Ethereum is sternly spreading its importance on the most prominent parts of the world, as it’s growing to become the blockchain of choice for the majority of European Union (EU) startups and corporations that are part of the rapidly growing blockchain industry.

This report was made available by a London and Paris based venture capital fund, LeadBlock Partners. However, despite this rapid growth recorded, the European Union still notably lags behind the United States in terms of funding, the report has said.

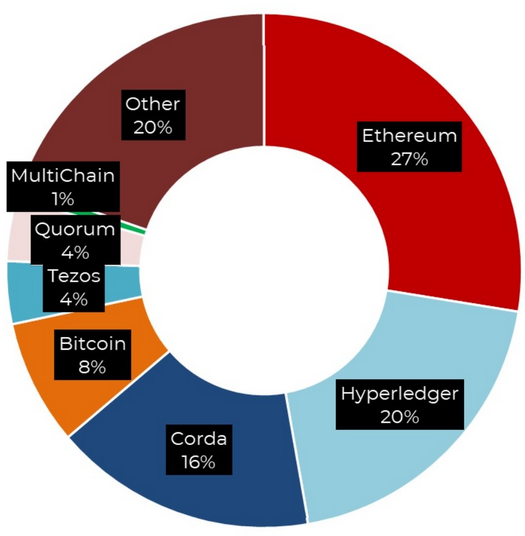

“Blockchain protocols now have three dominant players with Ethereum, Hyperledger, and Corda accounting for [around] 65% of the protocols used by enterprise blockchain start-ups. These protocols are also favored by corporates which are increasingly bringing blockchain into production,” the report noted.

Going by the data from LeadBlock Partners, 27% of European Union enterprise blockchain startups and corporations that are building decentralized solutions are using Ethereum for their projects.

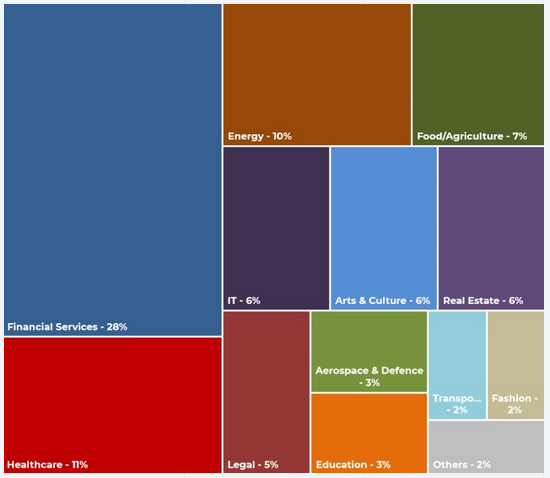

On the other hand, Hyperledger and Corda attracted relatively 20% and 16% of developers respectively. According to the data, about 28% of 200 startups that were surveyed by LeadBlock are presently working in the financial sectors. While healthcare, energy, and food/agriculture accounted for 11%, 10%, and 7% of European Union blockchain startups respectively.

Blockchain Investment Gap between Europe and the United States

LeadBlock Partners furthered by highlighting the huge difference between the amounts of funds invested in blockchain firms in the United States and Europe.

The data revealed that less than $113 million in assets is currently managed by European Union venture capital blockchain funds, compared to the United States with over $2 billion.

As the report explained, 200 startups surveyed by the researchers need an additional $395 million of investments for the next 18 months. The report added that the huge gap is as a result of the little knowledge about blockchain technologies possessed by investors.

LeadBlock noted:

“The knowledge gap is also apparent as many investors do not differentiate between Blockchain from cryptocurrencies and its associated negative perceptions”, adding that the eagerness of investors to learn about blockchain will result in an increase in investments.