Key Insights:

- Marathon Digital’s trading volume exceeds that of major tech companies, reflecting increased interest in the crypto mining industry.

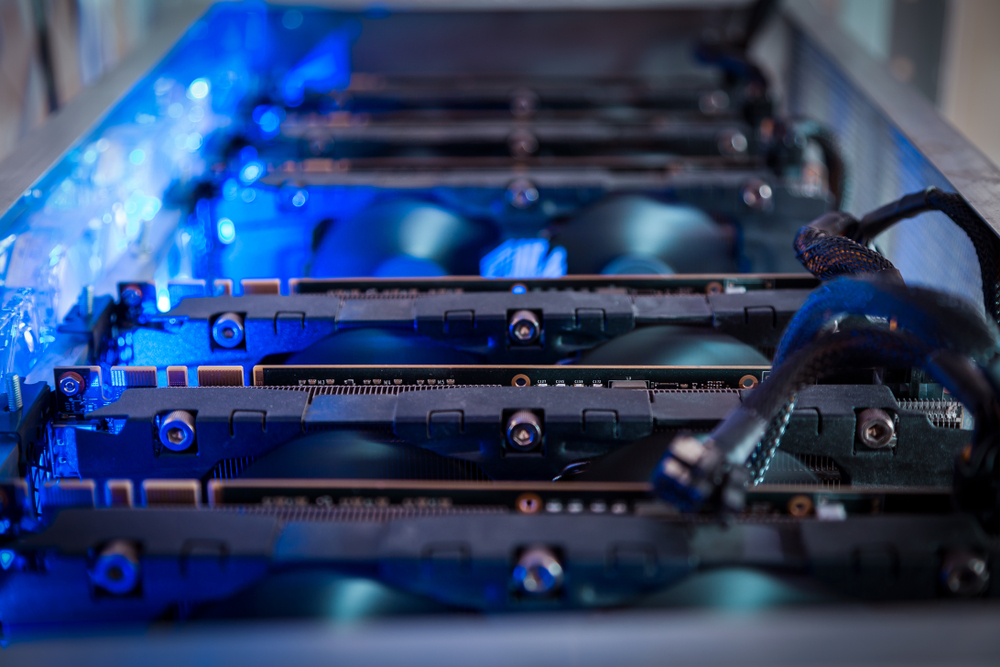

- Riot Platforms strengthens its market position with substantial investments in Bitcoin mining infrastructure.

- The upcoming Bitcoin ETF decision and halving event influenced Marathon and Riot’s stock performance, showcasing notable market shifts.

In a notable shift in the stock market, Marathon Digital Holdings Inc (MARA) and Riot Platforms Inc (RIOT), two prominent players in the Bitcoin mining industry, have recently demonstrated remarkable trading volumes. This surge places them ahead of major tech corporations like Tesla, Apple, and Amazon in trading activity, showcasing the growing investor interest in cryptocurrency mining operations.

Marathon Digital: A New Leader in Trading Volume

With its NASDAQ ticker MARA, Marathon Digital has seen an extraordinary trading volume of 105 million shares in just 24 hours. This figure surpasses the volumes of well-established companies such as Tesla (TSLA), Apple (AAPL), and Amazon (AMZN), data from Yahoo Finance confirms. This surge reflects a broader trend in the crypto mining sector, driven by strategic expansion and anticipation of market shifts.

Similarly, Riot Platforms Inc., trading under RIOT, has not been far behind, securing the sixth position in trading volume charts. With over 42 million shares traded, Riot Platforms highlights the increasing attention towards companies involved in Bitcoin mining and related technologies.

Anticipating Market Changes: ETFs and Bitcoin Halving

Both companies are reacting to potential market catalysts. One is the decision on the Bitcoin ETF by the Securities and Exchange Commission (SEC), which is expected to be on January 10, 2024. It could lead to significant capital influxes into the cryptocurrency market if approved. The second catalyst is the upcoming Bitcoin halving in April 2024, historically impacting Bitcoin’s price positively.

In response to these anticipated market developments, Marathon Digital recently announced a $179 million investment in new mining centers. This expansion will add 390 megawatts to their existing 584-megawatt capacity. In a similar strategic move, Riot Platforms has invested $291 million in Bitcoin mining rigs, marking a significant increase in operational capacity.

Outperforming Bitcoin: A Remarkable Year for Mining Stocks

Despite the volatile nature of cryptocurrencies, 2023 has been a lucrative year for Bitcoin miners. Marathon Digital and Riot Platforms have outshined even Bitcoin itself, with year-to-date gains of 767% and 452%, respectively, according to TradingView data. This performance underscores the critical role of mining operations in the crypto ecosystem.

The ongoing developments in the crypto mining sector and the broader market dynamics indicate heightened activity and interest. As investors and market observers await regulatory decisions and the outcome of the Bitcoin halving event, companies like Marathon Digital and Riot Platforms will be scrutinized.