Conditions are changing in the global crypto market following the short-lived bullish trends. The conditions changed their direction just after they made a significant shift for over 10%. Although it was helpful in helping the market gain hitherto lost values, it, however, could not last for long to give long-term leverage. The present situation as it is isn’t entirely in favor of the crypto market because significant cryptocurrencies such as Bitcoin, Ethereum, and others do not have a stable value. Having a steady market requires that these coins have to be relatively stable, especially the leading Bitcoin.

There continue to be problems associated with supply and distribution in the oil market as a result of the ongoing war between Russia and Ukraine. There is an inverse relationship between the price and supply of the commodity as the price keeps increasing and the supply dwindles. In a report by TradingView, Brent crude price has increased beyond $116/bbl. The issue is speculated to linger a bit longer because, as things stand, there are limited possibilities that the geopolitical situation in Eastern Europe will ease anytime soon.

On the flip side, various sanctions on Russian organizations and individuals are beginning to bite hard. The most recent set of sanctions has come from Japan as the assets of over four Russian banks have been marked for freezing soon.

Meanwhile, the government of Ukraine has been accepting various donations from different parts of the world. The most recent donation to Ukraine has been in Dogecoin. Ahead of that came donations in Bitcoin, Polkadot, Binance BNB, Ethereum, and a host of others.

A Brief Market Overview

Bitcoin Recedes Gradually

BTC/USD price chart. Source TradingView

Bitcoin has not been able to up the momentum of the increase that it suddenly woke up to a few days ago as it broke the gaining streak. The latest update signifies bearish moves reaching up to 0.33%, and it has brought down the price to $43,832.12. On the other hand, the coin had an excellent performance in the course of the past seven days as it gained 18.56%.

By market capitalization, Bitcoin is presently estimated to be at $831,775,159,411.

Cronos Glides Steadily

CRO/USD price chart. Source TradingView

Cronos (CRO) keeps gaining more value. As opposed to the experience of other major market players, CRO has succeeded in staying on the gaining side as it gained 1.46% within the last day. On a weekly basis, its performance has been impressive thus far as it added 12.80% on the week. The price of the coin has consequently improved to hit $0.4422.

Cronos market capitalization is currently at $11,197,153,233 while its volume in circulation sits at 25,263,013,692 CRO.

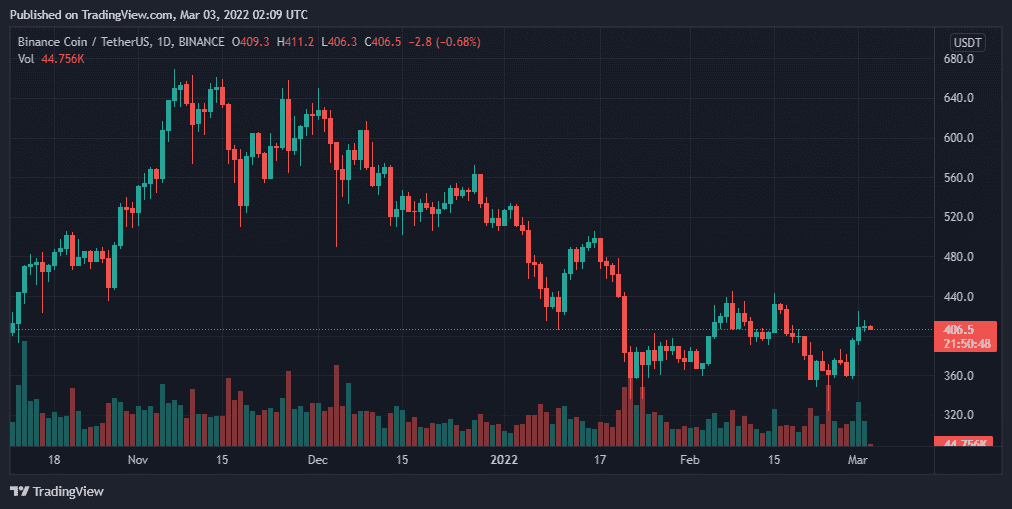

Binance (BNB) Driving into Difficult Terrain

BNB/USD price chart. Source TradingView

Binance coin (BNB) also had a change of course in the manner of Bitcoin. It was a bit stable in the course of the last day, but it lost 0.48%. Its current pricing is in the $408.40 zone, while its gains are about 11.66%.

BNB market capitalization is currently at $67,444,148,689, a stable level.

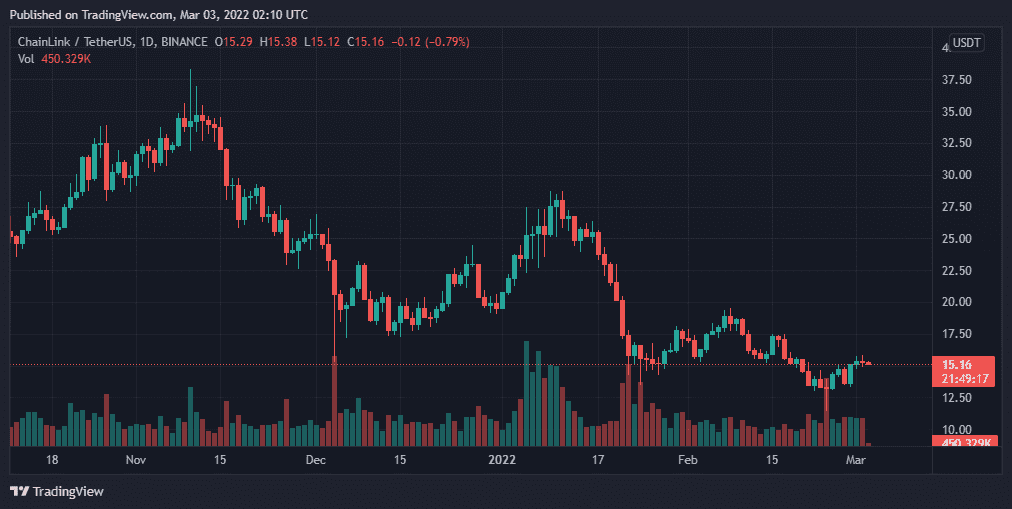

Chainlink Grows without Hindrance

LINK/USD price chart. Source TradingView

Growth also extended to Chainlink as a result of several factors. The newly reported gain caused its value to rise by 1.07%. Its weekly gains are also quite impressive as it mounted 14.15%. Chainlink currently ranks 22 on the global list of cryptocurrencies, while its price now sits at $15.27. Its market capitalization is presently estimated to be $1,132,104,890.