EquityGates Review

These days, picking the right online broker for your trading needs can be difficult due to the growing quantity. It involves considering various factors, including product offered, account benefits, support services, and sign-up process when making such a decision.

To ease this process, we decided to give you a thorough analysis of what the EquityGates broker has to offer. The brand has positioned itself as a trusted name in the market that provides a multitude of products and services to its users, all under one roof, which is why we want to spend time checking more about the company.

Asset Selection

The firm supports a variety of popular digital assets at the time of writing and claims to add new ones to its list continuously. You can choose from a diverse range of financial instruments, including indices, shares, stocks, commodities, cryptocurrencies, and precious metals. This enables traders to diversify their investment portfolios and exploit different market conditions. Another common aspiration towards diversification is to reduce the carried risk. The brand also delivers its promise of helping customers improve their trading decisions by regularly providing in-depth market data and analysis.

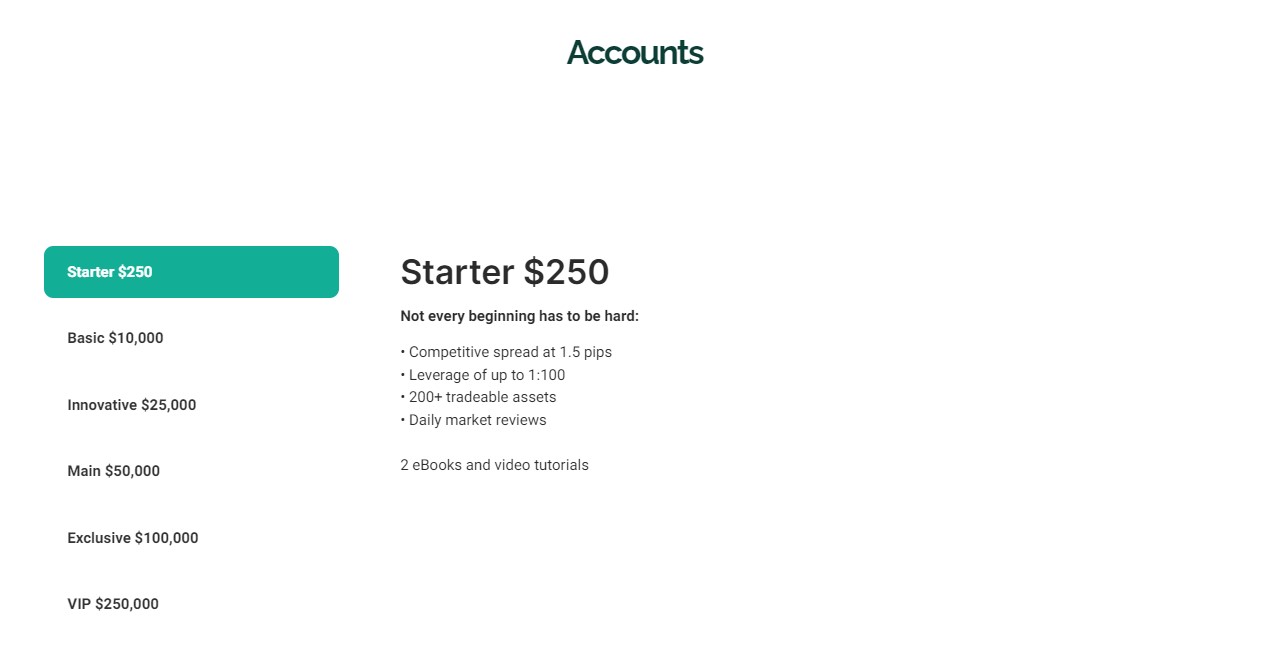

Account Types

The broker has six distinct account options, each designed to address customers of different backgrounds and levels of experience. What distinguishes them is the minimum deposit amount and associated account benefits.

When looking closer at the offers, the Starter trading account should be recommended to those who kick-start their trading journey with only a minimum balance of $250 to open. They provide this account holder access to essential tooΙs and resources like daily market reviews, eBooks, and video tutorials, assisting them in knowing the markets that they are trading.

In addition to serving beginners, EquityGates also handles the demands of seasoned traders well with Baic, Innovative, Main, Exclusive, and VIP accounts. Although the capital needed to qualify for these accounts is relatively high, up to $250,000, the unlocked trading conditions make sense.

From what we can see, the trading brand has managed to build many client account structures to match the specific needs of individual traders.

Customer Support

If you have already faced problems, be it the trading platform or the withdrawal process, it might dawn on you that you need reactive customer service to get in touch. We like that EquityGates offers two types of communication channels (phone calls and a contact form) that are dedicated 24/5 so that traders who have any questions regarding its services or have trouble can always reach out to them.

Our favourite way of communication is over the phone, with shorter wait times than in the message form. We receive prompt responses and timely support from polite support representatives whenever we contact them.

Account Opening Process

The current account opening process of the EquityGates brand appears to be simple and easy to complete. Check the steps below:

- Apply for an account by filling out some basic information about yourself (name, email, phone number) in the form.

- Verify your identity and activate your trading account with a few documents. This is a common way that all serious firms use to ensure security.

- Out of multiple deposit options accepted, you choose the method that best suits you and make the first deposit into the platform to carry out trades. They are all trusted channels, so you can rest assured that you are safe with the company.

EquityGates has board coverage market-wise, many account solutions, and professional support, indicating that it is committed to aiding traders in their path. Opening an account with them is not a challenging task. One can begin their trading journey after a few simple and quick steps.