Since the Bitcoin halving event in April, BTC has been highly volatile. Many factors point to a possible Bitcoin bull run in the coming months but the flagship crypto is still struggling below $70,000. Spot Bitcoin ETFs in the United States notched their 19th day of inflows on June 7, 2024. Traders explained why the inflow is yet to cause a surge in BTC’s price.

Despite the 1-day streak of inflows into United States-based spot Bitcoin exchange-traded funds (ETFs), most are wondering why the price of Bitcoin has failed to exceed its all-time high of $73,679 set in March. Some market analysts believe they have an answer for that.

As of June 6, spot Bitcoin (BTC) ETFs around the world held nearly 1.3 million Bitcoin, which is 5.2% of BTC’s circulating supply, with a huge chunk of that held by the US-listed ETFs, as highlighted by HODL15Capital.

Nevertheless, analysts believe several other factors affect the price and that the ETFs do not have adequate clout to push the prices higher. Capriole Investments founder Charles Edwards told reporters:

“ETF flows are fantastic, but they are not strong enough to exceed the entire ecosystem selling (yet).”

On the other hand, crypto trader Christopher Inks published in a June 7 X post:

“You do realize the market is made up of spot, futures, ETFs, and options, right? Price at any point in time is a product of all of these, not just one of them.”

According to crypto exchange co-founder Radar Bear, ETFs are important, but Bitcoin’s price is more heavily impacted by macroeconomic factors and geopolitical events.

Bitcoin ETFs Need To Open Up In More Markets First

According to data published by Farside, Bitcoin ETF net inflows on June 6 hit $217.7 million. Since their launch, these Bitcoin ETFs have seen more than $15.5billion in inflows – although some of the traders think this amount is very small to considerably affect prices until other markets open up.

According to Cane Island Alternative Advisors founder Timothy Peterson, there are still no spot Bitcoin ETFs in the United Kingdom and Japan, two major markets. There is a lot of room available to grow and it seems the ETFs are still in the budding stage.

After the approval of spot Bitcoin ETFs on January 10, Bitcoin gained almost 53%, hitting all-time highs of $73,679 by March 13. Nonetheless, in the three months since then, the crypto has failed to rally further, trading mostly within the range of its high and the $60,000 support level.

Long-Term Holder Movement Is An Important Factor

Edwards said that for another considerable price surge to occur, confirmation of one of the three major factors will be needed. He explained that higher average ETF buying, reduced long-term holder selling, global liquidity, or growth in the United States is needed.

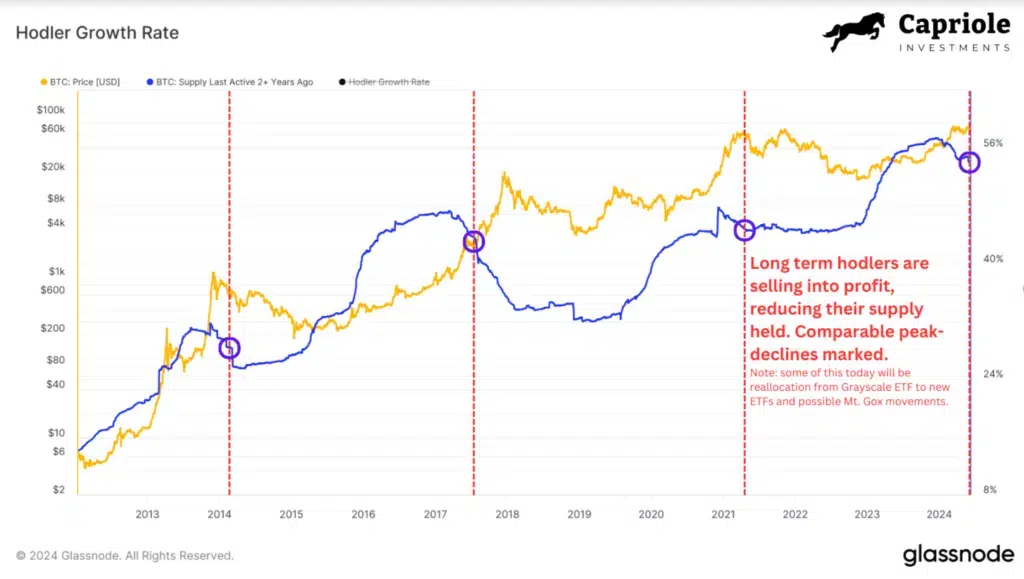

In that context, Edwards insisted that the selling by long-term holders is a considerable factor, noting that those who have held Bitcoin for over two years have been selling more frequently in 2024.

This specific group’s share of the total Bitcoin supply has plunged a little to 54% in the last six months, which has a lot of impact on Bitcoin than it plainly sounds. Edwards added that while 3% seems like a little amount, that represents nearly 630,000 Bitcoin, or around 3X the total amount acquired by all of the Bitcoin ETFs in the United States.

He also noted that the Bitcoin halving effects have not kicked in yet.

“We likely haven’t seen the impacts of the Halving, with the daily Bitcoin issuance dropping by 50% in March.”

He believes that we might see the delta between ETF consumption and Bitcoin mined widen considerably in the coming 12 months.