The latest report from a top crypto analytics research firm, Arcane research, reflects what happened this past year and predictions for the coming year. Asides from making predictions on the leading digital assets, it also made predictions on other aspects of the crypto industry (particularly, DeFi, NFTs, and other derivatives).

Some Prediction Highlights

Part of Arcane’s report remarked that BTC would keep outperforming the S&P 500 index in the coming year like it did in this outgoing year. BTC rose by 74% this year, while S&P rose by 29%. The index contains a list of the top 500 firms on the US stock exchange. The report also remarked that XRP and Cardano coins would no longer be among the top ten digital assets for various reasons.

It noted that BNB’s performance this year has been hugely impressive, rising to an all-time high of almost 1,650% seven months ago and closing the year with a rise of nearly 1,345%. Also, SOL, LUNA, and NFT-related tokens are expected to make strong price performance this year as they have made significant strides in the last few months.

Ethereum, NFTs, And Crypto Exchanges’ Public Listing

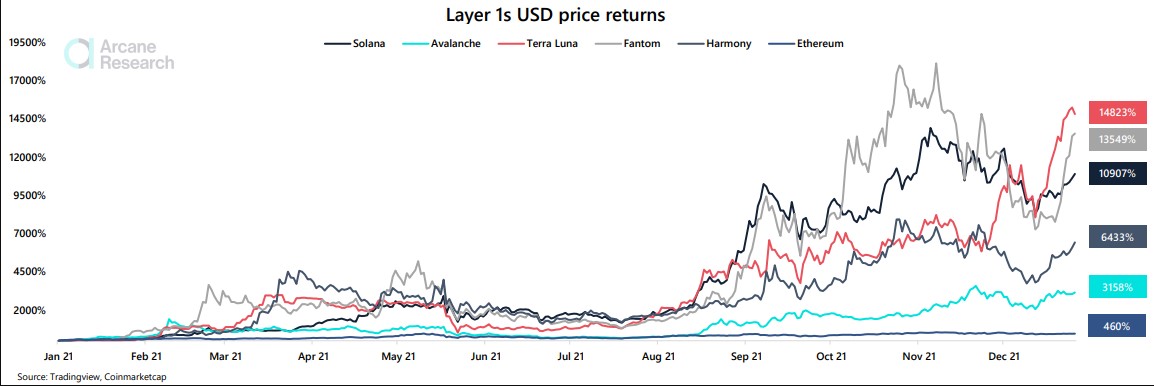

The report also noted that Ethereum would keep struggling to keep up with other layer-1 blockchains. Any separate, base-layer blockchain is called a layer-1 blockchain. Fantom and terra’s native tokens end the year with a 14,824% raise and 13,550% rise, respectively.

Layer-1s US Dollar price returns. Source: TradingView

NFT sales and blockchain-related games have contributed in no small measure to the growth and popularity of the crypto industry this year. A Dappradar data states that Alien Worlds and Splinterlands (two popular blockchain games) have approximately 527k active users every day. The Arcane report opines that the blockchain gaming industry will further boom next year as more traditional gaming companies enter the space.

The report also stated that the overall evaluation of the top five crypto firms that are publicly listed is more than $1B. Even though Coinbase was only listed publicly on April 15 this year, its market cap has grown significantly since then, and it’s currently valued at $73B. Arcane predicts that crypto exchanges will be publicly listed on the stock exchange, which will enhance their valuation.

BTC ETFs And BTC Hash Rate

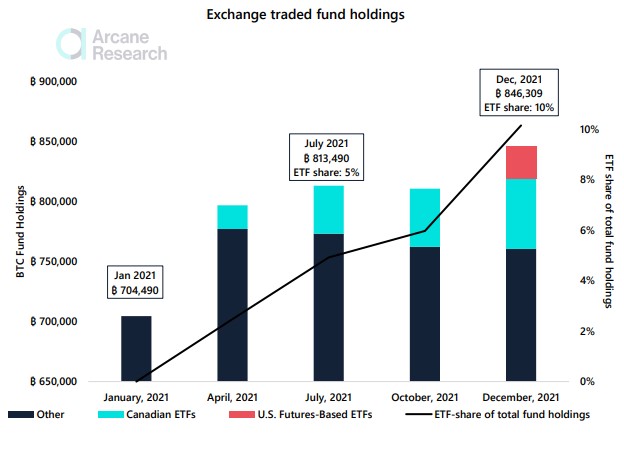

The report also predicts that more BTC ETFs will be launched next year, even though many were launched this year. Therefore, it estimates that BTC ETFs will collectively hold 1million BTC by the end of next year.

BTC ETF holdings. Source: Bytetree

The report predicts an even distribution of BTC miners with a rise in the number of miners in the Latin American region. BTC miners have had to disperse into various regions following a ban on crypto miners in china.

BTC’s hash rate dropped significantly after the ban because China had the highest crypto miners globally. However, recent data shows that it is gradually picking up. As of this writing, the US, Kazhakstan, and Russia (in that order) are the top three nations in BTC hash rate globally.