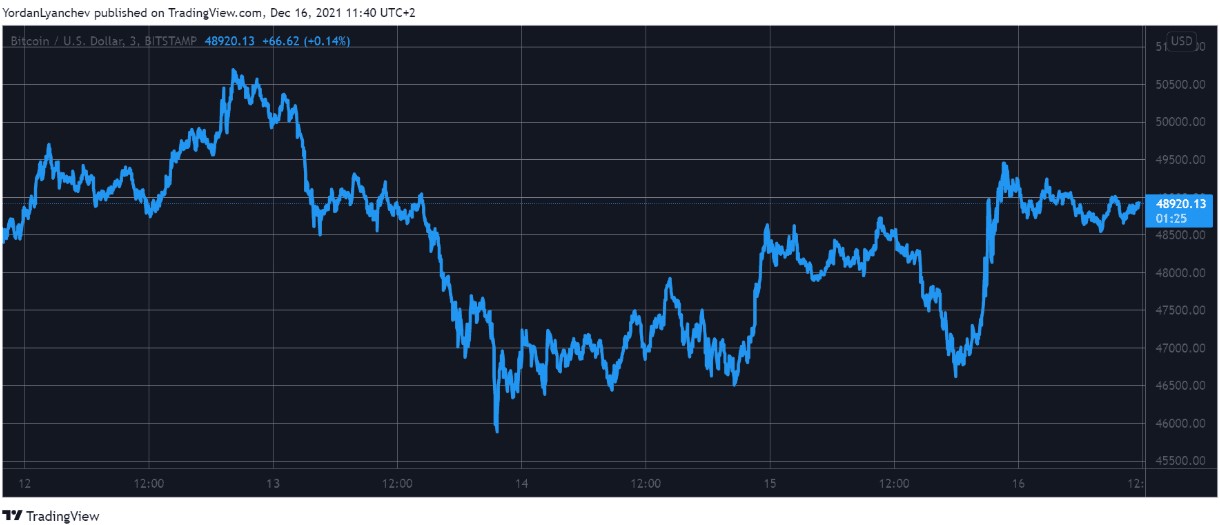

Over the past 24 hours, BTC has dipped and surged. Before the Fed’s rates disclosure, the leading cryptocurrency had declined to the $47K range, but after the news, it surged by over $2.5K. As is usually the case, ETH and altcoins followed suit, with ETH prices rising to trade at the $4K price range.

BTC And ETH Are On A Roll Following Fed News

As widely reported on December 15, BTC price got rejected at the $49K range and kept declining in the hours that followed till it dipped below $47K for a second time in 72 hours.

Hence, the market’s focus was on the US FOMC meeting with expectations on the Fed’s update regarding monetary policy and the solution to the rising inflation in the country.

After the apex bank announced a zero change to interest rates, BTC and other financial markets reacted instantly. Before retracing, BTC jumped by almost $2.5K and nearly surged past the $50K psychological barrier.

BTC/USD price chart. Source: TradingView

As of this writing, the BTC price stands at $48.9K. This price remains below the price coinciding with the 200 EMA and indicating that it is too early to predict that BTC would be bullish over the short term. BTC has failed to surge past the $50K price since its crash below that price on December 4. Its movement has been relatively flat as it continues to bounce between the $46.5K and $49.5K levels.

Altcoins’ Positive Performance

Like BTC, most altcoins were also performing poorly before the Fed news release. Following the news release, ETH, which had declined below $3.8K some days ago, surged by 4.5% to trade at over $4K. BNB, XRP, ADA, and DOT have also made gains over the past 24 hours. However, among the large-cap altcoins, Avalanche has made the most gains (gaining 13%), followed by SOL (8.5%) and TERRA (7.5%), respectively.

In addition to the network’s recent announcement of supporting USDC payments, the gains now make Avalanche price trade above $100. Unfortunately, DOGE and SHIB weren’t positively impacted by the Fed’s news release.

However, some of the low-cap altcoins made considerable gains. Among them were the XDC network (33%) and AIRWEAVE (18%). The positive performances of BTC and the altcoins also caused a surge in the crypto market cap. The market cap is now almost $2.3 Tr. despite being lower than $2.15 Tr. before the news.

Mixed Reactions Trail Crypto Market Performance

Analysts’ reactions to the recent events were mixed despite the cryptocurrencies’ price surge following the Fed news announcement. The news was positive for short-term investors, enabling them to keep borrowing to grow their business.

But the long-term traders weren’t excited by the news, noting that the Fed’s strategy of increasing interest rates at least three times next year to tackle inflation isn’t ‘transitory’ as it had previously claimed. There is still no excitement about the general market. The indicators on the timeframes of the top digital assets are still bearish, while the crypto Fear and Greed Index is also pointing in the Fear direction.