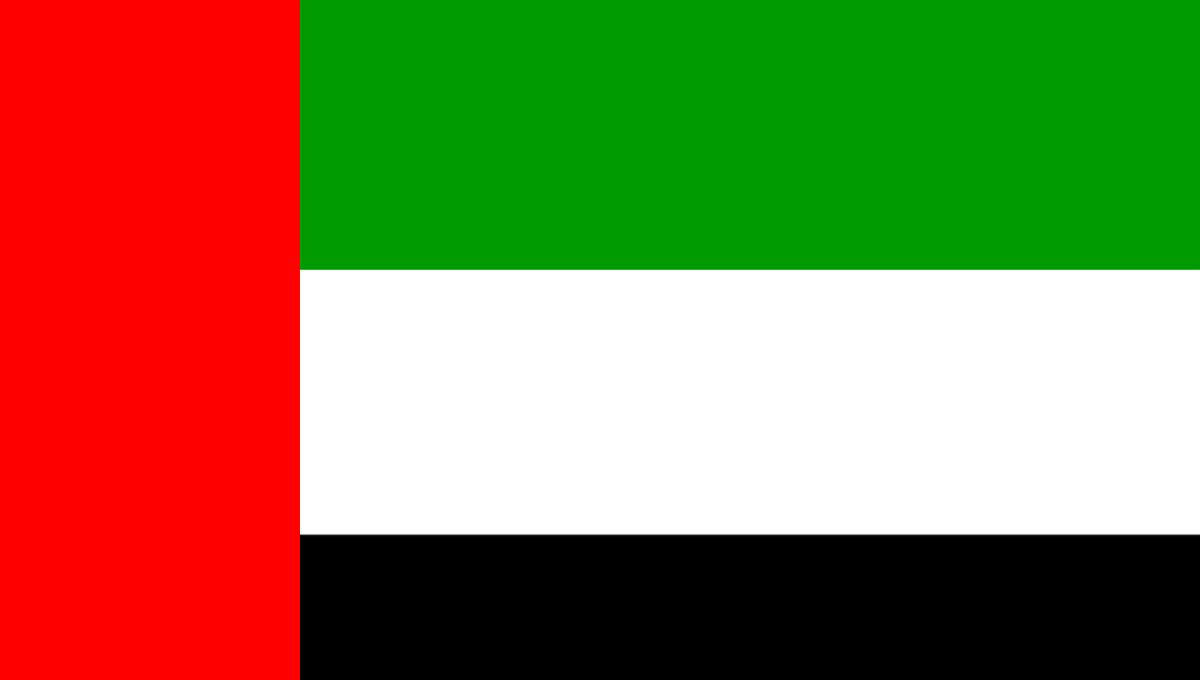

Institutional investors in the UAE have their eyes set on crypto assets, according to a survey. The survey revealed that these UAE big players want to gain more exposure to cryptocurrencies by 2023. This adds up to the burgeoning number of institutional investors already making forays into the crypto space and opening large positions.

The said survey was conducted on various UAE firms by London-based Nickel Digital Asset Management, and findings indicated the favorable disposition of big players in the United Arab Emirates (UAE) towards cryptocurrency assets. As revealed by the firm, the market correction has not affected the interest of institutional investors. Instead, their appetite for this asset class has been expanding. The firm also noted that adoption is also becoming vast in the Middle East region.

Global Institutional Investors Pick Interest in Crypto Assets, ARK Investments Leads the Pack

However, this interest is of a global nature as similar findings are being noted in other regions, especially the US. Major highlights in the US have been Ark Investments and Rothschild Investments, who have both opened positions heavily on Grayscale Bitcoin Trust. On its part, Cathie Wood-owned ARK Investments topped up its initial holdings on GBTC with additional 310,067 shares purchased at $25 per share and amounting to a total of $7.8 million. Initially, it purchased over a million shares.

Rather than scaring them off, the market correction seems to be what has been attracting these investors as they keep buying Bitcoin at a discount. Rothschild Investments took advantage of a price correction to the depths of $30k to purchase over 100,000 shares of GBTC bringing its total shares in the Trust to 141,405 from an initial 38,346 back in March. Reports also revealed that Rothschild purchased Grayscale’s Ethereum Trust (ETHE) as well.

UAE Yet to Establish Crypto Regulations

As the adoption of crypto in the UAE flourishes, regulators in the country are yet to come up with an all-encompassing regulations on cryptocurrencies. Although this has not affected the growing adoption by any means, investors have been reportedly approaching the space with extreme caution. The major factor responsible for the influx of UAE investors into the crypto space is the capital gains.

Meanwhile, the DeFi rave has attracted the attention of institutional investors as they make their way into the unregulated space. Grayscale recently established a Fund for decentralized finance products, including a multicap Large Fund.

In terms of institutional investments in crypto assets, Grayscale has been leading the way. The asset management firm has decided to expand its portfolio by turning its Bitcoin Trust to an ETF; the only hindrance is the US SEC which does not seem willing to assent to an ETF this year. The crypto market is yet to respond as expected to these purchases, notwithstanding, the coming months are definitely fruitful.