BlackRock head of digital assets Robert Mitchnick talked ETFs with Bloomberg’s James Seyffart at the Bitcoin2024 event. While speaking at this event, he said client demand was the power behind the Bitcoin exchange-traded fund (ETF) launch. He also believes that the funds are just starting to pick up momentum.

BlackRock CEO Larry Fink was a vocal critic of crypto when Mitchnick was hired in 2018. Fink was eventually ‘orange-pilled’ and even called Bitcoin ‘digital gold’ in a recent interview.

Digital Assets Need Study

Mitchnick credited Fink for the change of heart. Mitchnick stated:

“Larry deserves a lot of credit for the time spent studying the space. If you are a student of financial history and geopolitics or a technologist, Bitcoin tends to come more easily, and Larry is very much both those things.”

Bigger forces came into play too. Mitchnick noted that, with or without any regulatory clarity, crypto as an asset class and technology were “here to stay.” They had an institutional-grade ecosystem and “the final piece that helped push us over the top” was increased client demand.

Crypto ETFs Are Finding Their Client Base

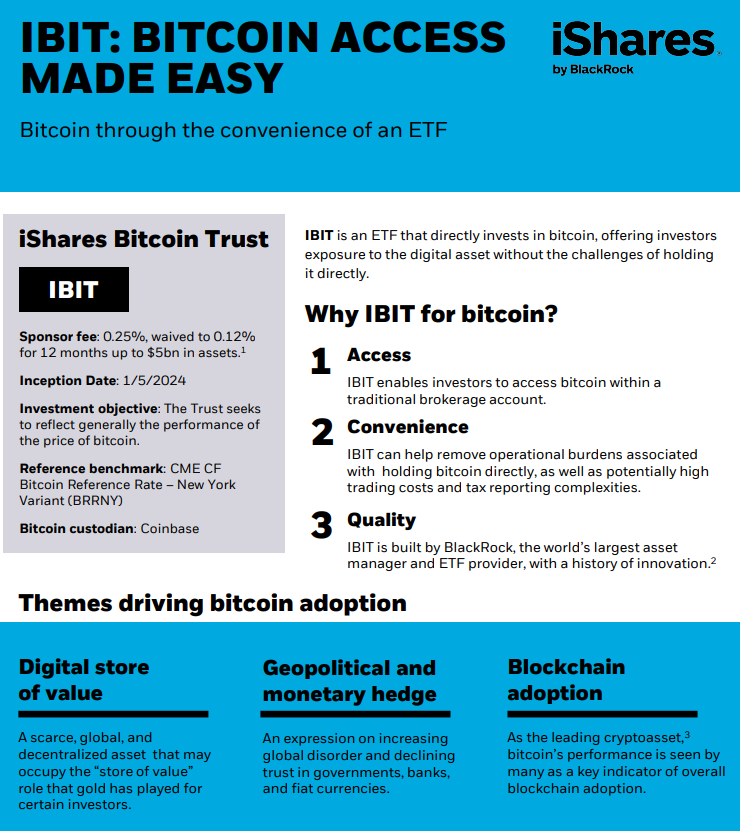

Bitcoin ETFs were the largest and most successful ETF launches in history, according to Seyffart. He estimated that 20-25% of BlackRock’s revenue flow in 2024 has come from the iShares Bitcoin Trust (IBIT), placing it as the asset manager’s second most successful offering after the S&P500 ETF.

Mitchnick stated that direct investors led this demand when the ETF was launched. BlackRock wealth advisory and institutional investors are still gaining momentum. He added:

“Those are much longer journeys and we’re still only part way down that track.”

No huge wealth advisory platforms, such as UBS, Morgan Stanley, and Merrill Lynch, have started offering Bitcoin ETFs on a solicited basis for now. This means they will offer the ETFs at the client’s request.

Mitchnick said:

“Typically, that takes multiple years for a new ETF to get to that solicited status,” although “many of the largest platforms are accelerating their efforts to do so.”

He believed the situation might start changing in 2024. Additionally, he estimated that the BlackRock Registered Independent Advisers who have adopted the ETFs are allocating 2-3% of funds to them.

Institutions also move similarly gradually as they do research and due diligence on new assets, according to Mitchnick.

BlackRock Foresees Minimal Interest In ETFs Past Bitcoin And Ethereum

Clients see Bitcoin and Ethereum as complements, not substitutes, in crypto portfolios, as explained by BlackRock’s head of digital assets.

BlackRock sees decreased interest among clients in crypto beyond Bitcoin and Ethereum and does not see many other crypto exchange-traded funds (ETFs) beyond those two major digital assets, according to Mitchnick. He spoke at the Bitcoin2024 conference on July 25 held in Nashville, Tennessee. He was speaking at a panel entitled From Strategy to Innovation: BlackRock’s Bitcoin Journey:

“I would say that our client base today, their interest overwhelmingly is in Bitcoin first, and then somewhat in ETH… and there’s very little interest today beyond those two. I don’t think we’re gonna see a long list of crypto ETFs.”

BlackRock introduced its first crypto exchange-traded funds, iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust ETF (ETHA), in January and July, respectively.

Nonetheless, not all asset managers agree. Franklin Templeton issues BTC and ETH ETFs. It is optimistic about more crypto ETFs, including a Solana product. On that note, Franklin Templeton wrote in a July 23 X post:

“Besides Bitcoin and Ethereum, there are other exciting and major developments that we believe will drive the crypto space forward.”

Most BlackRock clients see BTC and ETH as complements, instead of competitors. When these clients buy ETH ETFs, they normally ass to an existing crypto portfolio allocation, instead of swapping out of Bitcoin, Mitchnick explained. He cautioned that data on investor flows into ETH ETFs, which started trading on July 23, is currently limited.

Mittchnick commented:

“The whole store of value use case within crypto is pretty definitively territory that Bitcoin owns. ETH is trying to do a bunch of different applications that for the most part, Bitcoin is not trying to do. So, they’re more compliments than they are competitors or substitutes.”

Mitchnick mentioned that he expects investors to allocate about 20% of crypto holdings to ETH, with the remainder going to BTC.

BlackRock’s crypto ETFs are among the most popular in the sector, with IBIT commanding around $22 billion in assets under management (AUM) and ETHA hitting $270 million after several days of trading.