BitMEX co-founder Arthur Hayes believes that newly printed United States dollars will be required, which makes the latest Bitcoin (BTC) drop a perfect buying opportunity.

Hayes said the Japanese banking ecosystem is in a dire situation, and the consequences will just send Bitcoin and the crypto markets higher.

Much like what happened to the American banks in March 2023, Hayes argued on June 20 that Japanese banks would soon require a huge bailout because of the deeply underwater US government bonds on their balance sheet. He wrote:

“Y’all know what that means for Bitcoin and crypto … which is why I thought it necessary to alert readers about another avenue of stealth money printing.”

Since 2023’s banking crisis and the central bank bailout that followed, Hayes noted that Bitcoin’s price has gained over 200%.

The similarities between then and now are massive. Last year, Silicon Valley Bank announced that it had realized a $1.8 billion loss on its underwater bonds, resulting in a bank run and a rapid bailout from the US Treasury and the Federal Reserve. To resolve banking system contagion, the Fed also promised to entirely backstop any United States Treasuries held at US banks.

Fast forward to June 2024, and Japan’s fifth biggest bank, Norinchukin, has confirmed that it wants to sell $63 billion in U.S. and European bonds by March 2025, since its paper losses on these bonds have become too big to bear.

Hayes thinks that is just the tip of the iceberg, as Japanese banks and financial institutions cumulatively owned “$850 billion in foreign bonds going into 2022,” including nearly $450 billion in US bonds, as highlighted by a recent IMF survey.

He stated that a possible bond sale of this magnitude is something that US Treasury Secretary Janet Yellen would not be willing to tolerate. Hayes explained:

“That cannot be allowed as yields would spike higher and make funding the federal government extremely expensive. She will demand that the Bank of Japan (BOJ) purchase these bonds from Japanese banks it supervises.”

To accomplish this effectively, Hayes recommended that the Bank of Japan (BOJ) leverage its Foreign and International Monetary Authorities (FIMA) repo facility, which enables it to pledge US Treasuries as collateral in return for newly printed US dollar bills.

The consequences? More money printing, and larger bags for people holding assets like Bitcoin and top altcoins. On that note, Hayes mentioned that he will soon be rotating out of Ethena stablecoins and into “crypto risk,” and advised the readers to buy the current dip being seen in the market. He concluded:

“This is just another pillar of the crypto bull market. The supply of dollars must increase to maintain the current Pax Americana dollar-based filthy financial system.”

Earlier in June, Hayes told his followers that it was time to go long on Bitcoin and shitcoins because central banks are now starting to cut interest rates for the first time in several years.

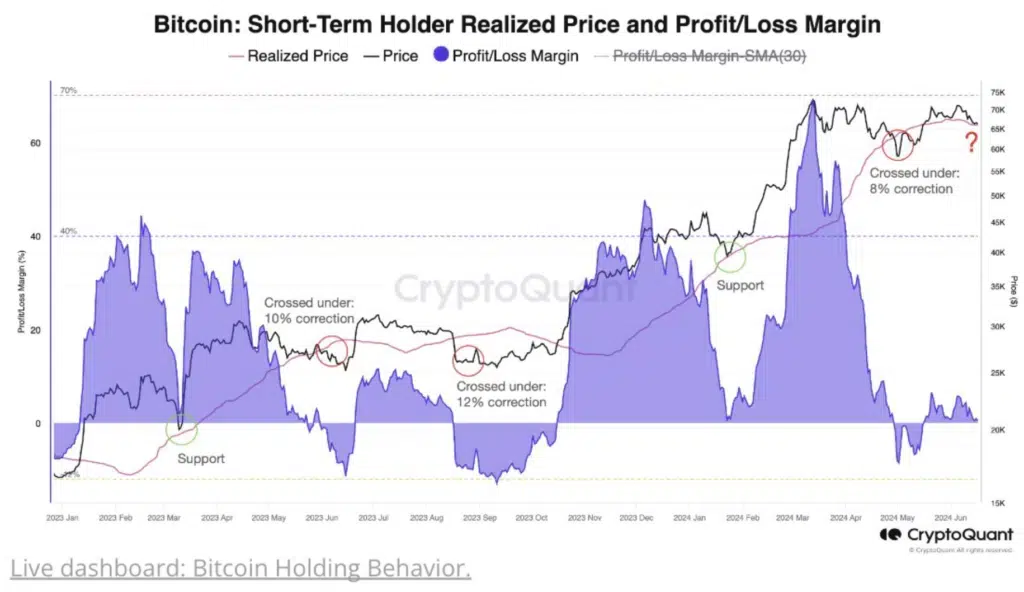

BTC Plunged Below Near-Term Holder Realized Price, Caused $60K Fears

Bitcoin’s price shortly dropped below a crucial level for traders, sparking fears that a deeper correction toward $60,000 might be coming up.

Recently, Bitcoin plunged below the $64K threshold, breaking its near-term holder realized price and signaling a potential further drop to levels not seen in seven weeks, based on CryptoQuant analysis data. On June 21, CryptoQuant wrote in an X post:

“Bitcoin is trading below the critical support level of $65.8K, now below $64K. Falling under this threshold suggests a potential 8%-12% correction toward $60K.”

This level has not broken since May 3.

On June 22, Bitcoin’s recent drop saw it slide to $63,442, plunging below the short-term holder realized price (STH-RP), which was $64,230, according to LookIntoBitcoin data. Near-term holder realized price is an integral indicator for traders since it is the aggregate cost basis of highly speculative Bitcoin hodlers – the wallets owning Bitcoin for 155 days or less.

It can act as a strong support, as it has done for most of the bull market since early 2023. Bitcoin’s price has tested the STH-RP several times recently, nonetheless, breaching the level raises fears among traders that another Bitcoin drop might be coming up.

Crypto Caesar wrote on June 19:

“Bitcoin’s short-term holder realized price generally acts as support in upward trending markets.”

LookIntoBitcoin founder Phillip Swift added:

“Let’s see if it holds.”

A drop to $60,000 will wipe out $1.64 billion in long positions, according to CoinGlass data.

Bitcoin Might Surge After Extended Consolidation

Bitcoin has been trading near $65,000 for some time now, making traders speculate where to next, mostly after two large events in 2024: the introduction of spot Bitcoin exchange-traded funds in the United States in January and the Bitcoin halving in April.

On June 13, reports emerged that Bitcoin has been in its longest period of consolidation for 92 days, and analysts think the long-lived steadiness might be preparing the asset for a “massive upside rally.”

The founder and CEO of CryptoQuant, Ki Young Ju, thinks:

“Bitcoin network fundamentals could support a market cap three times its current size compared to the last cyclical top.”

On May 8, Young Ju referred to a chart that compared Bitcoin’s price and the linked hashrate to market cap ratio, highlighting the crypto’s ongoing volatility and the resilience of the Bitcoin network.

If the ratio keeps growing, Young Ju declared it might ‘potentially sustain’ Bitcoin’s price to $265,000.