Argo Blockchain, an embattled crypto mining firm, is prepared to trade its mining facility called Helios to the blockchain-focused investment managing firm Galax Digital. The mining plant Helios will be sold by Argo to Galaxy Digital for up to $65M as included in its strategy to push back the bankruptcy. The struggling Bitcoin mining firm has been pursuing more capital to stay away from potential bankruptcy.

Argo Declares Selling Helios to Blockchain Firm Galaxy Digital, Citing Need for More Capital to Escape Bankruptcy

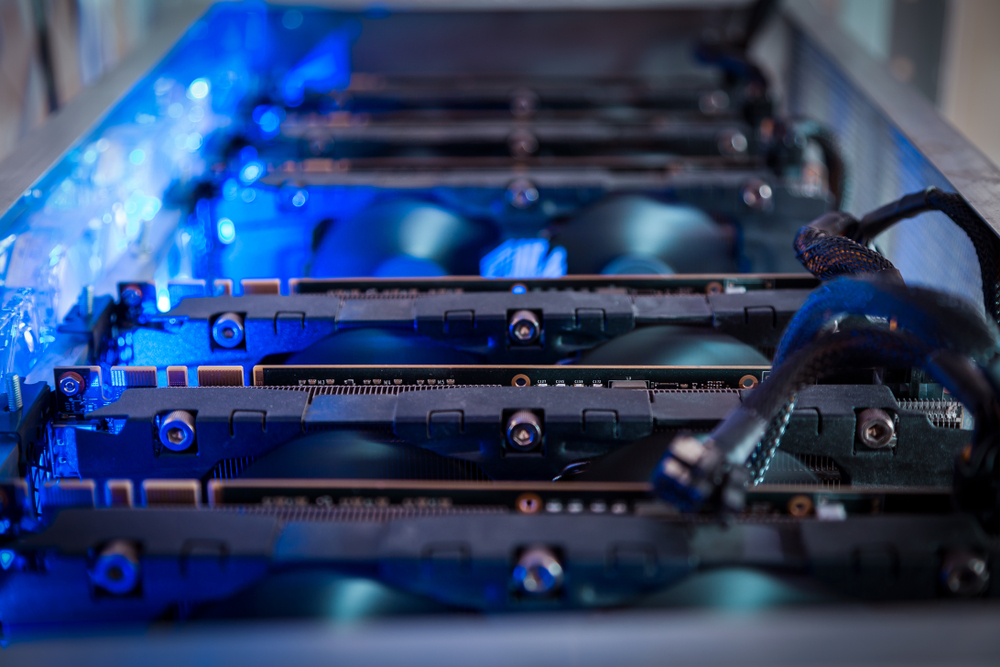

Galaxy, the contract pursuant, will offer Argo a unique asset-backed loan of nearly $35M (up to £29M). The respective contract’s earliest term is spanned 36 months. The financing entails a collateral package including 23,619 Helios Bitmain (the machines for Bitcoin mining).

Argo can utilize the cash proceeds taken from the trade with Helios as well as the asset-backed loan thereof to deal with the entirety of its financial responsibilities. They take into account recompensing the present debts, prepayment interest, as well as the rest of the charges equaling several million that many creditors owe it.

In October 2022, Argo issued a caution that the company might experience insolvency if it remains ineffective in getting more capital to survive. This discouraging forecast took place following a rescue contract backfired. At that point, Argo elaborated in its statement that was addressing the London Stock Exchange that a non-binding LOI was inked by the firm with a strategic investing entity.

As per Argo, the deal was carried out to collect a minimum of £24M (equaling $27M) through an ordinary-share subscription. The platform added that the deal would not be accomplished in line with the formerly declared terms. Hence, it would keep on delving into the rest of the financing opportunities. Argo declared that if it remains unsuccessful in securing financing, its operations would not be stopped.

The mounting energy charges and declining prices of the primary crypto put adverse effects on Argo and in turn shrunk its margins. Formerly, the London Stock Exchange imposed a provisional suspension on the Bitcoin mining platform as it reported bankruptcy by an accident. Apart from that, the Nasdaq additionally terminated trading for another time on Tuesday expecting a bankruptcy declaration from Argo.

Near-Bankruptcy Crypto Miners Grow in Number amid Cold Crypto Mining Industry

Argo is among many crypto forums which have been already facing bankruptcy or are near to it. The Bitcoin-mining space has been going through a downturn during the previous few months.

Other industry players that have crashed because of the spreading contagion take into account FTX and Core Scientific. Apart from that, Compute North (firm hosting activities related to Bitcoin mining) additionally requested bankruptcy protection 3 months back.