Key Insights:

- Fetch.ai (FET) battles bearish sentiment but shows potential for market recovery.

- Resistance at $0.2513 poses a challenge for Fetch.ai (FET), but bullish momentum remains.

- Negative indicators prompt caution, but the potential for positive market sentiment looms for Fetch.ai (FET).

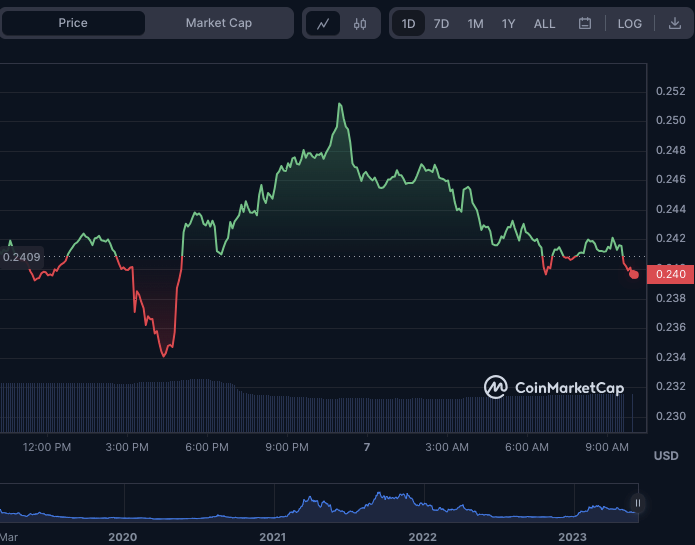

Despite starting on a bearish note, with the Fetch.ai (FET) price experiencing a 24-hour low at $0.2328, market sentiment eventually shifted in favor of the bulls. Their efforts led to a surge, driving the price to an intra-day high of $0.2513. However, despite their commendable push, the resistance at $0.2513 proved too formidable to overcome. As a result, the price has slightly retraced to $0.2377 at the time of writing.

If negative momentum breaches the intraday low of $0.2328, FET is expected to find support around the $0.221 mark. Conversely, if the bulls surpass the resistance level at $0.2513, the next barrier to overcome would be at $0.2667.

During the downward movement, the market capitalization of FET and its 24-hour trading volume experienced declines of 0.61% and 22.40%, respectively. The market capitalization now stands at $196,016,937, while the trading volume is $39,406,109.

FET/USD 24-hour price chart (source: CoinMarketCap)

When the Chaikin Money Flow indicator ventures into negative territory, it signifies a mounting selling pressure that could result in a price decline. Observing the FET 4-hour price chart, the reading of -0.04 for the Chaikin Money Flow suggests that capital outflows are now surpassing inflows.

Traders and investors may interpret this as a bearish signal, prompting them to consider selling their positions or refraining from making new investments. If the Chaikin Money Flow continues to decrease, it could indicate a growing pessimistic sentiment in the market.

The Relative Strength Index (RSI), currently at 33.53, is slipping below its signal line, further contributing to the prevailing negative sentiment. This RSI value suggests that the market is approaching oversold conditions, potentially intensifying the negative outlook. However, a reversal in the RSI, moving back above its signal line, might indicate a shift toward a more positive market sentiment.

FET/USD 4-hour chart (source: TradingView)

Investors rely on the Elder Force Index to assess the strength of a market upswing. It does so by comparing the number of advancing equities to those declining.

When the Elder Force Index experiences an uptick, equities are in high demand, and buyers control the market. Regarding the FET/USD price chart, the Elder Force Index is currently positioned in the negative region of 1.149k. This suggests that the market is currently under bearish pressure.

However, as the Elder Force Index continues to increase, the negative pressure could ease and pave the way for positive momentum.

The moving average convergence divergence (MACD) indicator also stands at -0.00709470, placing it in the negative territory. This negative MACD trend indicates significant selling pressure in the market. However, if the MACD trend and histogram eventually turn positive, it could signal a potential market reversal.

FET/USD 4-hour price chart (source: TradingView)

Conclusion

In summary, despite facing initial challenges, Fetch.ai (FET) is positioned for a potential market recovery, as signs point towards a shift from a bearish trend to a more positive momentum.