Key Insights:

- Bipartisan Congressional support for H.J.Res. 109 challenges President Biden’s stance on SEC’s SAB 121 and crypto regulation.

- Influential Democrats, including Chuck Schumer, support overturning SAB 121, pressuring Biden to reconsider his veto threat.

- The financial sector urges Biden to sign H.J.Res. 109, which highlights the economic benefits and widespread political backing for crypto custody services.

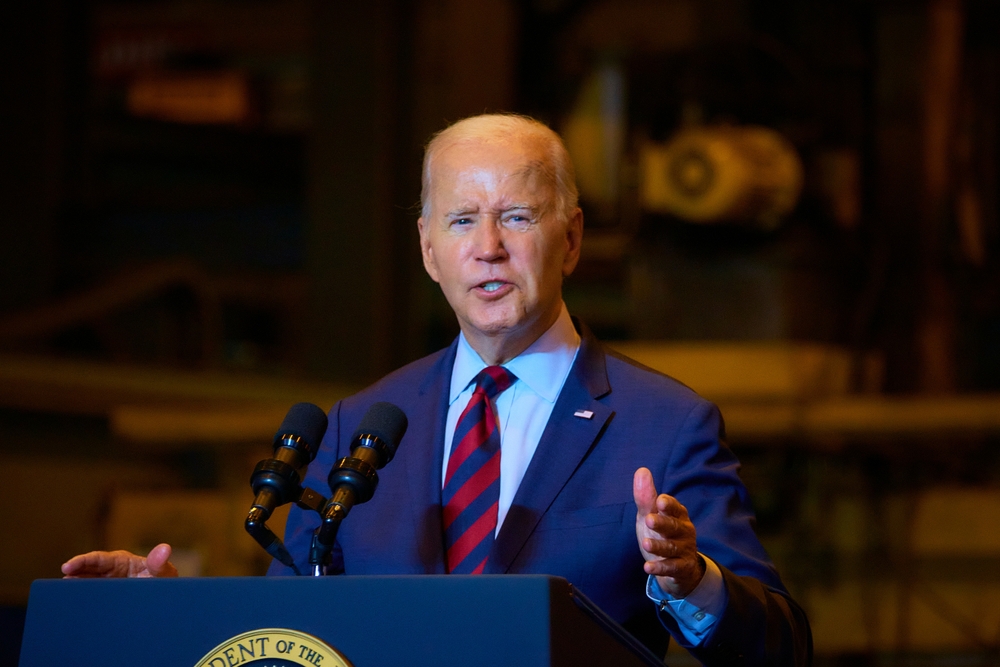

President Biden faces a complex decision regarding his threatened veto of the Congressional Review Act (CRA) resolution H.J.Res. 109, which seeks to overturn the SEC’s Staff Accounting Bulletin No. 121 (SAB 121). The recent bipartisan support for the resolution has highlighted significant political backing for the crypto industry, adding pressure on the President to reconsider his stance.

Congressional Support for H.J.Res. 109

On May 16, 2024, the U.S. Senate passed H.J.Res. 109 with a vote of 60 to 38, reflecting notable bipartisan support. This vote is particularly significant as it marks the first standalone crypto legislation to pass in a session of Congress. The resolution had substantial backing from both sides of the aisle, with 51 Democrats and 49 Republicans supporting the measure. Key figures like Senate Majority Leader Chuck Schumer also voted in favor, indicating strong Democratic support.

Senator Cynthia Lummis noted that this level of bipartisan agreement represents a milestone for crypto legislation in Washington. The overwhelming support suggests that many lawmakers view SAB 121 as potentially harmful to the burgeoning crypto industry and the broader financial system.

Potential Impact on Biden’s Decision

President Biden’s initial threat to veto the resolution came amid concerns about protecting investors in the crypto market and safeguarding the financial system. The White House has maintained that the SEC’s measures are necessary for these protections.

However, the substantial bipartisan support for H.J.Res. 109, including from influential Democrats, may compel the administration to reassess its position.

Perianne Boring, CEO of the Digital Chamber of Commerce, emphasized the significance of Schumer’s support, suggesting it could prompt the Biden administration to rethink its strategy. With the next U.S. elections approaching, Biden must weigh the potential political fallout of a veto, particularly given the visible shift in political sentiment toward supporting the crypto industry.

Pressure from the Financial Sector

Beyond political considerations, Biden faces pressure from the financial sector, which has expressed support for overturning SAB 121. The American Bankers Association has urged the President to sign the resolution, arguing that it would benefit American consumers and allow banks to offer custody services for cryptocurrencies. This sector sees economic incentives in aligning with the growing retail adoption of crypto assets.

The banking industry’s stance adds another layer of complexity to Biden’s decision. Aligning with the financial sector could provide economic benefits and mitigate some political risks associated with a veto.

Options and Potential Outcomes

President Biden has several options regarding H.J.Res. 109. He can sign the resolution into law, allow it to become law without his signature, or veto it. A pocket veto is also possible if Congress is not in session to receive the vetoed bill. This tactic could help Biden avoid direct political backlash while still expressing disapproval.

Should Biden choose to veto the resolution, Congress could attempt to override it, requiring a two-thirds majority in both chambers. Given the resolution’s strong support, an override is not out of the question, adding further uncertainty to the outcome.

Another potential solution lies with the SEC itself. The regulatory agency could revoke SAB 121, thus removing the need for presidential intervention. Commissioner Hester Pierce has criticized SAB 121, suggesting that it has deterred participants from entering the industry and does not function effectively. If the SEC decides to withdraw the bulletin, it would alleviate the pressure on Biden and potentially resolve the controversy without further conflict.

Editorial credit: OogImages / Shutterstock.com