The CTO at Ripple, David Schwartz has recently averred that taking money out of Bitcoin (BTC) at the moment is not the safest.

This came about after Brad Mills, the host of Magic Internet Money Podcast advised the Bitcoin investors not to rely on the present pump of BTC in the market.

He further pointed out that Monday will not look good for Bitcoin (BTC).

Brad Mills shared this, “If you have not taken your money off the table yet, I don’t know what you’re waiting for. Monday is not going to look good. Likely all 3 circuit breakers will be hit sometime soon. -7, -13%, -20% everyone go home. 1-2 week markets turned off, then no short selling.”

Brad Mills proceeded by saying that Bitcoin is going to experience another devastating price crash before the market can stabilize.

“Yes, Bitcoin is going to get rekt badly once more before this is over. Thinking of selling more here,”

Yes, Bitcoin is going to get rekt badly once more before this is over.

Thinking of selling more here 😬

— Brad Mills ✍️🔑 (@bradmillscan) March 20, 2020

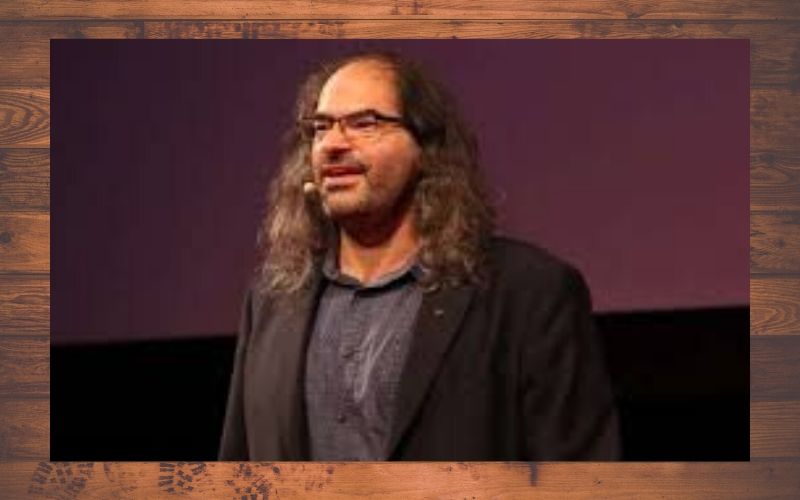

David Schwartz Contradicts Brad Mills’ Sentiment

In this regard, the CTO of Ripple David Schwartz has an opinion that contradicts Brad Mills’ sentiment about the next possible trend of the price of Bitcoin (BTC).

In response to the tweet, the Ripple’s CTO pointed out that bond funds are also risky as much as Bitcoin investment. He further questioned the safety of banks at the moment.

David Schwartz responded thus, “If you take it off the table, where do you put it? Bond funds are also risky, money market may break the buck, are banks even safe?”

If you take it off the table, where do you put it? Bond funds are also risky, money market may break the buck, are banks even safe?

— Lord David Schwartz (@JoelKatz) March 20, 2020

Over the past hours, Bitcoin and other cryptocurrencies such as Ethereum (ETH), XRP and others have been experiencing bits of price gains.

However, how long this positive price trend will last remains unpredictable. At press time, BTC is trading at $6,634.22, with a 16.84% price upsurge in the last 24 hours.