Crypto analytic platform Kaiko predicts Ethereum price movement sensitive to the spot ETH ETFs inflows.

The imminent launch of spot ETH exchange-traded funds (ETFs) is triggering widespread debate among market observers and analysts on the likely price movement of Ether (ETH). The July 22 market report by Kaiko features estimates on Ether’s price, capping the surge at 24% by December this year.

The analytic firm attributes a 24% estimated rise to the underwhelming demand from the spot ETFs. Ether price will likely develop sensitivity to the spot ETF inflows in subsequent days as investors regain the lackluster demand for futures products witnessed in late 2023, Kaiko illustrates.

The Monday market report outlines the unveiling of futures-based ETH ETFs in late 2023, which witnessed underwhelming demand. Kaiko’s index head, Will Cai, points out that all eyes turn to the spot ETFs launch optimistically on quick asset accumulation.

ETH Price Sensitive to ETF Inflows

Cai observes that the full demand picture may take several months to emerge. Nonetheless, the Kaiko executive notes the ETH price could portray sensitivity to inflow numbers at the onset.

The bullish prediction by Kaiko coincides with news of several spots where ETH ETFs received final approval of S1s on Monday. The Securities and Exchange Commission (SEC) gave the green light to the S-1 registration statements of spot ETH ETF issuers, allowing the second digital asset ETF to go live in the US.

The approval of spot ETH ETFs is visible across asset managers’ websites that bid for the product. Cai notes the apparent impact on ETH price will arise from potential outflows from the Grayscale Ethereum Trust (ETHE).

Like the Grayscale Bitcoin Trust, ETHE constitutes a fund offering institutional investors exposure to Ether (ETH). Nonetheless, it enforces a half-year period to lock up the shares.

Kaiko indicates that converting ETHE to the spot ETH ETF will ease purchases and sales quickly. The analytic firm considers many investors owning ETHE shares will seek to cash out as the trading begins.

Cai added that ETHE’s discount to the net asset value closure in the last few weeks to bridge the wide gap witnessed from the February to May period. The gap widened as hopes of spot ETH ETF approval waned.

The narrow discount implies traders purchased ETHE below the par value. Such are likely to redeem the shares at their net asset value (NAV) price on their conversion to spot ETF to reap profits.

Spot ETH ETFs to Underwhelm

Several market observers express less confidence that Ether ETFs will match anticipated popularity. The underwhelming performance will contrast the outcome when spot Bitcoin ETFs impacted price months after the launch.

Wintermute, in its research report on July 21, anticipates Ethereum ETFs to realize $3.2B to $4B inflows in the initial year of trading. The crypto market maker will witness lower-than-anticipated demand, limiting the inflow to below $4.5 billion.

Meanwhile, Wintermute forecasts the Bitcoin ETFs to generate approximately $32 billion in assets by the end of 2024.

The market maker estimates the total first-year inflows to the ETH ETFs to be 10-12% of the spot BTC ETF flows. Like Kaiko, Wintermute projects the ETH price surge to not exceed 24% by December 31.

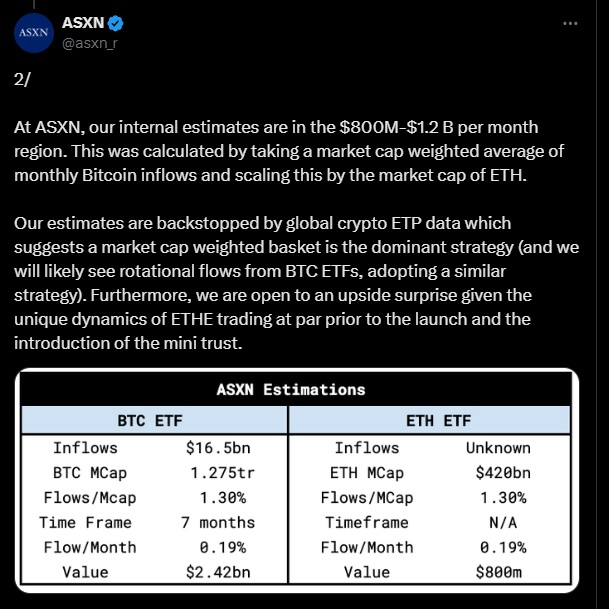

Nonetheless, boutique crypto asset ASXN offers a more bullish outlook in its July 19 post on X (formerly Twitter). The firm predicts the ETH ETFs inflow to average $800M to $1.2B monthly.

ASXN illustrates that the price impact of ETHE outflows will have a less dramatic effect than the present fears. Such is attributed to the tighter and more dynamic discount premiums evident in the net asset value. Also, it coincides with the unveiling of Grayscale’s mini ETH ETF, which ASXN considers likely to subdue the outflow pressure.

ASXN added that it was open to the upside surprise unique dynamics arising in ETHE trading at par before the unveiling of the mini trust.

Editorial credit: gopixa / Shutterstock.com