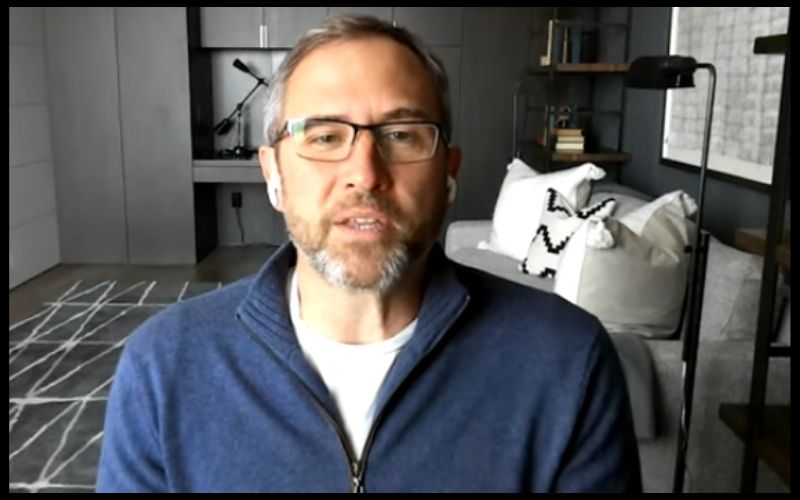

The Chief Executive Officer at Ripple, Brad Garlinghouse, has admitted that Ripple fully cares about the market value of XRP.

This was revealed in an article published by Financial Times a couple of hours ago. Virtually all the XRP community members have since criticized the trending article they tagged as a FUD.

In the report, Garlinghouse was quoted as saying that Ripple is a capitalist, so it holds a lot of XRP, adding that he fully cares about the price of XRP in the crypto market.

“We are a capitalist, we own a lot of XRP …So do I care about the overall XRP market? 100 percent,” Brad Garlinghouse stated.

However, the Ripple CEO stated that the payment firm aims to deliver a lot of utility through XRP, an aim he believes would take years to accomplish. But the company will continue to develop applications that utilize its blockchain technology, which will make the price of XRP justifiable.

Effect of the Uncertainty over XRP Regulation on Ripple’s Blockchain Adoption

In the report, Brad Garlinghouse further stated that more companies would have adopted Ripple’s blockchain, but the uncertainty in the United States over whether XRP tokens should be regulated as securities has been dissuading them. Recall that the company is still battling with the lawsuit over selling unregistered securities.

About Ripple’s Partnership with MoneyGram and Bitso

In June 2019, Ripple sealed a strategic partnership with the money transfer giant, MoneyGram. The payment firm also bought a stake in Bitso, a leading cryptocurrency exchange in Latin America.

According to Ripple, the strategic investments gave the company control over relatively 7% of all remittances from the United States and Mexico in June.

As it is, the breakthrough did not come without a cost. Inferred from MoneyGram’s filings, Ripple paid the payment giant the sum of $31 million market development fees to encourage the use of XRP in its transactions.

In defense of the fees paid to MoneyGram by Ripple, Garlinghouse pointed out that such payments have become a norm in the payment industry.

“If you look at more recent customers, it’s a different dynamic now than when we first got started,” Brad Garlinghouse noted.

Join us on Twitter

Join us on Telegram

Join us on Facebook