Pacific Financial Derivatives Review

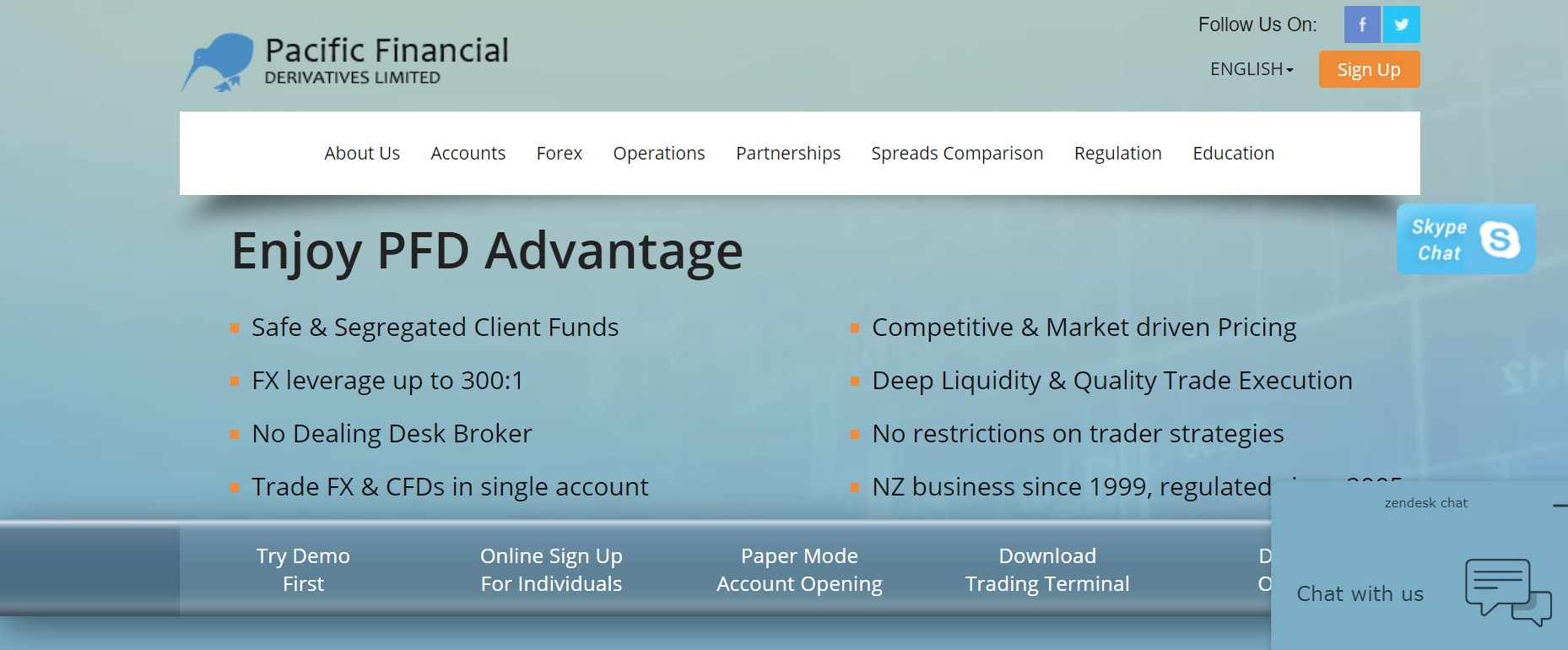

![]() Pacific Financial Derivatives is a brokerage firm founded in Japan using Japanese technology and expertise. The business was first licensed, and then it expanded its services to include being a Registered Financial Service Provider and an Authorized Futures Dealer. Pacific Financial Derivatives is a reputable online brokerage company with a long history and a wide range of services.

Pacific Financial Derivatives is a brokerage firm founded in Japan using Japanese technology and expertise. The business was first licensed, and then it expanded its services to include being a Registered Financial Service Provider and an Authorized Futures Dealer. Pacific Financial Derivatives is a reputable online brokerage company with a long history and a wide range of services.

Pacific Financial Derivatives Ltd is a New Zealand-based firm with extensive experience in the industry. Traders may choose from a variety of account kinds to suit their requirements. Pacific Financial Derivatives Ltd provides a broad range of high liquidity derivatives with narrow spreads, lightning-fast execution, and very cheap trading terms. Traders may use the most popular MetaTrader4 interface, which has minimal latency and excellent liquidity. PFD allows its clients to trade various assets, including futures, forex, and OTC products such as Contract For Differences.

Companies like Pacific Financial Derivatives provide individual and institutional clients with an electronic trading platform that allows them to trade in various market products, including commodities, currencies, financials, and stocks. The broker carries out the trader’s transaction. The business, based in Auckland, was established in 1991 and has grown rapidly since then. It now provides services to merchants all around the world. Pacific Financial Derivatives offers a safe trading environment through sophisticated Japanese technology, quick order execution, and low prices.

Withdrawals and Deposits

Pacific Financial Derivatives provides many simple ways for customers to deposit or withdraw money from their trading accounts. Levy service costs are taken from the profits in funding solutions. Payments from other parties are not permitted. Withdrawals may be requested in two ways: electronically and via paper.

Fees

Forex brokers earn money by charging fees or spreads to traders. Commissions are the fees a trader pays a broker to handle a transaction, and they are determined mainly by the instrument and account type. Spreads are the difference between the price a trader gets for selling and the price a trader spends to purchase. Depending on market movements such as interest rates, spreads may be variable or fixed. Brokers may impose rollovers, also known as swap fees, for trades kept open overnight in certain circumstances. The interest rate difference between the currency pairs traded in the open position determines these costs.

Pacific Financial Trading is open and honest about its commissions and costs. In the PFDTrader Account, there are no fees, and swaps are per transaction, while commissions for the PFDPro and PFDProPlus accounts are one dollar per standard lot.

Try Crypto Engine With Pacific Financial Derivatives Now – FREE Sign Up

Leverage

Leverage is the ratio of a trader’s capital to the amount of the broker’s credit that a broker gives to a trader to raise money possibly. If a trader has $500 in his account, he may manage a total of $50,000 with leverage of 1:100. Although using leverage to raise money is a beautiful way to do so, traders should be aware that the dangers are also more significant. Certain brokers offer bonuses as a means of greeting or compensating clients for trading with them. There are currently no incentives available with this broker.

Platforms

A trading platform provides real-time access to global trading marketplaces, often forex, CFDs, and futures trading. These enable traders to make well-informed choices, safeguard client money, and provide historical data, predictions, trends, and patterns. Pacific Financial Derivatives offers two robust trading platforms, each with its unique set of features and advantages.

Trading Platform MetaTrader 4

One of the most popular trading platforms in the world is MetaTrader 4. Most traders like it because of the many benefits, such as multiple asset trading and technical indicators.

The platform has the following features:

- Customizable

- 40 pre-installed technical indicators that are easy to use

- Tester of strategies

- Robotic commerce

- Data from previous periods

- Price notifications

- Support for many languages

- Trading with a single click

- Stop orders, trailing stops, and pending orders

- Recognize patterns

- There are nine distinct periods.

- a total of 24 graphic items

- Desktop, Android, and iOS versions are all available.

- Account statement and trading history

- Automated trading

- Desktop, Android, and iOS versions are all available.

Multiple Terminals

Multi Terminal trading software allows you to manage several forex trading accounts at the same time. It’s excellent for account managers and traders who handle numerous accounts at the same time.

The platform has the following features:

- A medium for real-time trading

- Taking care of a group of clients’ finances

- Various order types

- Capabilities for order execution

- All kinds of orders are welcomed.

- In the online form, you may get quotations and news.

- Language assistance is available.

- It works with spot metals, forex, futures, CFDs, and stock instruments.

- Multiple accounts solution with a single click, a single platform, and a single platform

- Microsoft Windows supports Multi Terminal.

Financial Information Exchange

The Financial Information Exchange Protocol is a protocol for electronic communication. The FIX API is used to exchange information about markets and securities transactions in real-time across international borders.

The protocol has the following features:

- Direct access to the aggregation engine at its heart

- Direct entry to the price stream

- Version 4.2 of MAM FIX is supported.

Summarily, Pacific Financial Derivative, like the majority of brokers, offers the MT4 trading platform, which is the most widely used worldwide platform with a user-friendly interface and robust features. The firm is a MetaQuotes partner, providing cutting-edge trading software and trade CFDs, Forex, and futures markets. The platform is delivered via web-based software, which streamlines the trading process since it can be accessed from any device and through any browser, with the only need being an internet connection. However, a downloaded version and a mobile application are also available, allowing you to remain connected and monitor positions with complete control, convenience, and simplicity. MetaTrader Market, a third-party robot and technical indicator provider, as well as a provider of many trading signals and a variety of level tools, has been added to Pacific Financial Derivatives’s MT4. Traders using MultiTerminal will be able to trade several accounts concurrently using a single interface. Thus Money Managers are also welcome, with the option of obtaining a MAM account.

Try Crypto Engine With Pacific Financial Derivatives Now – FREE Sign Up

Instruments, and Products

Traders have a wide range of goods and market instruments. The more diverse a trader’s portfolio is, the lower the risk. The most liquid market in the world is the foreign exchange market, often known as forex. Every day, $5 trillion in currencies is exchanged, making it the biggest market in volume. This market determines the exchange rates for all foreign currencies. The purchase or sale of currencies at current or set prices is referred to as foreign exchange trading.

Index trading includes a collection of worldwide equities such as the FTSE, NASDAQ, German DAX, AEX, etc. The value of various stock market sectors is used to calculate these indexes. Commodity markets are the economic sector that includes goods like oil and gas, metals, and agricultural products. It typically has futures trading as well as the purchase and sale of a variety of products.

Commodity trading is one of the safest trading choices, particularly in times of economic instability when done correctly. Contract for Difference (CFD) trading is the speculation of global financial markets, such as currencies, stocks, commodities, and indices. Cryptocurrencies are digital assets that may be exchanged for digital token currency such as Bitcoin. CFDs are often used in this kind of trading to speculate on price fluctuation. ETFs, like common equities, are investment funds that are exchanged on stock exchanges. It contains commodities, bonds, and stocks and may be traded in the same way as ordinary stocks.

Regulation and Safety

Before choosing a broker to trade with, potential traders should do extensive research. Customers are automatically protected when dealing with a Forex business licensed in the countries where its services are provided since they must follow specific laws and regulations.

Safe trading circumstances, such as separated client money and best trading procedures, are ensured by the regulatory authorities. The former Securities Commission approved Pacific Financial Derivatives as an Authorised Broker, Options Participant Firm, with the New Zealand Futures and Options Exchange. In 2011, the Financial Markets Authority designated the firm as an Authorised Futures Dealer. According to the Financial Markets Conduct Act 2013, the Financial Markets Authority licensed the business as a Derivatives Issuer. The company is now a Financial Service Provider Register member and the New Zealand Financial Dispute Resolution Scheme.

While licensed businesses are obliged to reduce risk management, rigorously follow regulations, and maintain specific capital, it is critical to choose a broker carefully. As a result, it’s essential to trade with a business that’s in good standing and has all of the necessary licenses. The Securities Commission approved Pacific Financial Derivatives as an Authorised IB with the Options Exchange and New Zealand Futures at the start of its existence. The company then expanded its offerings and obtained a license to do business as an Options Participant Firm and New Zealand Futures.

The business has been certified by the Financial Markets Authority of New Zealand to deal with futures since 2011, and four years later received a license as a derivatives issuer. Pacific Financial Derivatives is a licensed financial derivatives firm.

Since a result, there are no concerns regarding Pacific Financial Derivative’s operating standards and compliance, as FMA oversight ensures a secure trading environment for investors. The fundamental standards follow essential laws, including anti-money laundering and fair dealing rules. In general, the FMA’s mission is to regulate New Zealand’s capital markets and financial services, ensuring efficiency and openness.

Customer Service

Any trader needs a robust support system that is easily accessible since it can assist them in making crucial trading choices with minimum risk. Customers may reach out to the customer service staff via Live Chat, Skype, social media, phone, and email. They may rely on trade experts for technical assistance, operational issues, analytical guidance, and general trading inquiries. From Monday through Saturday, the support staff is accessible 24 hours a day, seven days a week.

Aside from easy ways and reasonable prices, the broker offers comprehensive educational assistance and customer care to traders. Apart from routine inquiry, customer support comprises traders’ experts who may help in any manner, including analytical advice, technological assistance, and operational issues. The business’s customer base includes retail traders of all levels, from novices to seasoned pros and corporate executives and institutional customers. The overall company rating consistently receives top marks from clients.

Research

To have a profitable trading experience, thorough market research is required. Traders utilize the research to spot patterns, comprehend market dynamics, price movements, short and long-term resistance, and values. Most brokers provide research tools to help traders learn more about the markets they’re interested in, allowing them to make more educated trading choices while reducing risk.

Traders have access to various research tools, including a comprehensive Economic Calendar that keeps traders up to date on trading activities and predictions. Trading-related issues such as market conditions, trading limitations, higher margins, and new CFD products are also discussed on the website’s Press Room page.

Training and Education

Most brokers provide instructional and training resources to assist traders in learning how to utilize chats and platforms, how markets operate, develop strategies, evaluate currency pairings, and face dangers. Pacific Financial Derivatives provides various instructional resources on its Education website, including a comprehensive Forex Glossary and a Forex Introduction. The current main currencies are discussed and interpret charts, trading psychology, trending techniques, and other topics.

Accounts

Pacific Financial Derivative Broker offers three account types with access to all available trading instruments and various trading conditions to meet your needs. And, of course, risk control through profit and loss positions, trading terminals with daily and monthly statements, and unmatched customer service. Like all other foreign exchange firms, Pacific Financial Derivatives provides its clients with various foreign exchange accounts through which they may trade the market instruments available. Traders may establish an account, deposit money in the main currency of their nation, and then hold, purchase, or sell foreign currencies.

The following are some of the benefits of a PFDTrader account:

- There is no minimum deposit.

- EUR, USD, NZD, JPY, and GBP are the base currencies.

- FX scalping, news trading, and operating robots are all permitted with no commission.

- Competitive spreads

- Quick action is required.

- There is no need for a minimum deposit. You may go as little or as large as you like.

- There is no dealing desk.

- A wide variety of marketplaces are available to you.

- In a single account, you may trade Forex, Metals, and CFDs.

The PFDPro Account has the following features:

- There is no minimum deposit.

- GBP, USD, JPY, EUR, NZD are the base currencies.

- Positive slippage is packaged with the original and narrowest spreads.

- The quickest execution

- Commission for Competitiveness

- There is no dealing desk.

- Scalping, news trading, and automation are all possible options.

- There are no restrictions on trading.

- A wide variety of marketplaces are available to you.

- In a single account, you may trade forex, metals, and CFDs.

Features of PFDProPlus are:

- There is no minimum deposit in base currencies.

- It is advantageous for traders to be able to hedge and swap at the same time.

- Spreads of institutional quality packaged with positive slippage.

- Commission for Competitiveness

- The quickest execution

- There is no dealing desk (NDD)

- There are no restrictions on trading.

- Forex, Metals, and CFDs are all available in one account, making it ideal for professional and system traders.

The features of Islamic Accounts:

- No Minimum Deposit

- On Overnight Positions, there is no switch fee.

- Overnight positions held for more than three days will incur an administrative fee.

- Competitive spreads.

- A leverage of up to 300:1 is possible.

- Market Execution in a Hurry.

- There are no restrictions on trading.

- Client Support is available 24 hours a day, seven days a week.

Three accounts are designed for either beginning traders or more experienced traders who may switch to Pacific Financial DerivativePro, the tightest spread and one dollar commission per side. What’s more, neither account has a minimum deposit requirement so that you may play with any amount. For Sharia-compliant clients, there is the option of opening an Islamic account, which includes no rollover interest on overnight holdings.

Pacific Financial Derivatives spreads are shown according to the account type you trade with; for example, the table below shows the averaged spread offered, which may reach zero pips when dealing via the Pacific Financial Derivative ProPlus account. Also, remember to factor in a rollover or overnight fee paid on open positions overnight, similar to one percent for short positions.

Try Crypto Engine With Pacific Financial Derivatives Now – FREE Sign Up

Leverage

You’ll have the freedom to select the proper leverage for your trading requirements at Pacific Financial Derivative, beginning with low leverage and working your way up to 1:300, which is considered high leverage. Although the leverage tool is a powerful feature, you should understand how to utilize it effectively since leverage may also operate against you. Despite this, Pacific Financial Derivative, as a New Zealand broker, nevertheless offers the most significant leverage for regular traders, providing an enticing chance to amplify possible profits.

Methods of Funding

To begin live trading, you must first fill your account, and you have many methods for transferring or depositing money. However, you should be aware that payment providers may levy fees based on specific payment circumstances. Bank transfers, card payments, and e-wallets are all standard options. Skrill, Neteller, iDEAL, POLi online banking, and SoFort are among the others. The funding or withdrawal fees vary per service, but they typically run from one percent to three percent, with a five-dollar minimum. However, you can make free withdrawals via Neteller or get a one percent discount if you pay with a credit card.

Conclusion

Pacific Financial Derivatives provides a competitive trading environment by providing an award-winning platform, low fees, high leverage, numerous research and instructional tools, and a wide range of account kinds. When trading with this broker, traders of all types and levels of expertise should perform well.

The Pacific Financial Derivatives report reveals a New Zealand-based brokerage firm that conducts business and depends on Japanese technological expertise. Through competitive spreads and strong capabilities, the established processing offers direct access. Overall, the trading circumstances are ideal for traders or investors of any size since there are no deposit restrictions and a wide range of trading options. Furthermore, traders benefit from instructional resources and extensive assistance from the business at any point in their trading careers. As a result, investing and expanding your options with Pacific Financial Derivative, which also adheres to New Zealand regulations, may be an intelligent choice.

HeraldSheets.com produces top quality content for crypto companies. We provide brand exposure for hundreds of companies. All of our clients appreciate our services. If you have any questions you may contact us. Cryptocurrencies and Digital tokens are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by our authors and the views expressed in them do not reflect the views of this website. Herald Sheets is not responsible for the content, accuracy, quality, advertising, products or any other content posted on the site. Read full terms and conditions / disclaimer.