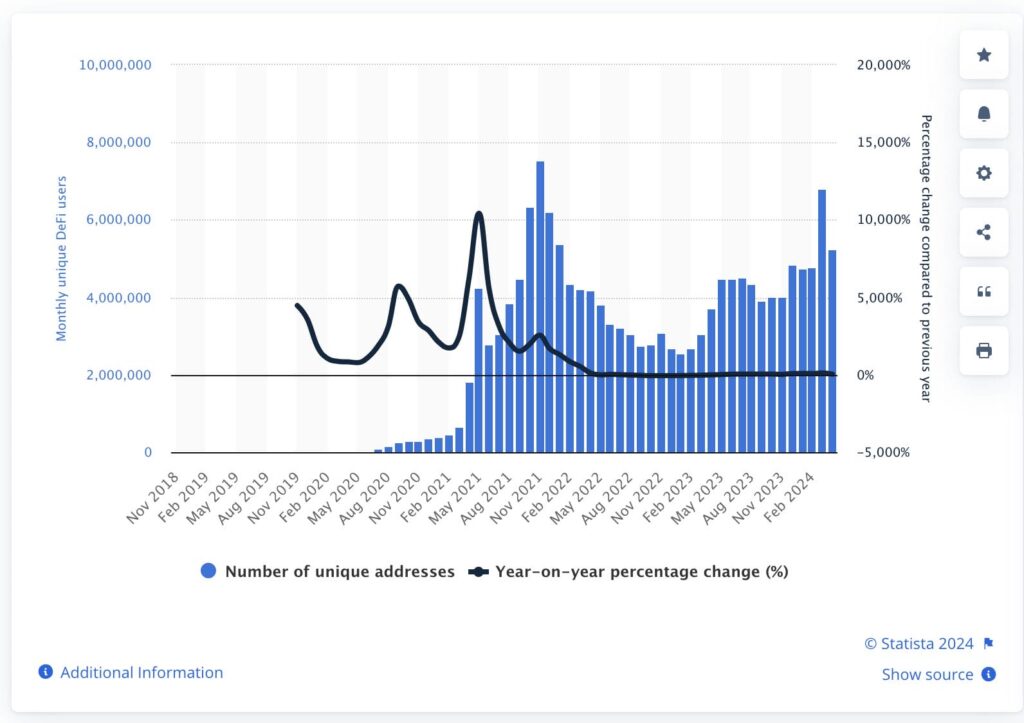

Nonetheless, despite its massive potential, DeFi faces huge obstacles to mainstream acceptance. Notably, DeFi user numbers peaked at 7.5 million in 2021 but recorded a steep drop in 2022.

The drop is also mirrored in the total value locked (TVL) within DeFi protocols, imploding from $175 billion at the end of 2021 to around $50 billion by November 2023.

DeFi Is Currently Challenging And Misunderstood

The major problems that hinder DeFi adoption currently are a lack of accessibility and minimal understanding of how the industry operates. For example, when compared to traditional finance (TradFi), DeFi is quite challenging for mainstream, and crypto users and investors.

CMO of Layer-1 network Radix, Adam Simmons, said that while the vision of DeFi is enticing, the concept around it seems not to deliver.

Simmons highlighted that DeFi concepts, including seed phrases, self-custody of assets, and security measures, have created huge adoption barriers for users. He commented:

“Self-custody of assets may sound great on paper — however, outside of the crypto bubble, the idea of putting large sums of money or assets into a system where a single seed phrase exclusively controls access is terrifying to most consumers.”

Furthermore, he said that in case a user loses their seed phrase, all of their money or assets could rapidly get depleted.

Last year, the DeFi sector recorded huge losses reaching highs of around $1.95 billion. Based on a De.Fi blog post, these losses were attributed to the increased battle against fraudulent activities, security breaches, and a bull or bear market.

Simmons commented:

“Hacks, exploits, and bad actors result in billions of dollars of assets being lost or stolen each year. In many situations, common patterns in DeFi today, such as spend approvals or blind-signing transactions, can drain all your assets, sometimes even months or years after you clicked something you shouldn’t have.”

Resolving DeFi Challenges Via Transparency

Simmons agrees that these hurdles present increased challenges for normal users. Nonetheless, blockchain projects are actively working to resolve all these challenges. For instance, Simmons highlighted that Radix is helping to ensure that users can sign and approve DeFi transactions confidently and easily.

Simmons added:

“The most common experience today is being presented with a screen that says something like ‘Confirm Transaction: 0xd12345aaa…. Approve / Decline.’ For 99.99% of the population, they completely trust that their wallet or dApp UI has correctly created the transaction they are expecting when they tap ‘approve.’”

He said that Radix solves the issue with a feature called “transaction manifests and transaction review.” Simmons believes the default Radix function enables users to readily see which assets are getting removed and deposited from their accounts.

Another issue the decentralized finance industry faces is real-time pricing from the time between the creation and signing of a transaction. Crypto prices change rapidly, mostly resulting in multiple prices.

Simmons pointed out that Radix has a ‘guarantees’ feature that ensures users will get the transaction amounts they expect.

Consumer DeFi Is Coming Up, But Will Take Time

While DeFi is still an ongoing challenge, consumers and investors might be able to manage decentralized finance concepts in the coming years. Simmons remarked:

“Consumer adoption of DeFi will be slow and steady.”

He added that despite technical innovations going a long way to make DeFi accessible to the masses, other factors must be considered.

For instance, Simmons said regulatory infrastructures are still changing and would require many updates. These changes range from how DeFi front-ends may work to how the consumers’ off-ramp and on-ramp from crypto.

Furthermore, Simmons believes that while real-world assets (RWAs) are gaining momentum, most DeFi is exclusively crypto-native assets that most users are not actively seeking to utilize in their daily operations.

Most DeFi dApps currently focus on relative niche activities for the average consumers, with maybe the exception of DEXs. Also, over-collateralized lending, yield farming, and perpetual trading might be highly popular with experienced users aiming for maximum profits. Nonetheless, the general users who normally engage with financial products like deposits, payments, and direct debits also find it appealing.

Despite the challenges, Simmons said that DeFi adoption is inevitable. From a pragmatic point of view, DeFi assists the global financial network to allocate capital efficiently, influenced by opportunity and risk.

In a similar way that the internet made data freely flow globally, a unified network, bringing significant opportunities, DeFi does the same for the assets. DeFi is still in the early stages.